For months now I’ve been laying out my case for dramatically lower stock prices.

Fed money printing is no longer fueling consumption. Price-to-Earnings multiples have yet to adjust to the lower earnings levels that will result. Rising interest rates resulting from tighter monetary conditions make the present value of those lower future earnings worth even less.

And the uncertainty surrounding future interest, inflation, and growth makes everyone step back from the table until valuations drop low enough to compensate for a much wider range of outcomes.

It’s a triple-whammy-plus set of factors driving stocks lower, each compounding the next. And this self-reinforcing cycle doesn’t end until confidence in the future price of money returns.

How far stock markets could fall is anyone’s guess — though I’ve laid three approaches to determining realistic bottoms.

Today I have a fourth.

But before I share the fourth with you, let’s review how far prices could drop and the three other ways to justify how we get there.

Fundamental Drivers

For a quick refresher, I claim that the S&P 500 could easily take out the 2018 highs of 2,947 — but will more than likely revisit 2015 highs of 2,134 (a 46% drop from today’s level).

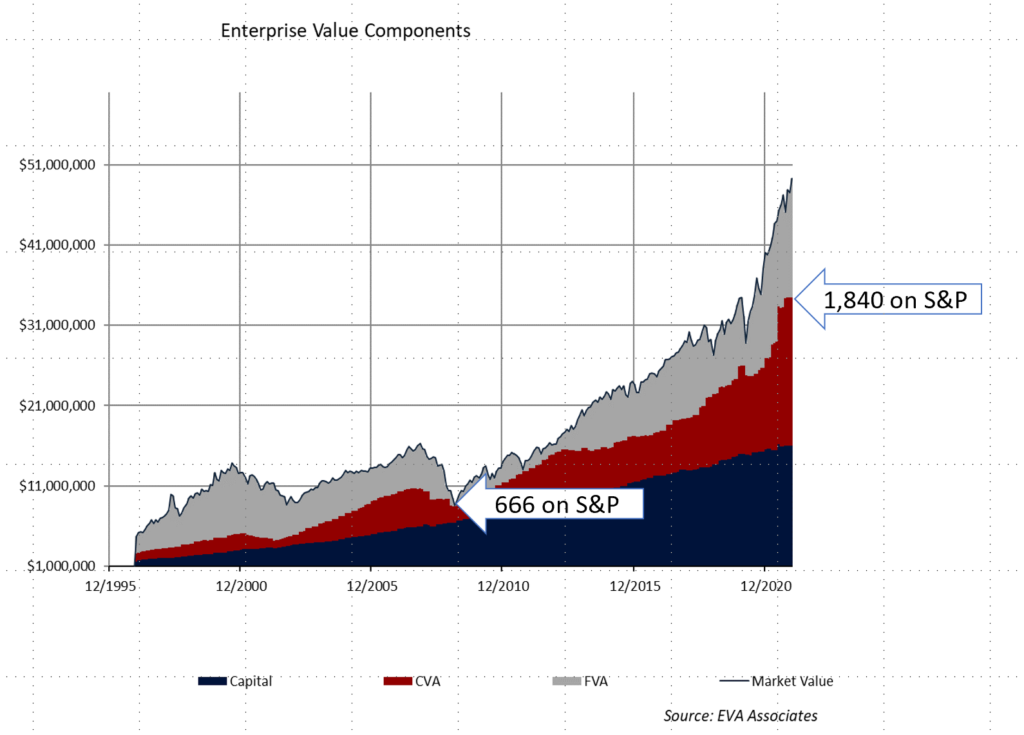

Now, when the market bottomed out in 2009 at the end of the Great Financial Crisis, markets gave no credit to future earnings growth. Stocks priced in only the amount of capital companies had invested in growth and current earnings.

Should they arrive at the same discount today, then that implies the S&P could trade to, or through, around 1,800 as demonstrated in the chart below.

