>>> We’ll play 1DTE Roulette and look for the strongest trending stocks this week to see if we can find a cheap play expiring Friday, do some live trading and cover stocks making interesting moves — Profit Panel starts at 2:30 PM ET, Click Here to join <<<

I learned something about technology depreciation the hard way.

Not from a quarterly report or some analyst deck — from my own desk.

I’ve been trading the AI and semiconductor space for a while now and one of my core theses has been about depreciation risk. These AI chips everyone’s racing to build are going to age faster than the market realizes.

The upgrade cycles are compressing and that creates real problems for companies trying to get a return on billions in capital spending.

Then, I lived it…

And ironically, this wasn’t the first time.

Years ago I ran a laptop into the ground for more than a decade — an honest 11-year-old machine that just kept going. Back then, tech held up. That kind of longevity feels prehistoric now.

When Old Hardware Hits a Wall

My latest laptop was 6 years old. Not ancient — just normal wear and tear, right? Wrong. I went to install an app and it wouldn’t run. Not slow. Not clunky. Just wouldn’t install.

That’s not gradual obsolescence. That’s a cliff.

So I replaced it with a brand-new machine — and the speed difference knocked me sideways. I’m talking night and day. This thing runs rings around what I had and my old laptop wasn’t exactly a clunker when I bought it.

Meanwhile, a lot of people are holding onto their devices longer than they used to, sometimes nearly two extra years before upgrading. That works fine for phones and laptops, where acceptable performance has a wide tolerance.

But the enterprise world — especially AI infrastructure — doesn’t get that luxury. The performance bar keeps rising and the hardware has to keep up.

Here’s the thing: This speed of improvement doesn’t just make old hardware feel slow. It hits companies right on the balance sheet.

When chips depreciate this fast, asset values sink just as quickly. Gear that was supposed to deliver returns over several years becomes a write-down in months. The financial models simply don’t match reality anymore.

What This Means for the AI Trade

I bought another new laptop last June and even that machine — just a few months old at the time — felt like a rocket ship compared to what I’d been using.

The improvement curve isn’t linear anymore. It’s exponential.

That’s great if you’re a consumer replacing a laptop every few years, but it’s a nightmare if you’re a company trying to justify multi-billion-dollar AI infrastructure investments.

Depreciation isn’t just an accounting line item. It’s a real risk and it’s accelerating.

The faster the technology improves, the faster your existing gear becomes a liability.

Companies counting on long asset lives are discovering those assumptions don’t hold. When hardware ages this quickly, the financial plan breaks before the hardware does.

I’m not saying don’t own semiconductor stocks or AI plays. I’m saying understand the risk.

Companies that can’t keep up with upgrade cycles — or that overbuild based on today’s specs — are going to get caught holding expensive, obsolete hardware.

When your apps won’t even install anymore, the depreciation schedule doesn’t matter. The asset’s already worthless.

Geof Smith

Geof Smith Trading

Follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

- Telegram: https://t.me/+lm8_Nq3Su104NmFh

- YouTube: https://www.youtube.com/@FinancialWars

Important Note: No one from the ProsperityPub team or Geof Smith Trading will ever contact you directly on Telegram.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

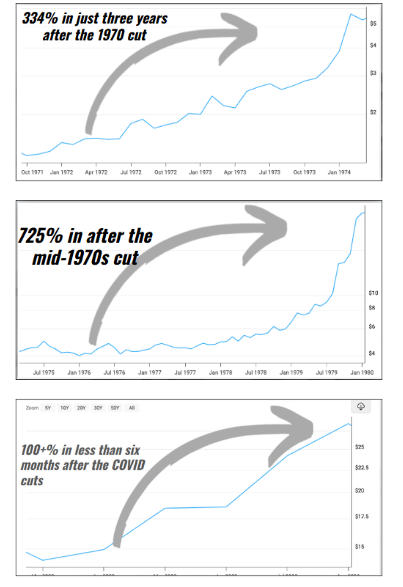

P.S. Did You Catch My Urgent Fed Briefing?

I broke down how this rate cut cycle has kicked off a massive shift in the stock market…

And showed my #1 play you need to know to take advantage of this opportunity.