JOIN ME LIVE AT 9 AM ET FOR: MACRO MONDAYS

I’m taking a stance right now that’s probably not going to win me any friends in the growth camp, but I’ve got to say it…

I’m actively moving away from the Magnificent Seven (MAG7) and into other areas of the market.

Look, I get it. Amazon (AMZN), Nvidia (NVDA), Alphabet (GOOGL) — these companies have put up remarkable growth and carried the U.S. indices higher.

They’ve been unstoppable. But here’s what’s nagging at me: Historically, most of the growth in the S&P 500 (SPY) comes from midcaps, not from mega-tech.

What we’re seeing in the last few years with MAG7 is an anomaly. And anomalies don’t last forever.

The thing is, the law of large numbers typically works against you when you get to be that size. It’s just math. Yet somehow, these companies have defied it — so far.

But I’m starting to wonder if we’re completely divorced from the actual real market.

Here’s the question I’ve been asking myself…

Is the steady performance of MAG7 enough to keep the entire market resilient, or are we setting up for a rebalancing?

Where I’m Actually Putting My Money

I’m not just talking about this theoretically. I’m actively trading Utilities (XLU), Energy (XLE) and Health Care (XLV) names like Biogen (BIIB). I bought Xcel Energy (XEL), and I’m long NextEra Energy (NEE).

Why? Because I think if we see rate cuts into 2026 and the economy holds up, there are other areas with more potential.

The MAG7 has played this defensive role during high interest rates, and they’ve done it brilliantly. But I don’t know if that remains the place to be when rates actually get cut.

The dynamics change.

If you’re sitting on a portfolio that’s 50% equities and 10% of that is MAG7, you’re not alone — but you might want to pay attention to what happened in February and March.

If you’re not rebalancing, you could see a correction coming to MAG7.

The Rebalancing Nobody’s Talking About

Here’s the reality: Utilities, Health Care and Energy have been overlooked while everyone piled into the same seven names. That creates opportunity.

I’m not saying MAG7 is going to zero, of course. I’m saying the setup for outsized returns might be shifting elsewhere. And I want to be positioned before everyone else figures it out.

This isn’t about being contrarian for the sake of it. It’s about recognizing when market dynamics are changing and adjusting before the crowd does.

Are you still overweight MAG7? Maybe it’s time to take a hard look at where your portfolio actually sits.

I’ll see you in the markets.

Chris Pulver

Chris Pulver Trading

Follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

- Telegram:https://t.me/+av20QmeKC5VjOTc5

- YouTube:https://www.youtube.com/@FinancialWars

- Twitter:https://x.com/realchrispulver

- Facebook: https://facebook.com/therealchrispulver

Important Note: No one from the ProsperityPub team or Chris Pulver Trading will ever contact you directly on Telegram.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

I’ll see you in the markets.

Chris Pulver

Chris Pulver Trading

Follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

- Telegram:https://t.me/+av20QmeKC5VjOTc5

- YouTube:https://www.youtube.com/@FinancialWars

- Twitter:https://x.com/realchrispulver

- Facebook: https://facebook.com/therealchrispulver

Important Note: No one from the ProsperityPub team or Chris Pulver Trading will ever contact you directly on Telegram.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

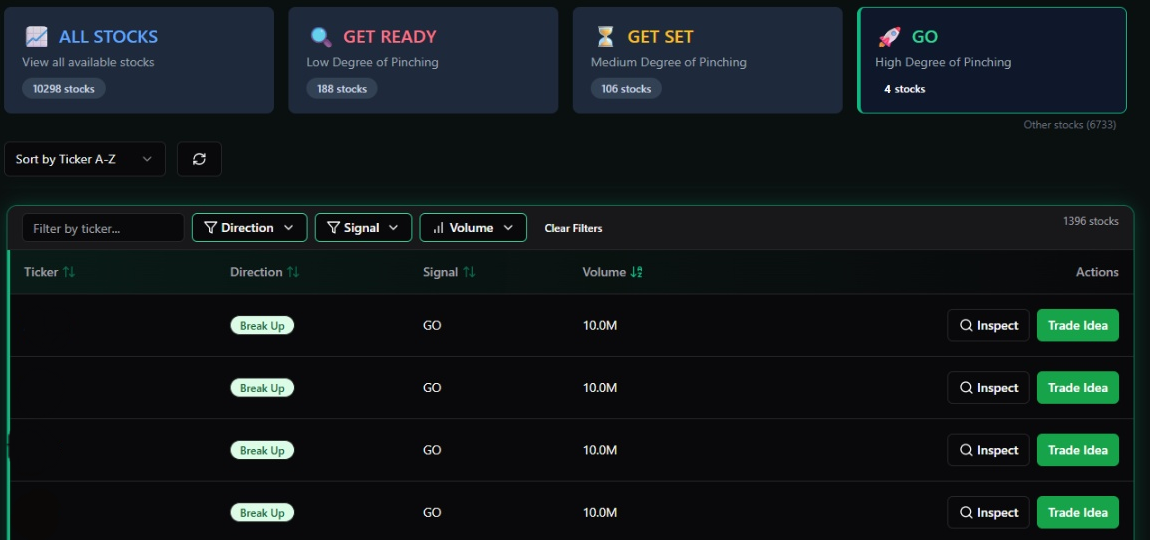

P.S. I’ll Be Surprised If You Find These Stocks Being Paraded on the News

But they are, however, flashing signs I love to see…

And one of them is already priming for a potential parabolic move!

If you’d like to see what they are and how I’ll go after them…