>>>I’ll be live with Jack Carter at 11:30 AM ET for Market Masters — we’ll cover current trends and trades, actionable opportunities, trading education and more, CLICK HERE TO JOIN US!<<<

There’s a corner of the market right now that’s so beaten down, everybody hates it. And that’s exactly why I’m paying close attention…

The Energy (XLE) sector is setting up as a classic contrarian play. Oil prices are predicted to fall, and I’ve been predicting the same. In fact, we’re looking at probably a bottom around the low $50s, and this could maybe prolong into early next year before we actually flush it out.

That should make your ears perk up.

Markets move in cycles. The hottest sectors typically don’t stay at the top, and the worst performing sectors don’t tend to stay at the bottom. We’ve seen this play out over and over.

Look at the AI trade — for the last two years it was basically free money, but now we’re in the hangover period. The easy money’s gone. Meanwhile, beaten-down areas like Energy (XLE) are setting up for the next rotation.

And it’s not just energy… Financials (XLF) have been in the doghouse for years, but bankers are talking about a comeback in 2026. Even Real Estate (XLRE) — after years of doom and gloom — is starting to show signs that the bottom is in. These are the kinds of sectors that often deliver outsized gains when sentiment finally shifts.

That’s why now’s the time to start thinking about where your position is going to be. Where are you buying? What’s the good stuff? What’s the bad stuff?

The Setup Behind the Scenes

Here’s what makes the energy setup interesting. While the refining side is getting hit hard, the big oil field services companies are looking ahead to a new cycle of international activity that’s expected to pick up in the second half or even late 2026.

Positioning now is a risky bet for sure, but knowing ahead of time that this is happening lets you start making a plan. You don’t have to jump in blindly today. But you should be watching, tracking and preparing your strategy for when the bottom comes.

On the technical side, oil’s getting close to a key level around $55, and if we can break down below that area, it should flush on down to $50 pretty quick. That may take us into the new year, which aligns with my earlier timeline.

The Potential Reward

Once we make it there it could be a long-term bottom, and we could start a rally for quite a while that takes us all the way back up to retest the $100 price on oil.

Let me spell that out: If we touch that $50 area and rally back to $100, that’s a double — a 100% increase.

For those looking for a straightforward way to gain exposure without getting into individual energy stocks right away, United States Oil Fund (USO) would be one of the easier ways to gain exposure to this without leverage.

It tracks oil prices directly and gives you clean exposure to the move.

This isn’t a play for tomorrow. It’s for the adventurous trader who understands that the best setups often form when sentiment is at its worst.

So the play for now is to start building your watchlist. Know your price levels. And when that flush happens — when everyone else is panicking — you’ll be ready to position for what could be one of the bigger moves of next year.

Jeffry Turnmire

Jeffry Turnmire Trading

I host my “Morning Monster” livestream at 9:15 a.m. ET each weekday on YouTube, and then “30 Minutes of Awesome” at 5 p.m. ET each Tuesday!

Please check out my channel and hit that Subscribe button!

You can also follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

- Telegram:https://t.me/+6TdDE7-F6GlhMmJh

Important Note: No one from the ProsperityPub team or Jeffry Turnmire Trading will ever message you directly on Telegram.

I’m just a regular dude in Knoxville, Tennessee: a husband, father, civil engineer, urban farmer, maker and trader.

I’ve been at this trading thing with real money for 20-plus years, and started paper trading over 35 years ago. I have a knack for making some epic predictions that just may very well come true. Why share them? Because I like helping other people — it’s the Eagle Scout in me.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

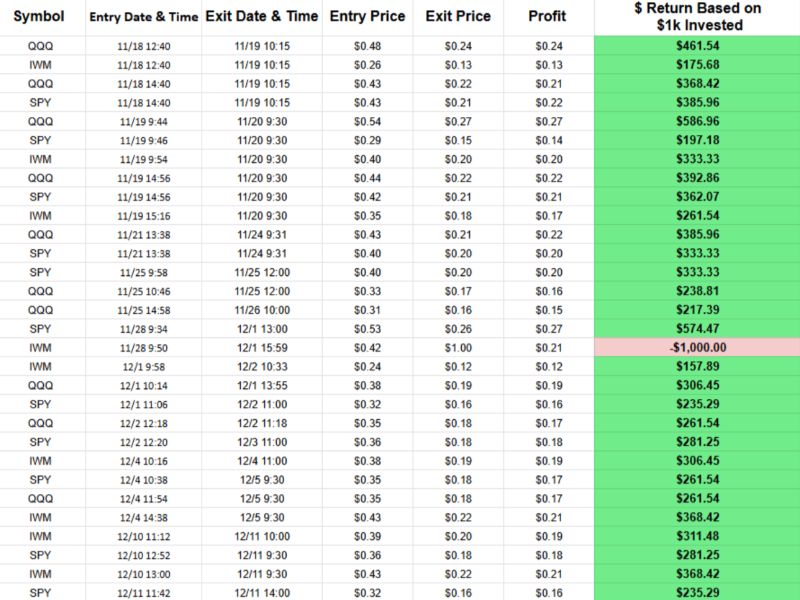

P.S. Make that 31 Wins Outta 32 trades!

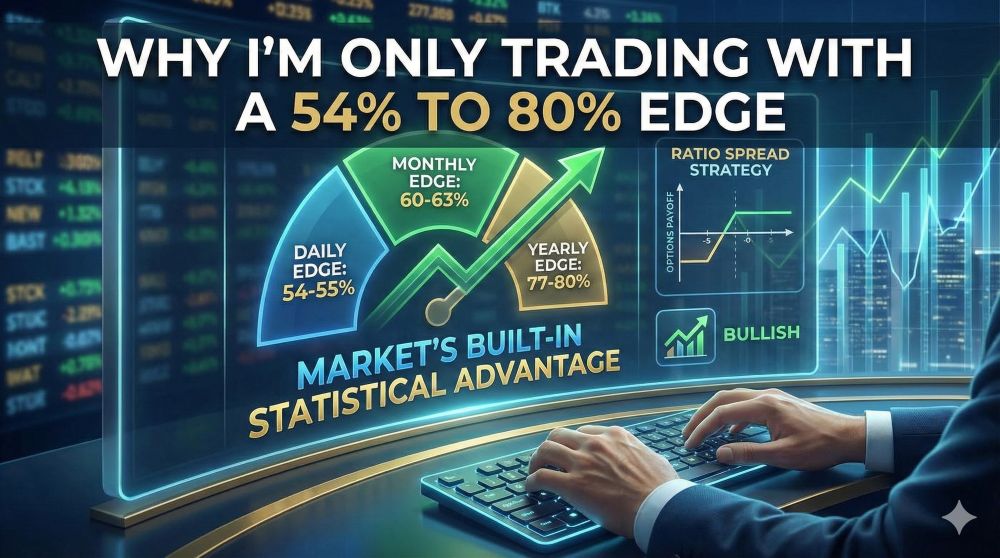

I’ve been tapping into a “timed advantage” in the options market, the same one Wall Street uses to rig the market in its favor…

To target high-frequency income up to 3 times a day.

So far, this approach has delivered 31 wins in 32 trades!

Want the entire breakdown?

Show Me How to Target High-Frequency Trades!

We develop tools and strategies to the best of our ability, but no one can guarantee the future. There is always a risk of loss when trading. The profits and performance shown are not typical. From 11/18/25 – 12/12/25 on 32 live trades taken with real money, the win rate is 96.8%, 27.49% average return, with an average hold time of 24 hours.