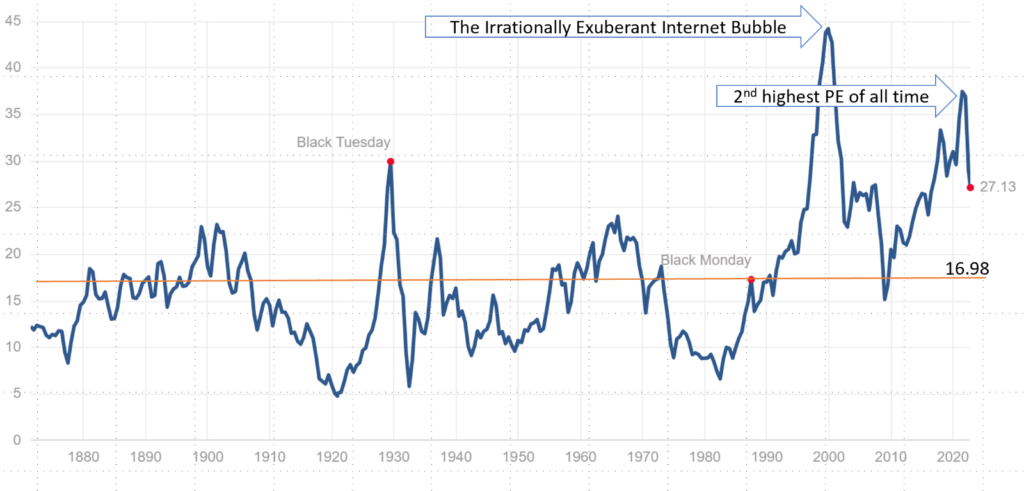

A second approach is the familiar Price-to-Earnings (PE) multiples. It measures how large a premium investors are willing to pay for future earnings.

It peaked a year ago. And if 150 years of history is any guide, it never peaks without dipping below 16.98 and taking the S&P down to around 2,200.

You can find my original analysis of these factors here.

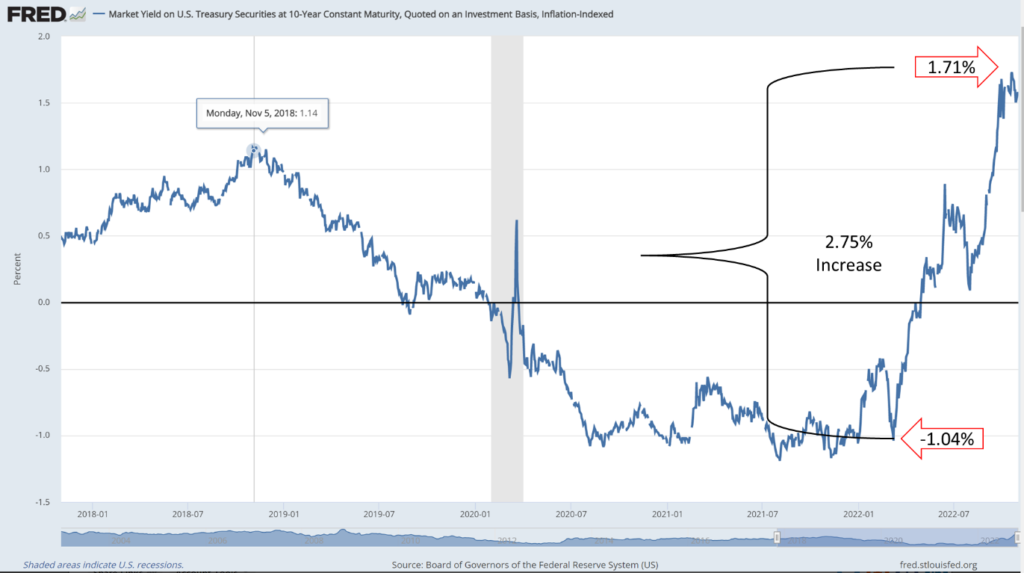

My third approach uses a valuation technique borrowed from bonds — duration.

Duration measures how far a security’s price will fall based on rising interest rates, or vice versa.

For example, a bond with a 10-year duration will fall 10% for every 1% increase in 10-year treasury rates while a bond with a 20-year duration will fall 20%.

You can do the same for stocks (as in “how much do equity prices fall for every percent rise in treasury rates?”)

This turns out to be 15%.

The chart below shows 2.75% percent rise in rates this year, which implies a 41% drop in the S&P. So far, we’re haven’t covered half that. And that’s assuming rates don’t rise even more.

Read this post to dig into this analysis further.

And now to plumb how far stocks could realistically fall from one final angle.

Looking Through the Technical Lens

What I’ve demonstrated so far are fundamental approaches using three different valuation techniques. But I also rely on a technical study called the Volume Profile to get a sense of what price levels have historically attracted the most trading volume.

The Volume Profile provides three key price levels:

The first is the Point of Control which is the single price with the highest trading volume across whatever time frame you’re looking at.

The other two are the Value Area High and the Value Area Low. These are the prices between which 68% of the trading volume surrounding the Point of Control has occurred.

Essentially, prices are drawn to these levels like magnets and provide future support and resistance levels.

When I add the Volume Profile to the S&P 500 futures chart I showed at showed at the start of this post, the 2018 high of 2947 aligns perfectly with the Value Area High for that 10 year period.

And the 2015 high of 2134 is essentially the same price that attracted the most trading volume over the last 10 years (2084 — within 50 S&P points).

In short, we’re in a bear market — and we’ll remain in one until confidence in price stability returns.

A volatile geopolitical scene only increases the risk that this bear market will morph into something far more severe.

Think Free. Be Free.

P.S. In my FREE Prosperity Pub Telegram channel, I look at the market’s possibilities every single day with a group of like-minded traders. Join us and see how we’re making these markets work for us.