For context, the following article was written the morning of April 2, 2024.

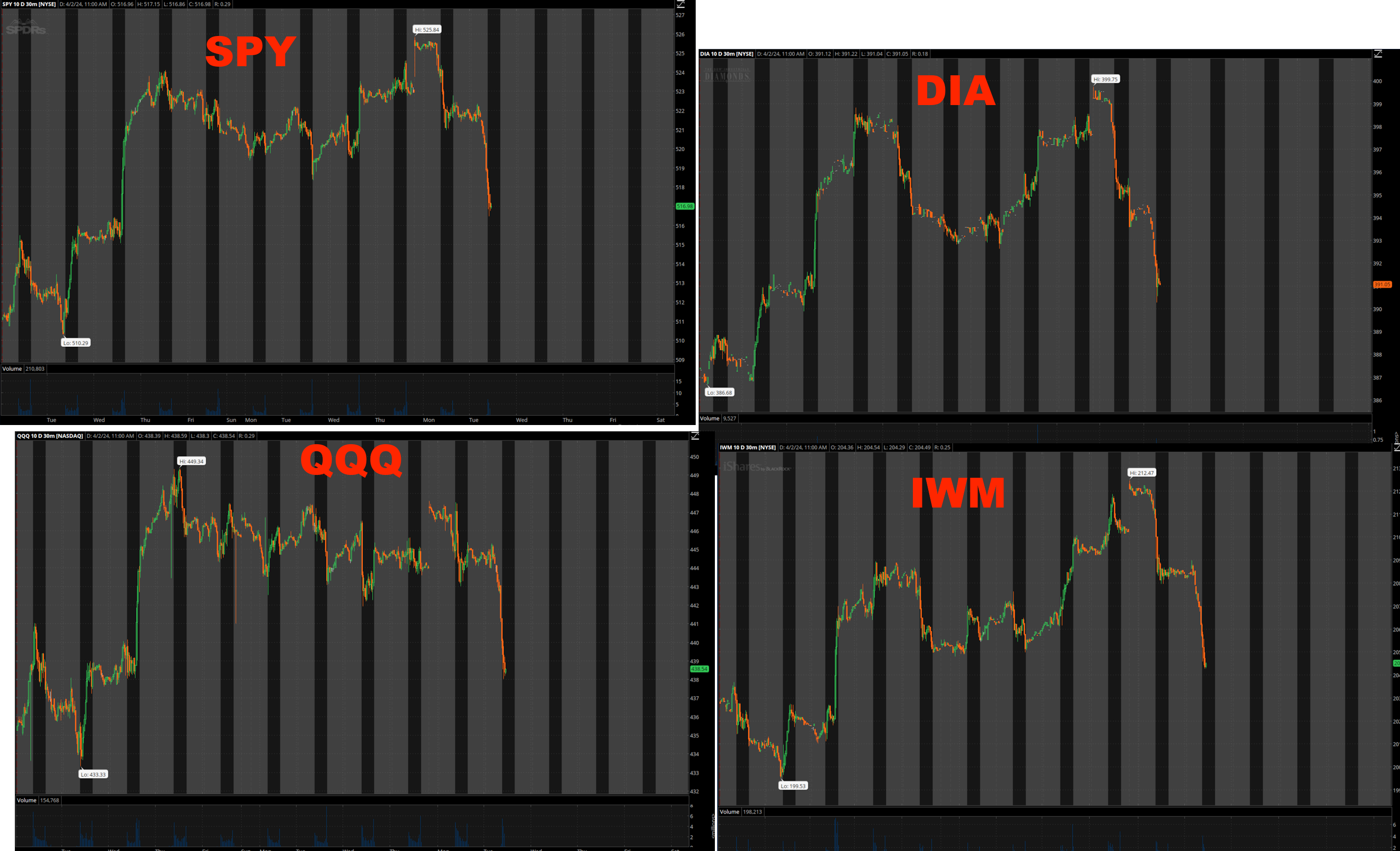

The past two trading sessions have brought what seem like steep selloffs in the major indexes.

The truth is, yes, the market has sagged a bit. But it’s a testament to the dramatic bull run we’ve seen over the last 6 months that even a small dip like this can feel like a major shift.

So before you hit the eject button on your portfolio, take a deep breath…

Market Downturns Feel Worse After a Bull Run

As I stated above, we’ve gotten so used to the dramatic gains of the recent bull market that even minor pullbacks feel like the sky is falling. In other words, we’ve gotten spoiled.

It can be easy to forget that the markets move in cycles and have enough perspective to look beyond a big “red” day in our account (mine is ugly today!).

