Ever since the banking crisis started throwing off sparks in March, Fed Fund futures have priced in a Federal Reserve pausing hikes in June and July, then beginning to ease in September.

And given that Fed action has been the only real catalyst kicking stock markets around for well over a year, I’ve been expecting sideways action through summer, with 4,200 as an upper limit on the S&P. At least until the fall.

But the markets now see something new.

Perhaps it’s the strong retail sales environment. Or maybe the markets fear persistent inflation in Europe will continue to pressure prices here. Could be that the markets expect congress to act on the debt ceiling quickly.

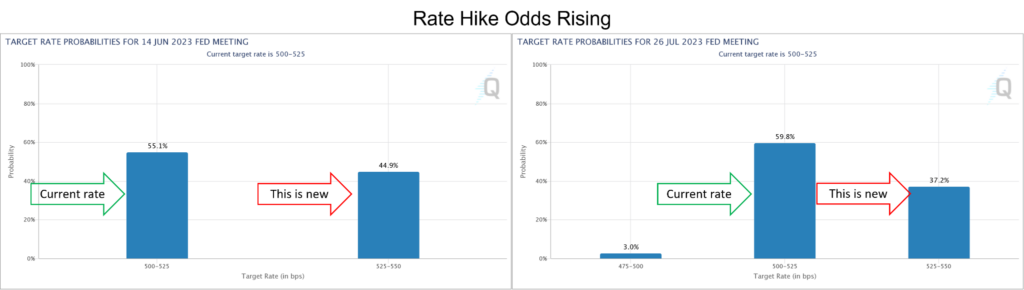

Whatever the reason, Fed Funds futures are placing increasing weight on the likelihood of continued rate hikes.

These two charts compare the probabilities for the June and July Fed meetings. The column to the right of both charts indicate a 25 basis point hike.

A week ago, the likelihood of a hike was negligible. That is no longer the case.

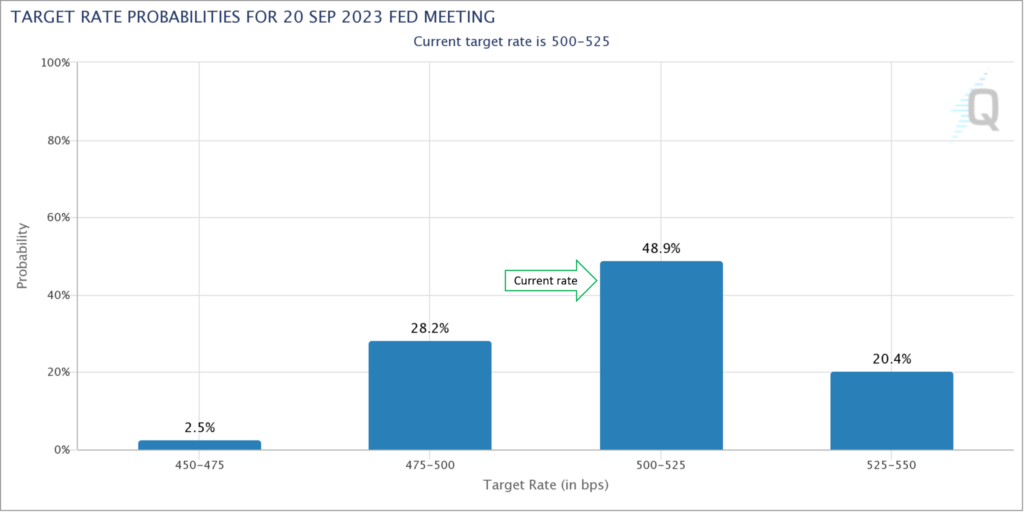

And the odds of a cut by September are fading fast too with hike odds creeping higher.

What’s truly notable in this shift is that the expectation is now for a more hawkish Fed while ever since last summer the market has faded the Fed’s hawkish statements.

Personally, I think recession fears are fading too. And once the summer has passed, the rally in stocks will begin.

Take What the Markets Give You