🚨 I’ll be live with Alex Reid at 2:30 p.m. ET🚨

>>> We’re covering high-risk earnings opportunities, the major market open signal appearing in my flows and the next nuclear energy company positioned for a powerful move, click HERE to join LIVE! <<<

Most traders don’t lose money because they’re bad at reading charts.

They lose money because they insist on fighting the market.

I’ve seen it repeatedly — traders forcing trades that don’t align with what the broader tape is doing.

They find a strong-looking setup, ignore market context and then wonder why it fails.

The market doesn’t care how good your idea is if you’re positioned against momentum.

Why Market Direction Still Matters

If the market’s green, especially on names like S&P 500 (SPY) and Nasdaq (QQQ), your odds improve dramatically by looking for calls instead of forcing puts.

That doesn’t mean every stock goes up on green days, but it does mean you’re swimming with the current instead of against it.

When markets are opening lower and selling off day after day, the easier trade is usually puts.

You can still find defensive names that move higher, but you’re stacking the deck against yourself if you ignore the dominant trend.

This isn’t about being perfect. It’s about making trading easier.

Use the Market as a Filter

One of the biggest mistakes traders make is falling in love with a thesis.

They decide if a stock “should” go down or “has to” bounce, and then keep pressing the trade even when price action disagrees.

That’s when accounts bleed slowly.

Aligning with the market doesn’t mean you can’t take contrarian trades.

It just means you should be intentional.

Opposite-direction trades work best when you understand you’re playing on hard mode.

Trading is hard enough without trying to prove the market wrong.

👉 Click here to join Profit Panel at 2:30 p.m. ET on weekdays!

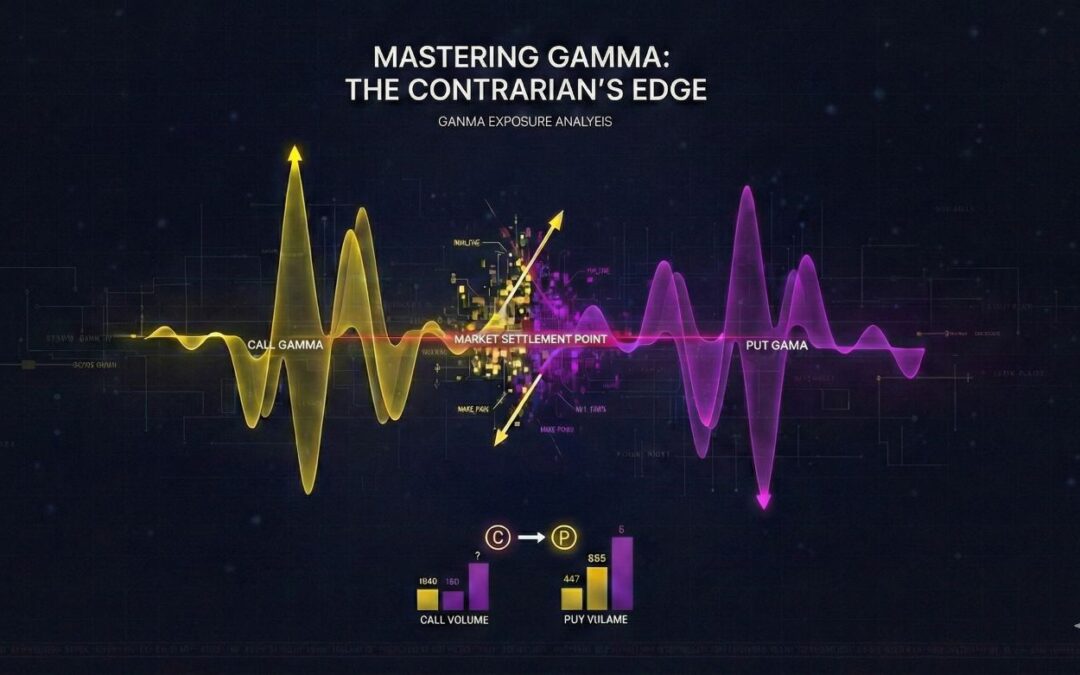

P.S. Don’t Let The Recent Gold Dip Fool You!

I’m the one who nailed the Gold Supercycle call back in 2023…

And now I’m seeing the setup for a third mega catalyst that could make gold’s recent 150% run look like a drop in the bucket.

At 1 p.m. ET on Thursday, I’m going live with Nate and Alex to break down the exact conditions that could ignite the next major leg higher.

I’ll also walk through the trading “glitch” I plan to use to take advantage of this move — the same approach that delivered a perfect win rate last year.

If you want to understand what’s lining up, why it matters and how I’m positioning for it, you’ll want to be there.

Geof Smith

Geof Smith Trading

Follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

- Telegram:https://t.me/+lm8_Nq3Su104NmFh

- YouTube:https://www.youtube.com/@FinancialWars

Important Note: No one from the ProsperityPub team or Geof Smith Trading will ever contact you directly on Telegram.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.