We’ve had a ton of mixed signals lately… But when you zoom out just a bit, the picture gets clearer — and I think it’s pointing toward higher prices.

First up: CPI came in lower than expected. That’s a win. It means inflation is cooling (even if just for a month), and it gives the Fed more room to possibly cut rates later this year.

No promises, of course, but at least the tools are back on the table. Funny enough though, bonds didn’t love the news. They sold off.

Meanwhile, gold has been choppy… but don’t let the recent stall fool you. I saw a chart the other day showing how gold and the S&P 500 tend to zigzag off each other — and we’re now at a pivot point where gold could be gearing up for a major leg higher.

Some of the big bank projections are now calling for $3,700 to $4,000 gold, and honestly, that doesn’t sound crazy to me. Could we see some short-term chop? Of course.

But over the longer term, I wouldn’t dismiss gold just yet.

Now, let’s talk seasonals — because I know everyone knows the phrase is “Sell in May and go away.”

And sure, if you look at average S&P 500 returns from May to October vs. November to April, the summer months do look sluggish. But here’s the thing: Even during those “slow” months, the market has still doubled over the last 30 years.

It’s not about abandoning ship — it’s about being a little more tactical. There’s still money to be made.

Bottom line?

Between improving inflation data, supportive seasonals (despite the saying), and some wild setups forming in gold… I don’t think this market’s run is over yet.

Will we get some cool-off or chop along the way? Probably.

But if you’ve been on the sidelines waiting for the “perfect” entry… don’t wait too long.

Greed is creeping back into this market — and the next leg up may already be forming.

C.H. Robinson Worldwide (CHRW) In Bullish Mode

Lately, CHRW has really caught investors’ attention.

The stock jumped more than 7% on Monday, thanks to a broad rally in trucking stocks sparked by easing U.S.-China trade tensions. That momentum was backed up by a solid earnings report — CHRW delivered $1.17 per share in adjusted earnings, beating Wall Street’s $1.05 estimate.

Analysts took notice too. The stock now carries a “Moderate Buy” rating with a price target of $108.54, pointing to more potential upside.

At the same time, our Newton Indicator is in bullish mode. As the stock has surged, it’s gone quickly from red to yellow to green.

This indicates it has strong momentum and could be ready to move higher.

FirstEnergy Corp (FE) Looking Bearish

On the flip side, FirstEnergy Corp (FE) is looking like it might roll over.

While its previous earnings call was good, the technicals on FE are bad. It’s now trading below the 200-day simple moving average and volume has been consistently below average, suggesting diminished interest.

Further, analysts are maintaining a “Hold” rating.

And the Newton Indicator agrees. Newton shows that momentum has fallen from green to yellow and now to red. It looks like momentum is fading fast.

Graham Lindman

Graham Lindman Trading

Follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

Important Note: No one from the ProsperityPub team or Graham Lindman Trading will ever contact you directly on Telegram.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

P.S. This 100% Accurate Bullish Indicator Turned Green

It’s gonna be a good year ahead…

That’s according to a bullish indicator with a 100% success rate over the past 75 years…

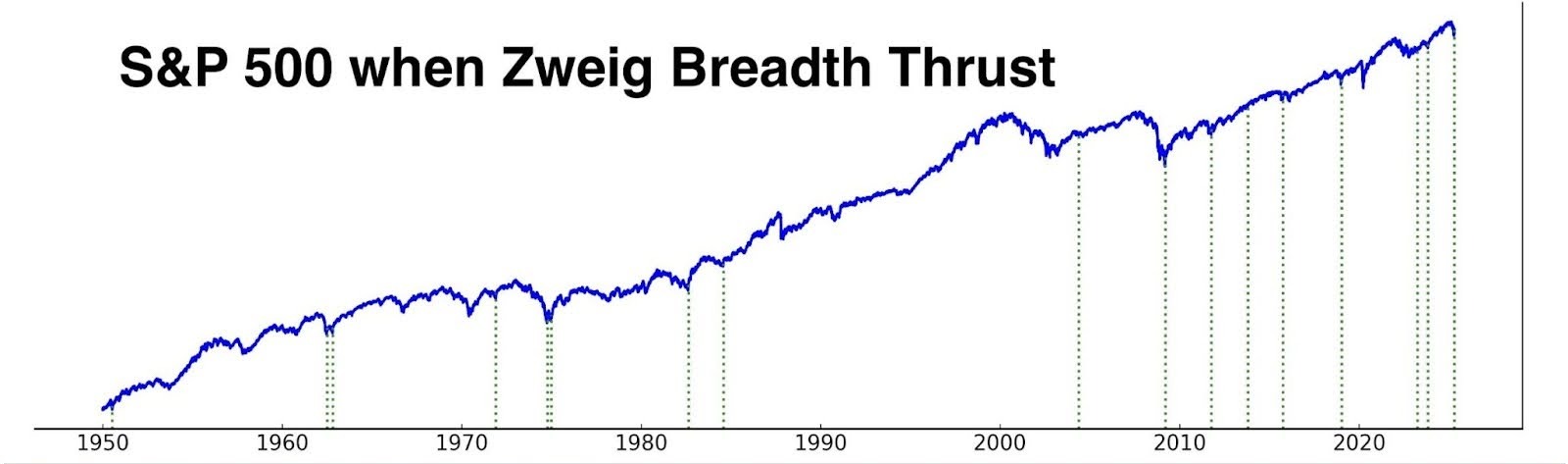

It’s called the Zweig Breadth Thrust (ZBT) indicator.

Admittedly, it’s not the catchiest name. But you can’t argue with the results…

The stock market gained about 23% the last 16 times this indicator turned green.

That’s great news!

But there’s a way to do even better than just buy-and-hold.

That’s because this indicator is SUPER bullish for a subset of stocks.

That’s why I put together a special presentation to show you how to take advantage of the ZBT.

Naturally, I can’t promise future returns or against losses, but…

Inside, you’ll discover:

✅ How to spot the market’s strongest stocks

✅ The No. 1 bullish stock it’s pointing to for May

🚫 And the No. 1 stock to avoid at all costs