Wrong address. Wrong driveway. Wrong car.

Sadly, that’s all it takes to get shot in today’s America.

I think it’s safe to say that paranoia, division, and suspicion have never been higher. And walking the streets of cities like L.A. and San Francisco seem more like running a gauntlet than going out for a stroll.

Now, none of these trends reveal where the stock market might end up next week. But they do relate to the rapid de-dollarization that will neuter the Federal Reserve, the profound financial fragility caused by easy money, and the rise of Bitcoin.

They are all symptoms of the same cause – social entropy.

To resist entropy’s spread, the decaying centralized status quo will continue to spend more money, pass more rules, and ultimately engage in more war.

So, there’s not a snowball’s chance in hell that the debt ceiling won’t get raised this summer.

Stirring the Pot

Don’t think for a minute you can count on the GOP to dig in its heels.

During the presidency of George W. Bush, the Republican-controlled Congress passed legislation to raise the limit from $5.95 trillion to $6.4 trillion. They did it again a year later, this time to $7.38 trillion.

In 2006, the ceiling was lifted to $9 trillion with support from both parties. Took it to $14.3 trillion in 2010. And the Republican-controlled Congress raised the debt ceiling to $21.8 trillion during the presidency of Donald Trump.

In the 23 years of this century, the debt ceiling has been raised around 15 times. Both parties share the blame. Neither can claim the high ground. And know that both rely entirely on more government, not less, for power.

They only differ in how they use that centralized power to violate individual rights.

Okay, so, that’s the obvious.

What’s not so obvious is how long Congress keeps up this round of debt ceiling chicken.

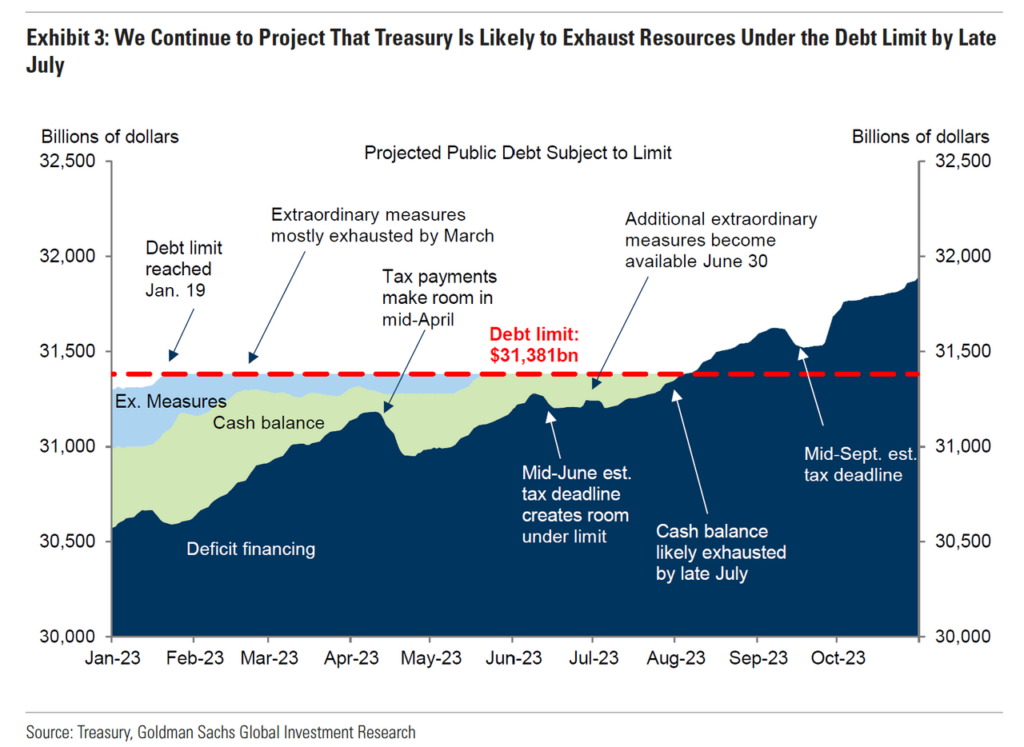

Goldman Sachs projects late July. Which is as good a guess as any. (h/t my colleague Jeffry Turnmire for the chart.)

But however long the game of chicken lasts, markets are pricing in a doozy of standoff.

The chart above shows the risk of the U.S. Treasury default.

It’s now higher than at any time before in history. And though there’s no way Congress will allow the U.S. to default on its obligations, the additional turmoil political chicken games like this create in capital markets only serves to further the decay of the centralized status quo’s grip on power.

And no matter how many trillions of dollars Congress raises the debt ceiling this time around, it will do nothing to slow entropy’s advance.

Take What the Markets Give You