After a solid two-day rally, stocks are taking a step back as investors are cautious ahead of the Federal Reserve’s big policy meeting.

With economic slowdown fears still hanging over the market, traders are looking for any hint of what the Fed might do next.

And with the S&P 500 still stuck in correction territory, many on Wall Street aren’t convinced the recent bounce means we’ve hit a real bottom.

SIX of our top experts are getting together at noon ET on Wednesday ahead of the announcement to break down our top trade ideas for the aftermath of the decision.

I’ll be live with Roger Scott, Nate Tucci, Jeffry Turnmire, Kane Shieh and Chris Pulver, so be sure to join us then for the big debate!

Gold Surges, Oil Climbs, and Geopolitics Stay Messy

Gold just hit a record high above $3,040 an ounce as tensions in the Middle East escalated again following more Israeli airstrikes on Gaza. Gold is up nearly 6% in the past month as investors look for safety outside of stocks.

Meanwhile, crude oil jumped over 1%, adding more fuel to inflation concerns.

At the same time, Donald Trump’s call with Russian President Vladimir Putin over a potential Russia-Ukraine truce and Germany’s historic spending vote are adding more uncertainty to the mix.

But that’s not all…

Housing starts surged 11.2% last month, hitting an annualized pace of 1.501 million units — well above expectations.

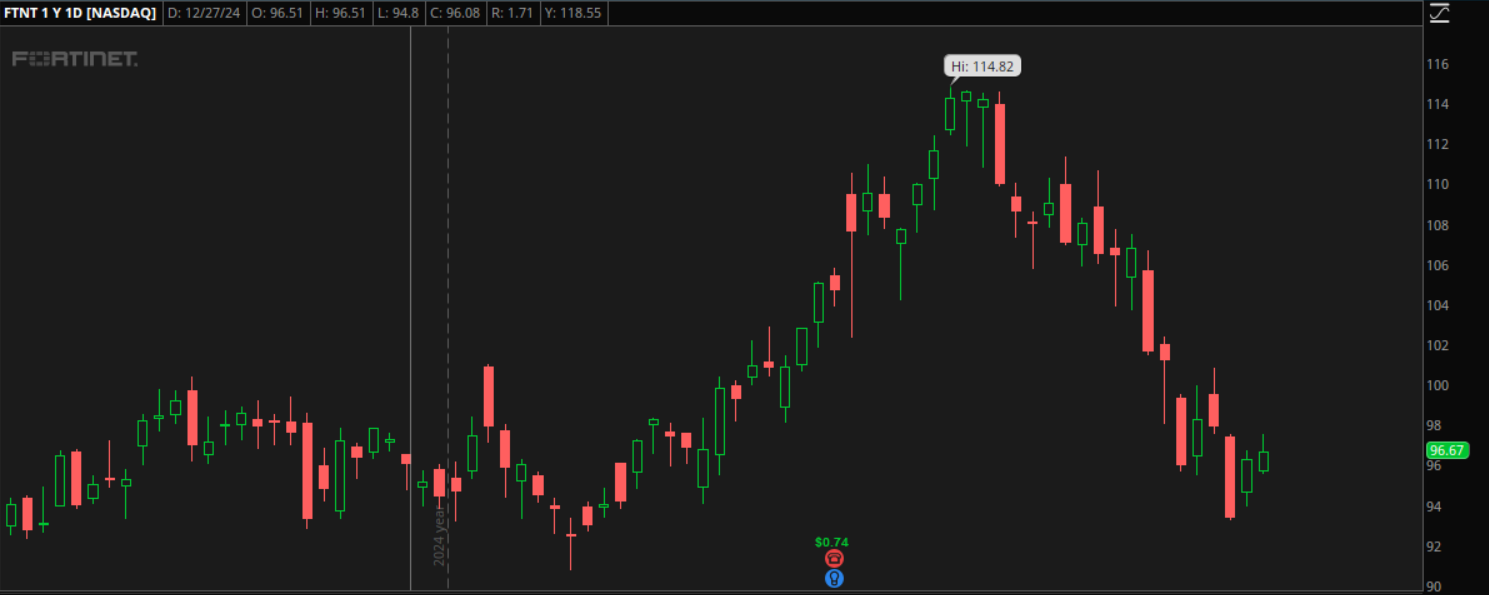

A Stock to Watch: Fortinet (FTNT)

Fortinet (FTNT) is a stock to keep on your radar this week, as it tends to be very bullish in March.

Despite current volatility, this seasonal trend could be worth a look, especially if we see continued bullishness.

Buying FTNT on March 17 and holding for 19 days has delivered an average return of 6.74% over the past several years. While past performance is no guarantee, it’s definitely worth considering as we move through March, which is one of the most bullish seasonal periods of the year.

Keep in mind, global markets remain volatile.

Geopolitical tensions, rising gold prices and climbing oil costs are keeping investors on edge. Meanwhile, that strong 11.2% jump in housing starts offers a rare bright spot, suggesting some resilience in the U.S. economy.

But with so much uncertainty surrounding Fed policy, trade disputes, and global conflicts, the market remains fragile.

For now, traders are bracing for whatever comes next — because volatility isn’t going anywhere.

Now be sure to join us at noon ET on Wednesday! We’ll also dive into…

- Our top actionable trade ideas in the current market.

- Expectations for what the Fed will do and how it will affect the market.

- One key mindset shift traders should make right now.

- And leaving plenty of time to answer all your market questions.

Graham Lindman

Graham Lindman Trading

Follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

Important Note: No one from the ProsperityPub team or Graham Lindman Trading will ever contact you directly on Telegram.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

P.S. Don’t Miss Out on the WORLD PREMIERE of Roger Scott’s Brand-New 0DTE Tool: Alpha Zone Pro

Roger has dominated the markets with a 94.1% win rate on over 300 live alerts using his ProTrader Dashboard.

But until now, that system was limited to stocks like Apple or Tesla with weekly options that have 10%-20% return potential.

Then he realized something…

What if we applied his proven method to tickers with DAILY options — potentially boosting profits about 5X?

And after six months of intense development and beta testing with Roger’s Trading Pit members, he’s finally ready to unveil his groundbreaking day trading system for 0DTE — Alpha Zone Pro.

And he’s going to premiere it at 1 p.m. ET on Wednesday, March 19!