Tag: energy – general

Select a guru below to view more of their posts!

All Posts - Casey Stubbs - Chris Pulver - David Trainer - Graham Lindman - Geof Smith - Nate Tucci - Jeffry Turnmire - ProsperityPub

The Government’s Writing Checks Again

The Pentagon is making bold bets on rare earths. But can government spending really fix a broken supply chain?

Read MoreCopper Just Got Tariffed — Now What?

Copper just surged — and it’s not just a chart story. From tariffs to tankers, the ripple effects are everywhere.

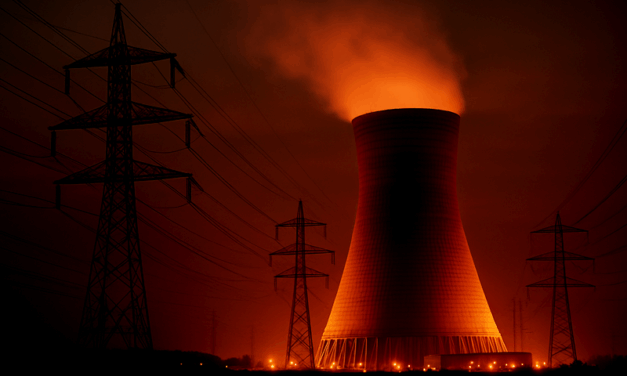

Read MoreUranium’s Still Climbing — And It’s Not Just AI

Uranium’s breakout is no longer just about AI — heat waves, grid stress, and a negative GDP print are fueling a second wind.

Read MoreThe Uranium Trade Isn’t Done Yet

Uranium is breaking out — and the AI revolution may be the reason why. Geof Smith reports.

Read MoreWhat China Just Gave Away (and What They’re Holding Back)

Markets are watching China after a rare earth giveaway — and rising energy demand has folks scrambling for backup power. Here’s what Geof’s watching this week.

Read MoreThe Chaos Is Loud — But Energy Could Be the Real Story

While the headlines scream, a quiet energy story may be setting up for the next big move.

Read MoreMarkets Are Churning. Here’s Why.

Geof Smith is back from teaching and diving into a volatile week: oil, gold, jobs, and geopolitical tension are all on the move. Here’s what he’s watching.

Read MoreWhy Crude Oil Didn’t Budge Despite a Huge Inventory Draw

A massive oil inventory draw didn’t move the needle — and that says a lot about the current economic backdrop.

Read MoreAI Can’t Eat If the Grid’s Starving

AI needs power — and lots of it. Geof explains why the real winners of the AI boom might not be tech stocks at all… but something far more elemental.

Read MoreMarket Radar: AI, Aluminum & Uranium — The Power Problem No One’s Ready For

Geof explains how AI, aluminum, and uranium are converging into a power-hungry trifecta — and why it’s moving markets in unexpected ways.

Read MoreGermany’s Nuclear Reboot Could Spark a Uranium Boom

Germany just did a nuclear 180 — and it could supercharge uranium demand. Geof explains what this energy pivot means and how he’s positioning for it.

Read MoreMarket Radar: Germany Goes Nuclear, Oil at a Crossroads, and Moody’s Sparks Gold

Germany stuns with a nuclear pivot, oil sits at a tipping point, and Moody’s shakes up the bond market — Geof Smith breaks it all down in this week’s Market Radar.

Read More