Twenty-two years ago, my soon-to-be wife and I upped stakes and headed out to California.

We had just finished grad school at Washington University in St. Louis and were on our way to make Newport Beach our home.

With U-Haul loaded, we hitched up my Honda Civic and ventured out with our two dogs – all of us crammed in the front seat.

Most of the trip was uneventful, except when we decided a detour through Sonoma, Arizona, was a good idea.

The climb from the desert floor to Sonoma was so steep that even with the gas pedal floored, we managed a mere ten miles per hour on the way up. The narrow road with hairpin turns made it a real white-knuckle ride. Imagine staring over a 1,000-foot cliff from the driver’s side window while wondering where wheels and cliff-edge meet, and you get the picture.

But the “fun” didn’t really start until the way down.

The dogs were in severe gastric distress because we switched them to canned dog food so that they would eat quickly (not worth it). My dog Jack sat with his head on my shoulder staring at me while hoping I would pull over soon.

Plus, gravity isn’t your friend on a steep decline with no margin for error. The accelerator was vestigial at this point. But the nerve-frazzling dance with the brakes ramped my emotional tension to its maximum.

That I could smell the brakes working overtime didn’t help.

The Federal Reserve finds itself in a similar situation. After flooring the gas pedal to gin-up inflation for over a decade, it finds itself suddenly on the downhill slope. It’s anyone’s guess whether they can skillfully pump the brakes.

Or perhaps the brakes don’t work at all…

Easing Up on the Gas

The road to economic growth and full employment has been a long, windy road uphill.

It took $6.4 trillion to climb it. But surging inflation put the Fed on the downhill slope much sooner than they dared admit because, despite their newfound fondness for Hawkishness, the Fed’s foot is still on the gas.

The Fed still buys bonds (and prints dollars to buy them) through their Quantitative Easing program. And it’ll be March before they stop (that’s the tapering currently underway).

Call it less fast rather than more slow.

And not until the foot is off the accelerator do they intend to tap the brakes with an initial rate hike.

And based on this week’s action in the dollar and treasuries, the market believes they will do it. The dollar soared, and treasuries bailed. So, someone out there has taken Powell at his word by baking in higher rate expectations.

But, to me, the real question boils down to whether their dance between the accelerator and brakes ends up tightening the supply of dollars in circulation.

Draining the Liquidity Swamp.

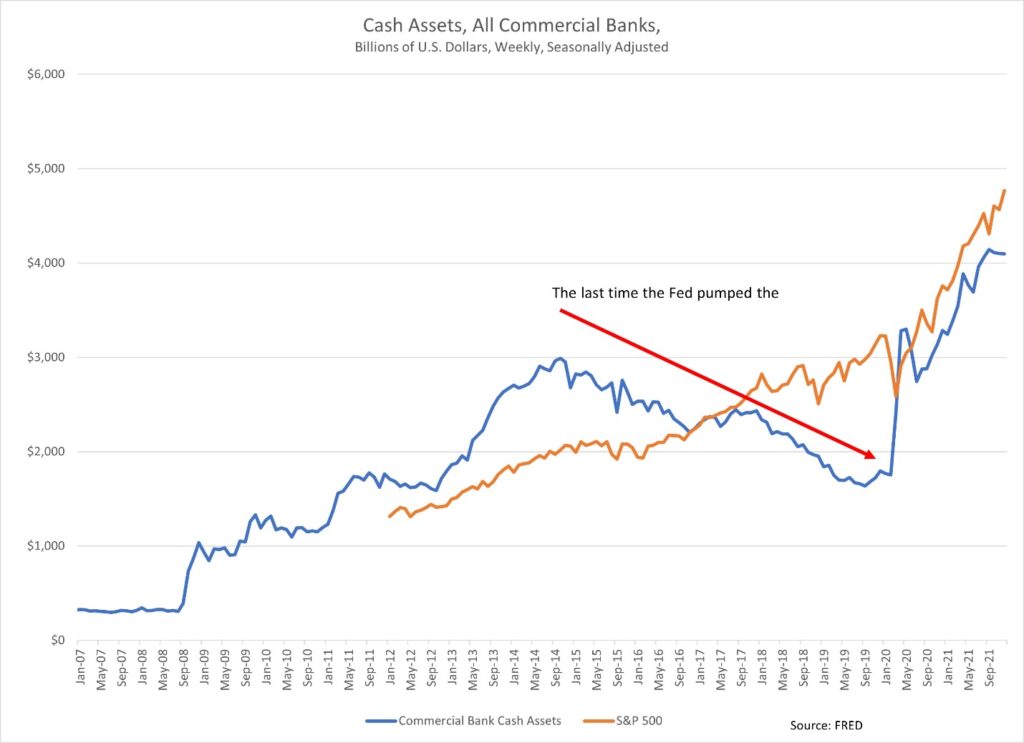

Commercial banks hold over $4 trillion of the Fed’s $6 trillion in cash.

They didn’t lend what the Fed gave them. They didn’t buy bonds with it. It just sits there.

And the last time the Fed pumped the brakes, the S&P kept right on smiling with an 86% rally.

The Fed rate hikes (modest as they were) and tapering did nothing because you can’t count cash sitting in a vault as liquidity. And taking money out of the vault and handing it back to the Fed (where it technically ceases to exist) doesn’t tighten liquidity conditions

As I discussed on Wednesday, the inflation we’re facing now isn’t because of money printing. And draining money that isn’t there will do nothing to solve it. It’s vestigial much like my gas pedal was on the way down from Sonoma.

But an oversupplied oil market will temper the demand-pull inflation of the last year. After all, inflation is its own cure – unless it’s the confidence kind.

I also don’t expect the Fed’s planned Tightening to crash stocks by crushing growth. For that, we need either 1) continued supply chain issues (you can’t grow when you can’t sell) or 2) war.

To be sure, inflation hurts, self-correcting or not. But it’s also a normal process. One that markets haven’t had to deal with in the last 20 years.

The real inflation threat comes when the money velocity match hits the money supply tinder. Inflation of that sort feeds on itself.

And I doubt politicians or the Fed have the will to deal with it when it comes.