It’s an everything melt up day!

Looking at the tape heading into the Final Hour — be sure to tune in at 3 p.m. ET on Monday, Tuesday, Thursday and Friday…

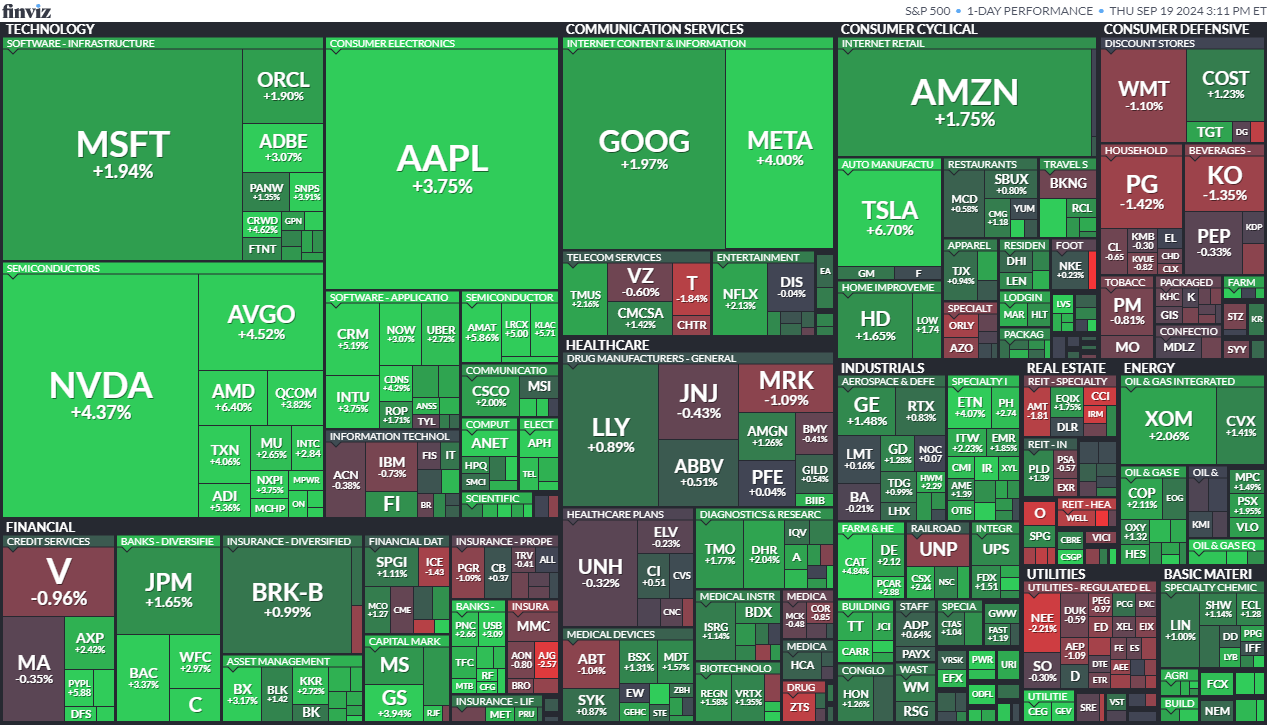

Tech is absolutely ripping, outperforming most everything else, but there isn’t much that’s really “lagging” on a day like today aside from more defensive stocks.

As of 3 p.m., the Nasdaq 100 (QQQ) was up 2.7%, the S&P 500 (SPY) is up 1.8%, the Dow is up over 560 points, and the Russell 2000 (IWM) is up 2%.

All of this comes of course after the Federal Reserve cut interest rates by 0.5% on Wednesday, the first rate cut in four years after an aggressive hiking campaign.

I’m not so sure this will continue, but we have over $5 trillion dollars that will settle Friday with monthly options expiration across the board.

I expect Friday will be volatile, but whether today is a blow-off top or not, it’s still too early to say.

But take a look at this…

The Magnificent 7 is rocking and rolling!

The immediate reaction was subdued when the rate cut was announced, but then futures started rallying after the U.S. markets closed.

So let’s dive in at the video up top, and cover it all, including what’s to come Friday and beyond, how I’m trading it and more!

Chris Pulver

Chris Pulver Trading

Follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

-

- Telegram: https://t.me/+av20QmeKC5VjOTc5

- YouTube: https://www.youtube.com/@ChrisPulverTrading

- Twitter: https://x.com/realchrispulver

- Facebook: https://facebook.com/therealchrispulver

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

P.S. Check Out This 9:35 Profit Window

What do you usually do between 9:35 and 11 a.m. ET?

Catch up on emails? Attend a meeting? Maybe grab a coffee?

For me, it’s the most important part of my trading day.

85 minutes. That’s usually all it takes.

Set up at 9:35 a.m., check back at 11…

And when things work out, there’s an extra $100 to $150 in my account (on a $1,000 starting stake).

Sounds too simple, doesn’t it?

Here’s the truth… The market has a rhythm, a subtle pattern that shows up day after day.

Most miss it because they’re too busy predicting where the market will end up by the closing bell.

But in those 85 minutes? That’s where the real opportunity lies.

Get the Complete Breakdown Here

The trades expressed are from historical back teste] data from June 2022 through April 2024 combined with Chris’s live money trading from June 2024 through September 1 2024 to dem@hstrate the potential of the system.

The average winning trade during the backtested data was 11.5% while the average losing position was 74.5% per trade and a 90.9% win rate.

The average winning trade during the real time data was 10.5% while the average losing position was 29.5% per trade and an 83% win rate.