Markets sure have been tough lately. And that was before the big selloffs last Friday and this past Monday.

Seems like a perfect time to revisit some golden advice that Jason — one of Jeffry’s most successful traders — shared in Jeffry’s Discord chat a few weeks ago:

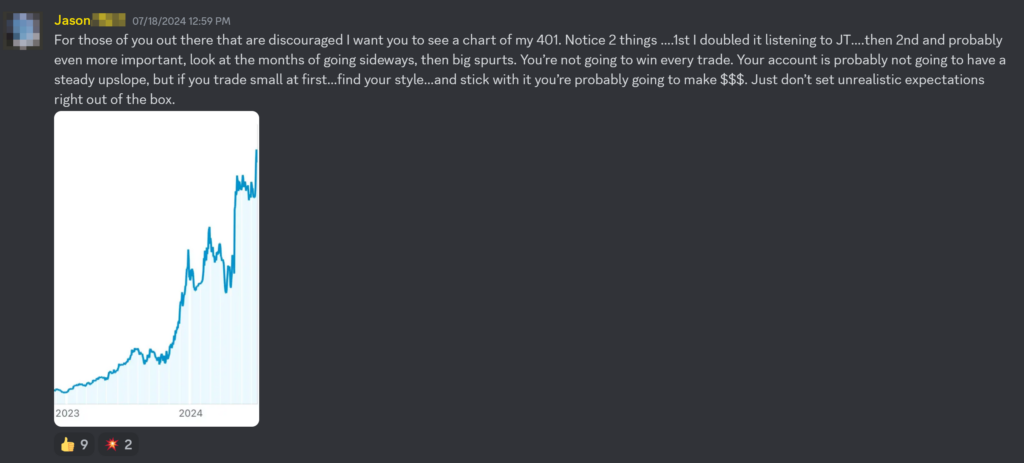

Jason offers sage advice to traders who might be feeling discouraged with their results and he even shared a screenshot of his 401k retirement account growth to show that trading isn’t all sunshine.

Jason is quick to point out that while your eyes might be drawn to the massive spikes, it’s just as important to look at the months of sideways choppiness.

Without labels, it’s hard to tell, but it looks like after some spikes from January through March, he gave back all his gains in April, putting him back where he started the year.

“You’re not going to win every trade.” he cautions.

He warns that — like him — you’re more than likely not going to have steady account growth.

Probably most importantly, he tells us to trade small at first and find our own style.

Once you’ve proven you can trade small, then you can take it big time.

Jason’s experience highlights a crucial aspect of trading: patience and resilience. The reality is that trading is not a straight line to success.

There will be times when it feels like you’re treading water, and the temptation to chase quick gains can be overwhelming.

But, Jason’s chart serves as a powerful reminder that staying the course those choppy periods can set the stage for massive growth.

His “golden advice” boils down to a few key principles:

-

Start Small: In the beginning, focus on honing your skills and understanding your trading style without risking too much capital. Trading small allows you to learn from mistakes without catastrophic losses, building a solid foundation you can build on.

-

Embrace Your Style: Every trader has a unique approach that suits their personality, available time and risk tolerance. Finding what works for you is essential, and it’s okay if your path looks different from someone else’s. Embrace your individuality in trading, and don’t feel pressured to conform to others’ strategies.

-

Be Patient: Success in trading often comes in spurts, as Jason’s chart demonstrates. It’s not about winning every trade but about staying in the game long enough to capitalize on opportunities when they arise. Patience and perseverance are key.

-

Manage Expectations: Set realistic goals and be prepared for ups and downs. Trading is a marathon, not a sprint, and maintaining a long-term view can help you navigate short-term volatility.

The journey of Jason’s 401k is a testament to the power of sticking to these principles.

By trading small, finding your style, and maintaining realistic expectations, you too can up your odds of achieving lasting success in the markets.

Keep Jason’s golden advice in mind as you navigate the trading world — especially the choppy periods we’ve had lately — and remember: patience, persistence, and a personalized approach are your greatest allies.

— The Prosperity Pub Team

Cut The Chaos With One Of The Most Rock-Solid Assets

Commodities expert, Geof Smith has figured out a way to target weekly income in the hundreds…

By targeting one of the most rock-solid assets in the market.

Click to discover the power of the Oklahoma Trade!