Adjusting for the “New Normal”

Here’s the thing: the second quarter, especially during election years, is known for being a bit choppier. The market might move sideways more often, with less of the dramatic action we’ve seen recently.

This can be frustrating after the gains of the last few months, but it’s important to adjust your expectations and adapt your strategy accordingly.

The key takeaway here is to avoid overreacting to short-term fluctuations. Don’t let the fear of missing out (FOMO) during a bull run turn into the fear of losing everything (FOLE) during a correction.

In fact, I would say that too much activity is one of the main mistakes investors make and it can be especially exacerbated in a more sideways market.

Here’s a few things to keep in mind…

Think Long Term: Don’t Chase Every High

With the changes that we might see in the coming quarter, I want to emphasize the importance of long-term thinking. I am actually not talking about long term investing or even long term analysis…

I just mean understanding where we are right now with a historical reference longer than October through today when the market has been red hot.

Because when your lens is that magnified, everything seems like a big deal!

So don’t react to the hourly and daily moves unless they actually trigger a fundamental change in your strategy (most times, they don’t).

A sideways market doesn’t have to be a bad thing…

I am not going to sit here and tell you it’s as fun as a raging bull market, but it can be a great opportunity to accumulate shares at a good price point, especially if you’re using the Income Wheel to pad your account during the process.

Confirmation is Key: Not Every Dip Spells Doom

Now, let’s talk about bear markets. A true bear market requires confirmation, such as a sustained decline or a weekly close below a key level.

As an example on the QQQ, I currently see 409 as a key level to watch for a potential deeper correction. That’s still a good ways off… Just because we see some short-term bearish momentum doesn’t necessarily mean we’re entering a full-blown bear market.

Think of it like this: imagine you’re walking down a path and you come across a puddle. Do you immediately assume the entire path is flooded? Probably not!

You might adjust your route slightly to avoid the puddle, but you wouldn’t completely change your destination. In the same way, a temporary market dip shouldn’t completely change your plan.

A Perfect Fit for Choppy Waters

Speaking of adapting your strategy, the Income Wheel, which I’ve written about here is a great approach for choppy markets.

Now, what I love about this approach is that it doesn’t need choppy markets. And that’s important.

For all I know, we might see a massive bullish momentum the next 3 months. And the Income Wheel does great in those conditions as well.

Or maybe we actually will see a deeper correction by mid summer. Well, the Income Wheel is a great way to keep cash flow hitting your account when that happens too.

So, just to be clear…

I don’t recommend pivoting all your strategies for a sideways market (that would kind of defeat the whole point of this letter haha), but I definitely do recommend being prepared for multiple scenarios.

And the Income Wheel is probably my most versatile strategy.

There’s a Middle Ground: Bullish Doesn’t Have to Mean Reckless

Here’s another key point: You don’t have to jump from a bullish mindset to a full-blown bear market panic.

There exists a happy medium where you can remain optimistic about the long-term potential of the market while acknowledging the current choppiness.

For me, I am still about a 7 out of 10 on my bullish bias. I am not a 10 so there’s some room for me to adjust, but I am certainly not “flipping” my strategy until I see significant confirmation of a new trend.

Think of it like adjusting the sails on your ship.

In a strong wind (bull market), you might unfurl all your sails to catch the maximum power. But in choppier waters, you might shorten your sails a bit to maintain stability and avoid getting knocked over.

Adaptation Strategies: Keeping Your Portfolio Steady

So, if the market turns and we do enter a sideways, choppy period, what are some specific things you can do? Here are a few tips:

- Focus on Income Trades: Explore options strategies that generate consistent income, like I describe in the Income Wheel example.

- Extend Option Expiration: So you’re still bullish, right? Well, you can still trade calls, just consider giving yourself a little more time than you would in a full momentum market. Instead of trading 3-6 weeks out on medium term trade signals, go 8-12 weeks out, for example.

- AdjustYour Portfolio: I am not big on “traditional” diversification because I don’t think it works very well. But proactively shifting your account based on what’s actually happening, I am all about. For example, I shifted more of my portfolio into Energy and Gold in March. That wasn’t me “diversifying” into boring assets, it was me adjusting my conviction on directional assets I liked better and, based on my research, had more upside over Q2.

The key here is that you don’t have to “flip” from a bullish investor to a bearish investor on a whim to manage your portfolio. You can have a more nuanced approach that adds some protection while still positioning yourself for upside if the market continues higher.

The Bottom Line: Stay Calm and Adapt

Remember, the market is constantly shifting. It somehow feels like we’ve been in a bull market for a long time already, even though it’s just 6 months old!

I recommend trying to take a step back, add context into your approach and, ideally, make nuanced adjustments in your account rather than flipping back and forth from aggressively bullish to panicky bearish.

— Nate Tucci