Some traders like to buy “sin” stocks.

You know, companies that specialize in gambling, smoking, etc.

And those can sometimes pay off.

But others prefer to take the “high road” and buy stocks that try to do good, wholesome things.

Like organic farms.

What could be more healthy than pasture-raised organic eggs?

And Vital Farms (VITL) does exactly that.

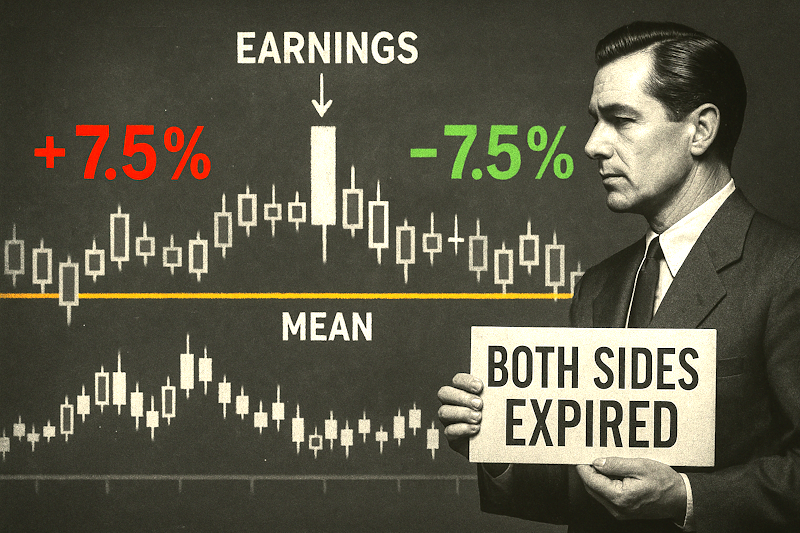

Here’s the chart:

VITL has quietly been going sideways for a while now. But if that stored-up energy leads to a break above $18.18, we could see a move up to $30 or beyond.

We’ll keep an eye on it.

Happy trading,

— Scott Welsh

P.S. As a reminder, these plays are based on my longer-term Weinstein Stage Analysis method. The chart above uses weekly candles and a 30 week simple moving average. For details on this method, see my explanation on this Ask The Pros episode starting at timestamp 20:45.