When the S&P 500 is pressing up against all-time highs, the temptation is to jump in with bearish exposure — especially when a key level like 6,150 comes into view. But these are the exact moments when patience and precision matter most. That’s where the VIX and resistance levels can give you the edge.

I was watching the SPX closely this week as it hovered near 6,147, the February 2024 high. It printed 6,144 intraday, just a couple of points shy, and looked like it might pop 6,150 late in the day. I had a 6,150 by 6,155 bear call spread ready to go — but I didn’t pull the trigger.

Here’s why.

Know Your VIX Thresholds

The VIX continues to hover in the low teens, which means premium is cheap and you’re not getting paid much for risk. In this kind of environment, I rely on a simple guideline: If I’m not getting enough credit on a $5 wide spread — typically at least $2.50 — then it’s not worth the heat. I had the spread loaded and ready but didn’t get the fill.

With only minutes left in the session, I was watching the 6,150 level like a hawk. SPX was sitting at 6,144. A push through 6,150 could have triggered the fill, but without that final squeeze, the premium didn’t get high enough. And with the rule of 16 guiding the way, there wasn’t enough time left to justify jumping in with the trade just hanging near max risk.

Use Resistance as the Trigger — Not the Signal

It’s not just about where the market is — it’s about how it gets there. If the SPX had surged through 6,150 with velocity and volume, maybe I’d have taken the trade for a quick fade. But it didn’t. The market just drifted up to that level. That’s not the kind of rejection I want to see when timing a credit spread.

In the end, I canceled the order. The edge wasn’t there. But the structure is still valid. If SPX stretches again, and I can sell premium near resistance — with a VIX backdrop that justifies the credit — I’ll reload the same spread setup.

Timing these kinds of trades is about discipline. That’s what keeps the edge alive.

I’ll see you in the markets.

Chris Pulver

Chris Pulver Trading

Follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

- Telegram:https://t.me/+av20QmeKC5VjOTc5

- YouTube:https://www.youtube.com/@FinancialWars

- Twitter:https://x.com/realchrispulver

- Facebook: https://facebook.com/therealchrispulver

Important Note: No one from the ProsperityPub team or Chris Pulver Trading will ever contact you directly on Telegram.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

P.S. If It Feels Quiet, That’s Usually a Signal

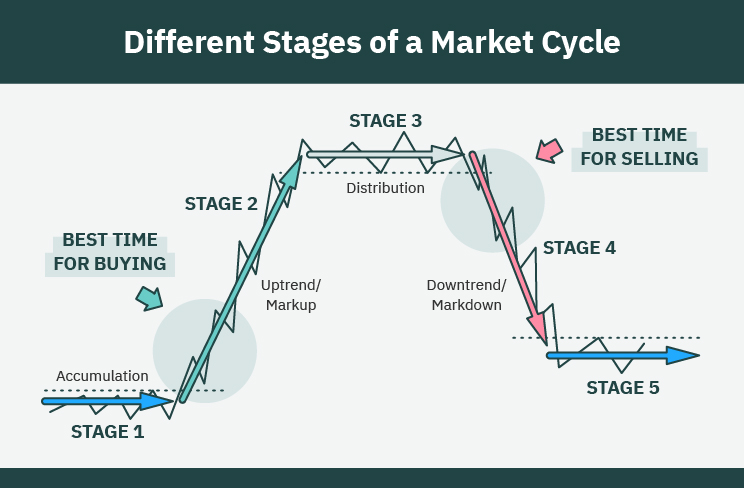

Every major market move follows the same cycle, and if you don’t know what stage we’re in…

You’re playing a dangerous game. Take a look at this chart:

Most traders only wake up during the markup phase, when prices are flying and headlines are bullish.

That’s when the emotional buying starts…

And it’s also when Wall Street is already preparing to distribute their shares, leaving retail traders holding the bag.

But what if you could spot the accumulation phases, before the rest of the market catches on?

That’s exactly what I revealed in my latest briefing…

How to use these “pinch point” setups to anticipate the next breakout, not chase it.

The next breakout candidate is already consolidating quietly…

Naturally, I cannot promise future returns or against losses…

But it’s only a matter of time before the smart money catches on.