A lot of traders out there want to call the top. I get it — we are right back near the all-time highs. But as I said — no matter how much I hate this rally — I think this market has plenty of room to keep pushing higher. In fact, I’m actively positioning for a move toward 6,400 to 6,500 on the S&P 500 by year-end.

History Says Melt-Ups Can Stretch Further

We’ve already seen how markets behave after big recoveries. After the April bottom, this has become one of the strongest volatility crushes in history — the third best all-time recovery after 2008 and 2020.

If you look at past patterns, pullbacks to key levels like the U.S.-China trade gap often reset momentum and invite smart money back in.

I want to see that kind of pullback — 3%, 5%, maybe even 7% — to reload positions. But whether we get it or not, I still think we are likely to see that 6,400 to 6,500 zone hit.

The reflexive move off the April lows tells me this market has strong momentum, and the path to those levels is wide open.

Fighting the Tape Is a Losing Game

As I said, trying to short this market based on some arbitrary number is dangerous. The market can stay irrational longer than traders can stay solvent.

If the Fed remains accommodative or if AI-driven profits continue to fuel earnings, this market can absolutely stretch well past where many think it “should” stop.

That’s why I’m positioning accordingly — holding long exposure, keeping hedges in place, and looking to reload on dips. If we get back to that 6,400 to 6,500 range, there will be a lot of opportunities to capture upside.

But I’m not about to fight this melt-up — history tells us that is a losing game.

I’ll see you in the markets.

Chris Pulver

Chris Pulver Trading

Follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

- Telegram:https://t.me/+av20QmeKC5VjOTc5

- YouTube:https://www.youtube.com/@FinancialWars

- Twitter:https://x.com/realchrispulver

- Facebook: https://facebook.com/therealchrispulver

Important Note: No one from the ProsperityPub team or Chris Pulver Trading will ever contact you directly on Telegram.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

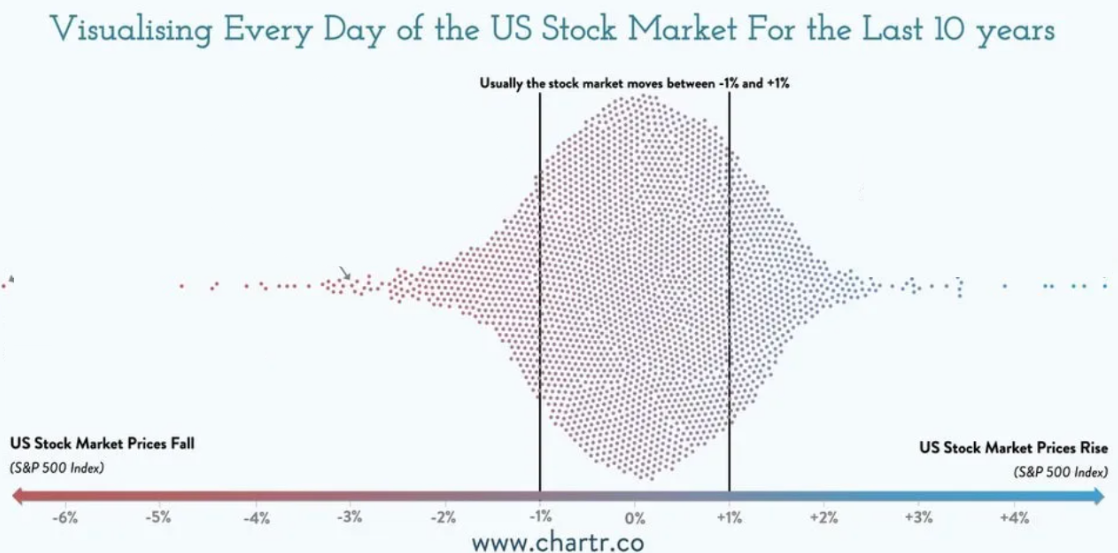

Most trading days are dead flat.

But a new type of setup by the CBOE means that’s a GOOD thing…