It’s shaping up to be another wild day in the markets — and that was going to be the case before the big rally we’ve seen so far today…

And once again, tariffs are stealing the spotlight.

Stocks were down pretty big premarket and opened in the red. But things quickly changed after.

Tesla (TSLA) has been hit especially hard, down over 5% after a disappointing Q1 delivery report. But then wouldn’t you know it…

Trump said Musk is likely leaving his DOGE post soon, and shares of TSLA took off, from down over 5% to up 4%.

And now, we’re in somewhat of a wait-and-see mode.

Traders are hoping for clarity, but worried we might get chaos instead. Some reports suggest Trump could go as far as 20% blanket tariffs — and that has investors on edge.

Once this tariff news is out of the way, the next big thing on the radar is Friday’s jobs report. That’ll give us our first real read on how the labor market is holding up under all this uncertainty.

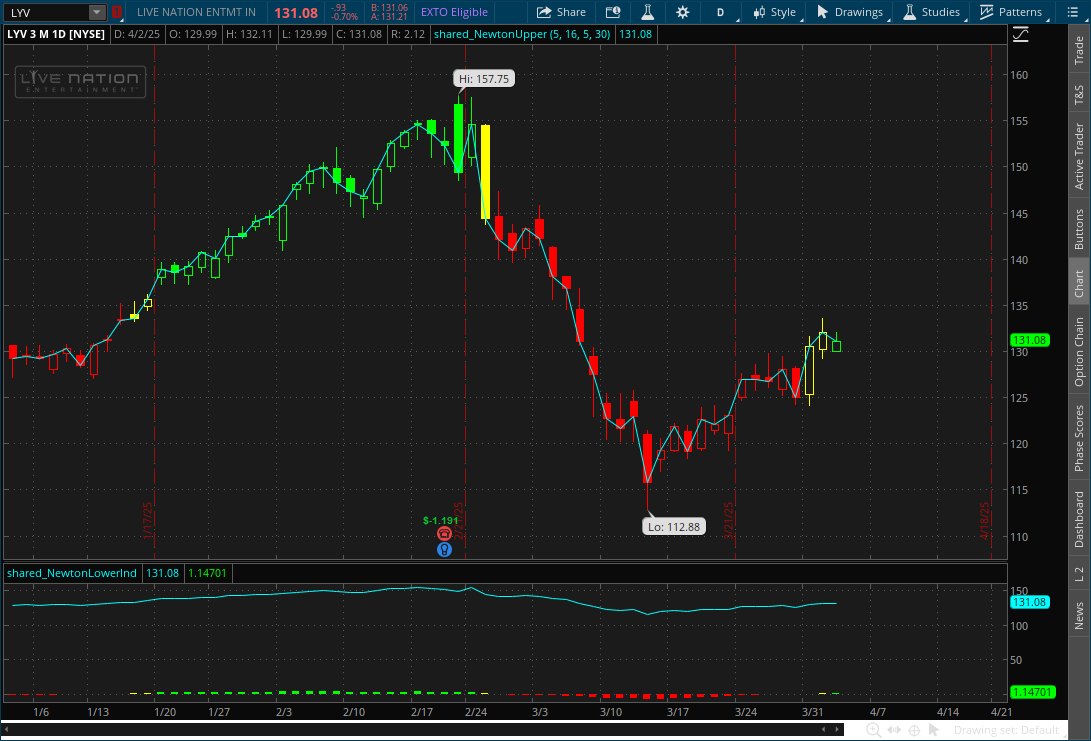

Live Nation Entertainment (LYV) Moving Higher

LYV has been on a tear recently. As live events roar back to life, the company’s ticket sales have skyrocketed, reflecting a public eager for more concerts and festivals.

And after a pullback in February and early March, it’s been straight up for this stock lately.

At the same time, our Newton Indicator is in bullish mode. It’s gone from yellow to green. This indicates it has excellent positive momentum and could be ready to make a nice move.

Warner Bros. Discovery (WBD) Looking Bearish

On the opposite side, Warner Bros. Discovery (WBD) is looking bearish and just can’t seem to catch a break in 2025.

After a tough 2024, hopes were high for a turnaround — but the stock has continued to struggle. A big part of the pressure is coming from ongoing concerns about streaming profitability.

Investors aren’t just looking for subscriber growth anymore — they want to see real, sustainable profits. And so far, WBD hasn’t delivered enough to ease those worries.

And the Newton Indicator shows that momentum has gone from yellow to red as momentum continues to sink…

In the meantime, it’s a market that rewards preparation and punishes guesswork.

Stay nimble — and stay tuned.

I’ll be live at 10 a.m. ET Thursday for “Opening Playbook,” and I’m sure we’ll have plenty to talk about as the market digests the big tariff news.

Graham Lindman

Graham Lindman Trading

Follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

Important Note: No one from the ProsperityPub team or Graham Lindman Trading will ever contact you directly on Telegram.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

P.S. Turn Tesla’s Strength Into a Shot a Potential Weekly Payouts

Tesla has certainly faced its share of challenges recently…

From new tariffs and vandalism to boycotts and market turbulence.

Tesla is surging again today while much of the market continues to struggle for traction.

It’s becoming clear to many that Tesla is unlike any other stock…

Time and time again, it defies expectations, outperforming the market in ways that leave others behind.

But here’s the key point…

While everyone probably feels tempted to buy the stock right now…

Jack seems to have his sights on a bigger opportunity.

He says it’s linked to an unusual pattern in Tesla’s option chain that’s leading regular traders to target the stock every week for a shot at potential payouts…

And if you want the details behind this unusual pattern…