Anyone clinging to hope of a growing U.S. economy had a tough week.

Both the Dallas and Richmond Federal Reserve banks reported a massive decline in manufacturing activity. Consumer confidence collapsed. An already negative GDP growth for the first quarter got revised lower. And a national survey released yesterday shows 4 out of 5 consumers have cut back on spending – 25% have done so drastically.

We all rode Federal stimulus and cheap money higher. But with consumers now squeezed by both 40-year inflation and 30-year rate hikes, we have no choice but to ride the consumer all the way back down.

Companies rode that ride too.

And none rode the artificially stimulated consumer higher than Amazon.

Amazon revenue leaped 70% during the pandemic. Everyone was home and everyone felt flush with government checks.

And today I want to share with you one way I’m riding Amazon all the way back down.

Amazon at $60

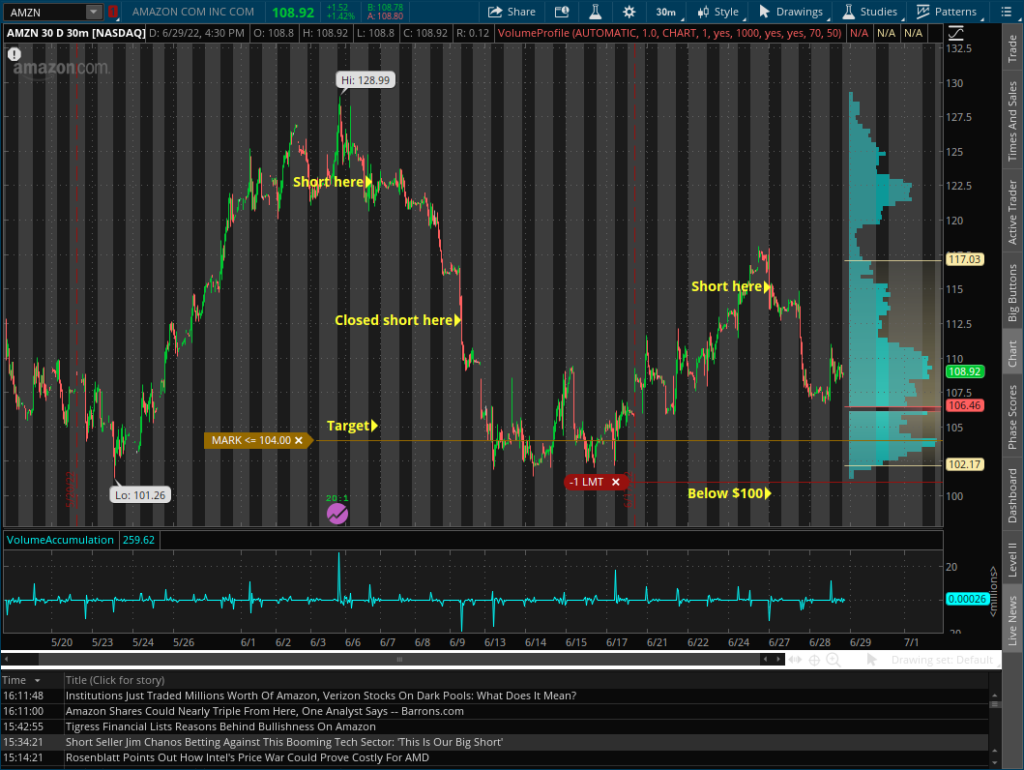

On Monday I shared with members of my trading group my most recent short on Amazon.

I bought the September 16 $100 Puts on Amazon when the stock was at $115. It’s now just below $109. Should the stock trades to $100 over the next couple of weeks, I’ll be able to double my money.

That trade follows on a short position on Amazon earlier in the month. I initially bought puts with the stock at $122 and then closed the trade for a 70% profit when the stock hit $112 three days later.

The chart below shows you my notes on the trades.

I’ll probably close my position when it gets close to $100. But there’s still plenty of room in the trade.

In fact, I think $80 is easily in reach and $60 possible as the stock price churns through the pre-pandemic high trading volume range of 2018 and 2019 (could find some motivated sellers).

To hear more of my thinking behind the trade, check out my Trade Walk-Through video on Amazon, below. I do these for most every trade. And through them my members can better understand my rationale and make a more confident decision.

Ultimately, the consumer is in for a rough ride. And no matter where it takes them, there’s always a way to make the ride work for you.

Click play below to watch the Amazon Trade Walk-Through:

Take What the Market Gives You

PS> To keep up to date on what I’m seeing in the market, you are free to join my Telegram group any time you’d like.

I’m starting a new feature where I’ll let you peek over my shoulder as I scan the markets and pick the plays that have the highest likelihood of working out in our favor. If you’ve ever been curious about my process, this is a great way to see what I do — at absolutely no cost to you.