>>> I’ll be live with Jack Carter at 11:30 AM ET for Market Masters — we’ll cover current trends and trades, actionable opportunities, trading education and more — JUST CLICK HERE!<<<

I’m not gonna pretend my Nvidia (NVDA) earnings trade was some legendary 200% moonshot — it wasn’t. But I did walk away with 60% gains in a single trade, and more importantly, I knew exactly when to exit.

Here’s how it went down: I bought options at $3, watched the setup unfold exactly as predicted, and closed them out at $5 when the market opened and immediately started turning red. That early warning was all I needed to punch out and call it a day.

The real story here isn’t just the gains — it’s how predictable this trade was from the start, thanks to one indicator that most traders overlook.

When the MMM Draws the Exact Boundaries

Before Nvidia reported, I plotted the market maker move (MMM) on my chart. This indicator shows where the smart money — the people who actually run the market — think the stock will stay during the earnings event. They’ve already priced the options based on these expectations, and it’s unlikely the stock breaks out of that range before expiration.

And you know what? NVDA stayed right in between the uprights, just like the indicator predicted.

The stock ran up to about 198, hit the top of the expected move, then bounced back down to the middle. The MMM laid out the boundaries, and price respected them almost perfectly.

One more detail stood out: premium stayed elevated even with one day left. The MMM still showed a $6 to $6.50 range despite half the time already burning off. That signaled that volatility was still high and the market wasn’t done pricing in risk.

Why There Were No Real Surprises Left

Nvidia reported late in the big tech cycle, which meant there were no real surprises left.

They beat on everything and guided that they’re sold out of everything they can make for the next six months. But we already knew where everybody spent their money and how much they spent.

The other big tech companies had already reported their capital expenditures, so Nvidia’s numbers were effectively priced in.

When everyone already knows the story, upside surprise is limited — and that’s exactly what played out. The stock moved, but it stayed within the expected range because the market had already accounted for the major drivers.

That’s why I got concerned when we opened and immediately turned red. I didn’t need to wait around to see if it would reverse. I had my 60% gain, the setup had played out, and the early price action signaled that the easy money was already made.

So I closed the trade at $5, moved on, and didn’t look back.

Sometimes the best trades aren’t about being greedy and squeezing every last penny out of a move — they’re about recognizing when the setup has run its course and taking profits while they’re still available.

Jeffry Turnmire

Jeffry Turnmire Trading

I host my “Morning Monster” livestream at 9:15 a.m. ET each weekday on YouTube, and then “30 Minutes of Awesome” at 5 p.m. ET each Tuesday!

Please check out my channel and hit that Subscribe button!

You can also follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

- Telegram:https://t.me/+6TdDE7-F6GlhMmJh

Important Note: No one from the ProsperityPub team or Jeffry Turnmire Trading will ever message you directly on Telegram.

I’m just a regular dude in Knoxville, Tennessee: a husband, father, civil engineer, urban farmer, maker and trader.

I’ve been at this trading thing with real money for 20-plus years, and started paper trading over 35 years ago. I have a knack for making some epic predictions that just may very well come true. Why share them? Because I like helping other people — it’s the Eagle Scout in me.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

P.S. Dave’s Viral Stock Scanner Just Flagged a New Name

You can’t afford to miss out on this one!

Graham Lindman’s star student Dave just launched the Viral Stock Scanner to the public for the first time ever!

The very same tool he’s used to exploit social momentum for trade opportunities on viral stocks.

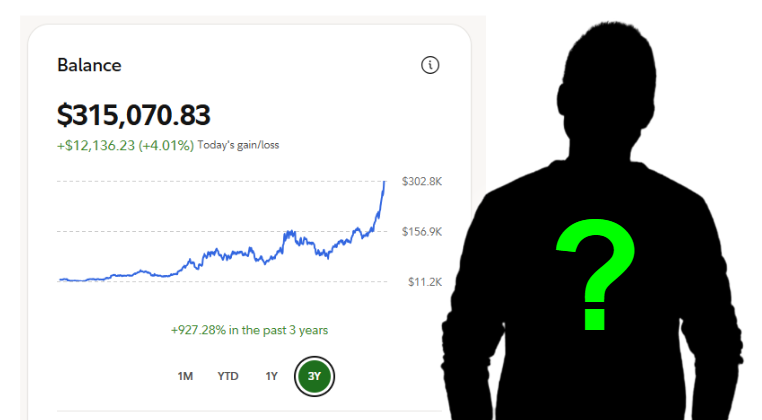

He’s been doing this over the last three years, and he’s turned a $38k account into $315k…

Practically outperforming Wall Street’s top hedge funds within that timeframe.

Now here’s the important part…

The Viral Stock Scanner just caught yet another stock building powerful social momentum as you read this.

From the looks of things, this one is showing the power to dwarf many of the opportunities that have come up this year!

He’s willing to hand you the details of this stock and even show you how best to get in on it.

It goes without saying that we can’t make absolute guarantees here…

We develop tools and strategies to the best of our ability but no one can guarantee the future. There is always a risk of loss when trading. Past performance is not indicative of future results. Over the last three years, Dave was able to turn a $38k retirement account into $315,000 trading what he calls Viral Stocks on X. What you will see today are some of the best examples, and only a small fraction of the overall trades that it took to build up the account. There were smaller winners and there were losers along the way. We’ve taken Dave’s methodology and created a “Viral Stock Scanner” to help us find these opportunities automatically. Since we can not promise future returns, we are not implying that this new software system will help you see similar results to Dave. Because the new Viral Stock scanner is a tool for traders, results will vary among users. Trade at your own risk.