Tag: risk management

Select a guru below to view more of their posts!

All Posts - Casey Stubbs - Chris Pulver - David Trainer - Graham Lindman - Geof Smith - Nate Tucci - Jeffry Turnmire - ProsperityPub

The Rational Trader: What I Learned From a Losing Trade on Delta Airlines

JD breaks down a losing trade in Delta Airlines and explains what went wrong — and why sticking to defined-risk setups matters in earnings season.

Read MoreWhy Most Hedges Hurt More Than They Help

Most hedges cost more than they protect. Nate Tucci shares a smarter way to stay in the game — without dragging down your gains.

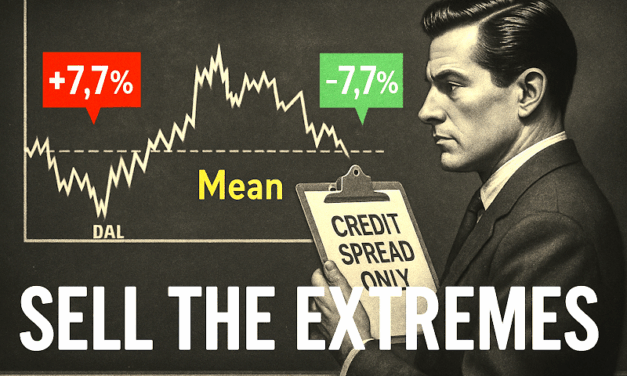

Read MoreThe Rational Trader: DAL Earnings Mean Reversion Trade: My Full Setup

JD previews a potential mean reversion trade in Delta Airlines (DAL) ahead of Thursday’s earnings. He’s watching volatility and preparing to sell the extremes — with protection.

Read MoreThe Rational Trader: DAL Is Hugging Its Mean — And I’m Planning My Next Move

JD previews a potential mean reversion trade in Delta Airlines (DAL) ahead of Thursday’s earnings. He’s watching volatility and preparing to sell the extremes — with protection.

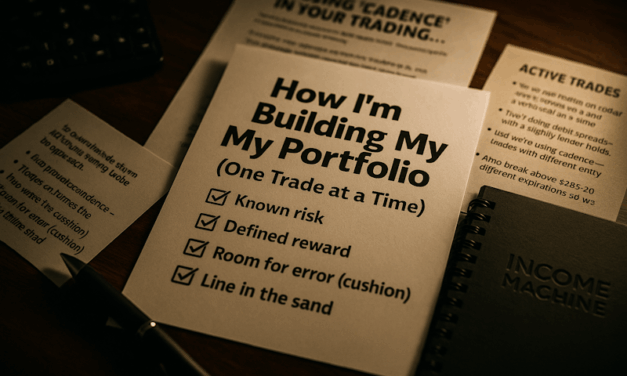

Read MoreHow I’m Building My Portfolio (One Trade at a Time)

Cadence in trading isn’t just timing — it’s strategy. Here’s how Nate Tucci uses it to build smarter, steadier portfolios without betting the farm.

Read MoreThe Apple Trade I’m Watching (Even After Everyone Gave Up on It)

Even after Apple fell out of favor with traders, Nate still sees a compelling trade setup — and he’s sharing exactly how he’d play it.

Read MoreThe Rational Trader: STZ Didn’t Move — And That’s EXACTLY How I Got Paid

JD recaps the STZ earnings trade — and how both the puts and calls he flagged expired worthless. A textbook mean reversion play with a 95% historical edge.

Read MoreThe Rational Trader: Why I’d Risk $445 to Make $55 — And Still Call It a Good Trade

JD breaks down a simple expected value setup — and a real earnings trade in STZ — that most traders would skip, but statistically? It pays.

Read MoreHow I Decide If a Strategy Is Worth It (Hint: It’s Not Win Rate)

Why win rate isn’t enough — Nate shares a smarter way to evaluate trades and strategies that can actually grow your capital.

Read MoreConservative or Aggressive? How to Choose the Right Setup

Nate Tucci breaks down conservative vs. aggressive income strategies — and how to pick the one that fits your goals.

Read MoreQuestion for today’s roundtable

What does income trading mean to you? Stephen digs into the stigma, the misconceptions — and what today’s Roundtable will reveal about fitting it to your goals.

Read MoreCutting through the noise

With fear in the headlines, why isn’t the market panicking? Stephen Ground explains how to cut through the noise — and what signals actually matter.

Read More