Every time you hit the aisles of your local grocery store; you make all kinds of tradeoffs.

Maybe you feel like paying up for organic kale today.

You like good cheese, but that grass-fed Irish white cheddar seems a bit steep.

Country ham from the deli-counter sliced as thin as your heart desires sounds great though you grew up just fine on Oscar Meyer bologna.

We constantly make decisions to optimize our spending – some big, some small.

Even the items you buy without thought come with a history of past decisions.

Day in and day out, the only person with any clue as to what makes the most sense for you, given your needs, goals, values, desires, habits, or whatever, stares back at you from the mirror every morning.

But that fundamental truth gets lost on meddlers.

Meddlers know what you SHOULD do because they incorrectly presume an informational advantage. They believe they can make those tradeoffs better than you.

And when persuasion doesn’t work, they also know they can always resort to force.

Their arrogant presumption – Hayek’s fatal conceit – carries an enormous cost that undermines the one tool essential to impose their will.

And your edge in this Game of Wills lies in the fact that you will always be free to use that tool against them…

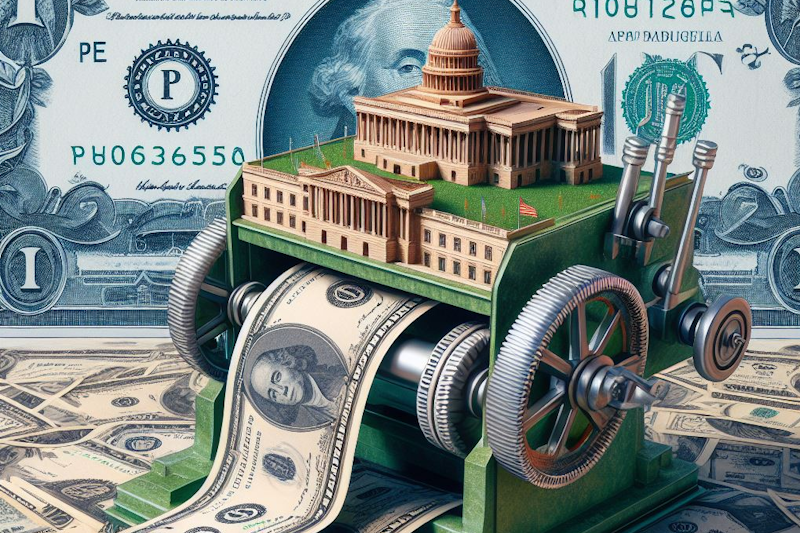

Malignant Money

That tool is currency, fiat currency, to be precise.

U.S. dollars, euros, Yen, Pound Sterling – all major nation-backed currencies – amount to nothing more than “money on demand” for the governing forces behind them.

And as demands for “Unity” from authority’s lofty perch surge higher, so too do their demands for more money to pay for absolute compliance.

The government spending required to impose the government’s will results in a tremendous misallocation of resources.

The greater the misallocation, the more authoritarians spend to correct their errors. Which, of course, leads to a fantastic comedy of errors, each compounding the cost of the last.

Like rules nailed to a wall increasingly crowded with rules, government mandates, laws, regulations, emergency initiatives, and executive orders pile up.

TMI

But no central authority could ever process the information necessary to optimize the actions of hundreds of millions of people.

Even with a quantum computer capable of processing more data than you can meaningfully express as a number, the decisions would still fall short of what millions of individuals – with the freedom to choose for themselves – can deliver.

That’s why a system increasingly reliant on centralized decision-making can’t work. And the rising tide of malignant money demanded into existence ultimately crushes the productive potential of each dollar spent to support some top-down policy.

But know that you’re not trapped in this system.

Owning stocks is not owning dollars. Companies can choose how they get paid. They can also hedge their currency risk or simply exchange the dollars, euros, yen – whatever – immediately into something more stable.

Their ability to create shareholder value isn’t hampered by one medium of exchange.

Plus, innovation moves on. And the individuals driving business forward have choices.

Just like you.

Rather than saving in dollars or owning bonds that pay you dollars in the future – precious metals and other commodities offer a way out, provided you can stomach the dollar-price volatility.

Plus, truly open source, permissionless and decentralized crypto like Bitcoin opens a vast field of opportunities for anyone seeing the writing on the wall. But you need to invest the time to learn how to take full control over whatever you own.

You are free to hold any form of payment you want. And your assets don’t have to be beholden to the dollar. Every act you take that favors something else over dollars amounts to a bet against the system.

The system we have may no longer work, but your actions do.

Think Free. Be Free.