JOIN ME LIVE AT 9 AM ET FOR: TECHNICAL TUESDAYS

This is all about chart work. I’ll break down price levels, key patterns and potential trade setups. It’s where I’ll show how I’m drawing levels and setting entries and exits based on what the market gives us.

FOMC week is here, and everyone’s talking about Wednesday’s Fed decision.

The market’s expecting a rate cut — no surprise there…

But here’s what I want to walk you through: why Wednesday might be one of those days where I don’t force a trade, even if the setup looks perfect.

This isn’t about being bearish or nervous about volatility. It’s about understanding a very specific phenomenon that shows up on FOMC days — one I’ve run into before and one I’m not interested in repeating.

The Sticky Implied Volatility Problem

Fed announcement days create their own unique rhythm.

The market can sit perfectly sideways from the open until 2 p.m. ET, barely moving 5 to 10 points, and even though price action is doing exactly what you need, your options rarely cooperate.

The issue is simple: Implied volatility refuses to decay the way it normally does. Mornings can be especially frustrating because you can take a great trade, see price behave flawlessly, and still watch your options go nowhere.

Time decay just doesn’t behave the same way when the entire market is waiting for Fed Chair Jerome Powell.

Trades that should close within a couple hours often end up needing an all‑day hold. Both September and October played out that way — noisy candles, sticky pricing, and exits that dragged all the way through the announcement.

Why This Year Feels Different

The longer‑term trend is up and I’m bullish overall. But it’s also that time of year where Powell can toss the market a curveball.

Last December he went off script, the market hated it, and we saw a fast 6% correction in just a couple days — followed by a huge rip right after the holidays.

That’s the kind of whipsaw you don’t want to get caught in when you’re holding positions that depend on clean, predictable option behavior.

This week typically starts out calm — Mondays, Tuesdays, even Wednesday mornings — and that quiet can make the afternoon volatility even more dramatic. The tone of the press conference matters just as much as the rate decision, and one unexpected phrase can shake loose a lot of pent‑up movement.

So my plan this week is pretty straightforward: either skip Wednesday trading entirely or wait until after the 2 p.m. announcement to see how the market absorbs the news.

I’d rather miss a trade than sit through sticky volatility that turns a good setup into an exhausting all‑day hold.

The short‑term and long‑term trend is still up and I’m focused on bullish setups. But not every day deserves a trade — especially when the mechanics of the market work against you.

I’ll see you in the markets.

Chris Pulver

Chris Pulver Trading

Follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

- Telegram:https://t.me/+av20QmeKC5VjOTc5

- YouTube:https://www.youtube.com/@FinancialWars

- Twitter:https://x.com/realchrispulver

- Facebook: https://facebook.com/therealchrispulver

Important Note: No one from the ProsperityPub team or Chris Pulver Trading will ever contact you directly on Telegram.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

P.S. Can You Spare a Few Minutes Every Monday At 11:59 AM?

That’s when I leverage a special niche in the options market to place a specific trade on one ticker to target “Weekly Windfalls.”

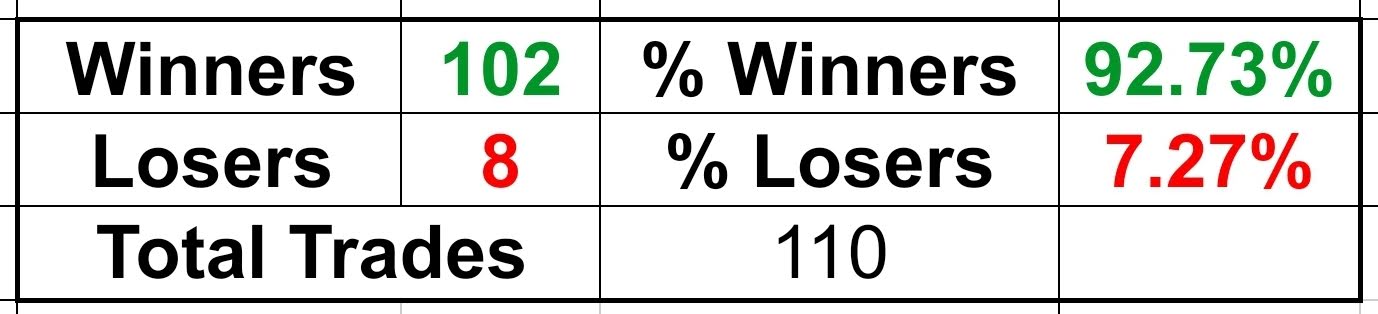

This same approach has delivered a 92.7% win rate on LIVE trades.

Want to see how you can target extra income every week?

We develop tools and strategies to the best of our ability, but no one can guarantee the future. There is always a risk of loss when trading. Past performance is not indicative of future results. From 9/30/24 – 11/07/25 on live trades the win rate is 92%, 16.5% average return, with an average hold time of 12 days.