>>>We’ll discuss our No. 1 holiday tickers, how to play the metals rotation and short chicken noodle soup, plus do some live trading and cover stocks making interesting moves as usual — Profit Panel starts at 2:30 PM ET, CLICK HERE TO JOIN!<<<

I spotted something Monday that doesn’t get a lot of attention but probably should.

DigiPower (DGXX) — a utility play that powers data centers and has a piece of the crypto mining business — just broke above its 50-day moving average, and there’s real room for it to run from here.

The stock came down from around $7 and got cut in half before stabilizing, which makes this breakout even more interesting as crypto and related names start to recover.

This isn’t a household name. But when you look at what’s happening in Bitcoin and stocks like Riot (RIOT), it’s hard to ignore a company that sits right in the middle of two strong themes: data centers and digital mining infrastructure.

Market Context and Technical Setup

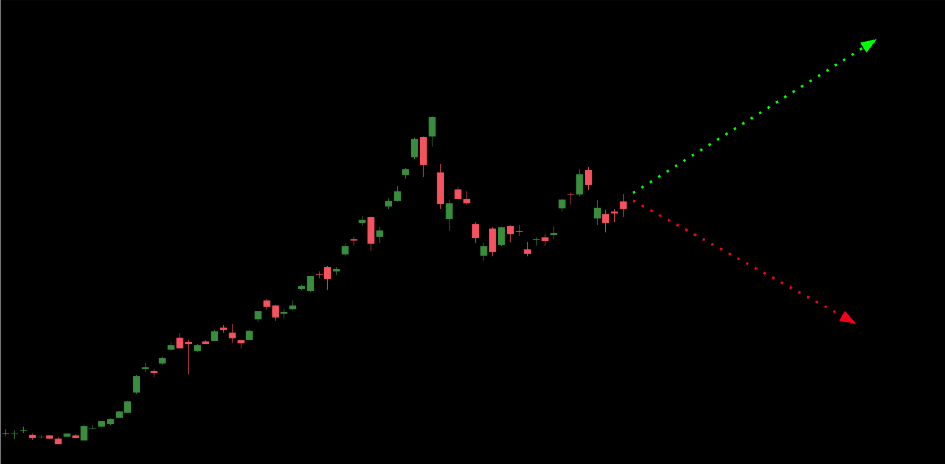

DGXX has been following the broader recovery that’s starting to take shape in crypto-linked names. If Bitcoin continues climbing and Riot holds its rebound, DGXX should have every reason to participate. The stock already weathered a big drawdown, and now it’s pushing through resistance levels with a clean technical setup.

Beyond the 50-day moving average break, anchored VWAP is showing the stock finally reclaiming pricing levels that have suppressed it for months. That’s often a sign of a shift in control from sellers to buyers, especially when volume starts to pick up.

It’s still early in the move, which is why the pricing remains attractive across multiple angles — especially in the options market.

Options Strategy for DGXX

What really stands out here is how inexpensive the calls are relative to the potential upside. DGXX trades with dollar-wide strikes, giving you room to choose how aggressive you want to be. The Dec. 19 expiration, $5 strike call has been trading around 25-35 cents (30 cents this afternoon), and the higher strikes are still very reasonable as well.

With a few weeks until expiration, the combination of a technical breakout, improving sector sentiment and low-cost options sets up an asymmetric situation.

You don’t need a huge move for these calls to make sense — just continuation of what’s already starting.

This is the kind of setup where the risk is defined, the pricing is friendly and the narrative is improving. That’s usually worth at least a closer look.

Geof Smith

Geof Smith Trading

Follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

- Telegram:https://t.me/+lm8_Nq3Su104NmFh

- YouTube:https://www.youtube.com/@FinancialWars

Important Note: No one from the ProsperityPub team or Geof Smith Trading will ever contact you directly on Telegram.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

P.S. Urgent Gold Notice for Traders!

During gold’s first extended pullback in nearly two years, is it time to sell everything or double down?

Roger invited Geof Smith to share his latest expert forecast…

Geof nailed the current gold supercycle… but this briefing is primed to be on a different level and keep you on the edge of your seat.

Yes! Show Me the Entire Forecast!