>>>I’ll be live with Jack Carter at 11:30 AM ET for Market Masters — we’ll cover current trends and trades, actionable opportunities, trading education and more!<<<

Here’s something that’s been on my mind lately, and it might completely change how you’re thinking about this AI rally we’re in.

Everyone’s worried about the wrong thing. They’re watching the hyperscalers — Alphabet (GOOGL), Meta Platforms (META), OpenAI — waiting for one of them to stumble and bring this whole thing crashing down. But that’s not how this plays out.

I think we are in some sort of bubble. This may be the mother of all bubbles, as far as everything goes. But here’s the thing most people are missing about where the actual vulnerability lies.

Think back to the dot-com era for a second. It wasn’t the infrastructure companies that collapsed first — it was the thousands of companies building applications on top of that infrastructure. Sound familiar?

The Real Weak Link in the AI Chain

Think about all the apps that are being built on this AI infrastructure. Those companies — the ones creating AI-powered applications — those are the customers that are buying this stuff from Alphabet, Meta, and OpenAI.

Those customers are essentially the dot-coms of this cycle. And just like 2000, they’re the ones that’ll start falling apart first when the music stops.

Now, before you start rushing for the exits, here’s what you need to watch for. If we see an explosion of these little companies that do weird stuff with AI start going public — which we haven’t really seen yet — that’s kind of the sign that we’re going into the hyper explosion higher, the blow-off top.

And this could keep running for a year, or maybe three years, before we push this out to redline. We may not be anywhere close to the top yet.

The Circular Money Problem That Can’t Last Forever

There’s another angle to this that’s fascinating — and a bit troubling. NVIDIA (NVDA) is in a circular firing squad kind of thing, where they’re investing in all these companies and saying, hey, we’re gonna give you some money if you buy our GPUs.

It’s almost like leverage in the stock market, where you can buy a stock and then use 80% of that to buy more stock, and then use 80% of that to buy more stock. Sounds great on the way up, right?

Eventually, though, you get to where you can’t roll it out any further. There’s a limit to how many times you can recycle the same dollar through the system before someone actually has to generate real revenue from real customers.

So I’m not saying run for the hills tomorrow. What I am saying is keep your eyes open for that wave of AI app company IPOs. When that starts happening en masse, we’re probably entering the final euphoric phase. And when those customers — not the hyperscalers — start going under, that’s when the real trouble begins.

The infrastructure will survive. It always does. But the application layer? That’s where the carnage happens.

Jeffry Turnmire

Jeffry Turnmire Trading

I host my “Morning Monster” livestream at 9:15 a.m. ET each weekday on YouTube, and then “30 Minutes of Awesome” at 5 p.m. ET each Tuesday!

Please check out my channel and hit that Subscribe button!

You can also follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

- Telegram: https://t.me/+6TdDE7-F6GlhMmJh

Important Note: No one from the ProsperityPub team or Jeffry Turnmire Trading will ever message you directly on Telegram.

I’m just a regular dude in Knoxville, Tennessee: a husband, father, civil engineer, urban farmer, maker and trader.

I’ve been at this trading thing with real money for 20-plus years, and started paper trading over 35 years ago. I have a knack for making some epic predictions that just may very well come true. Why share them? Because I like helping other people — it’s the Eagle Scout in me.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

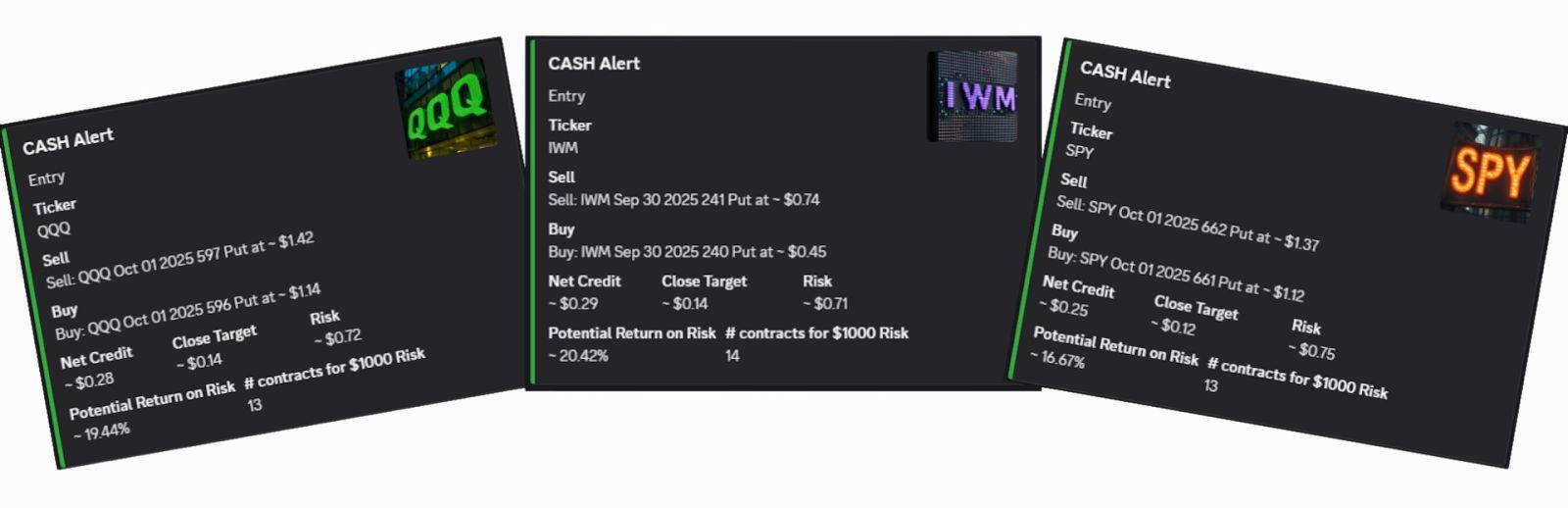

P.S. Would You Like 3 Hot Cash Opportunities per Day… Delivered on a Platter?

My CashBot is showing folks what seems to be a better approach to income trading.

With up to 3 opportunities to target cash every day, CashBot is changing the game for day traders.