There are two general strategies to adopt when things get tough.

One relies on a fortress. The other on light, nimble feet.

A fortress is robust. It makes you immune to stress. Good or bad, you could care less.

But adopt an anti-fragile strategy, and you actually get better off with stress.

A block of granite is robust. It doesn’t get stronger or weaker. It’s as tough as it’s going to be.

Your muscles, on the other hand, get stronger with tension – provided you don’t go too far at once. Over time, tension makes you resistant to even more stress. You do better than most when things go nuts. Hence, you’re anti-fragile.

To get geeky about it, you can say under a robust strategy, wellness has zero correlation to nuttiness while wellness exhibits strong and positive correlation to nuttiness for anti-fragile strategies.

From all this, you can infer that fragile strategies don’t do well when things go nuts.

And, from the way things look, Nuts has never been more likely…

OK, So I’m No Shakespeare

To be Robust or Anti-fragile…? That is the question for today’s nutty times.

That, or stick with Fragile’s continued attempts to prop up weakness with printed money.

To point you in the right direction, here’s a quick rundown of “Nutty Things” off the top of my head:

- Nuclear war is openly discussed.

- One-third of American’s think nuclear war is an acceptable outcome of Russia making war with Ukraine.

- There has never been a sanctioning regime as pervasive and disruptive as the sanctions now in place on Russians.

- Supply chains were already a mess anyway.

- Forget energy. Food security is now a real threat in many parts of the world unaccustomed to it.

- Oh yeah…COVID may be in the past (who knows) but the politics of it sure aren’t.

- The Fed must choose inflation OR growth, not inflation AND growth, but they don’t know which to favor.

AND

- Saudi Arabia could soon be accepting Chinese Yuan for oil so, bye bye Petrodollar network effects.

- Plus, you know, Bitcoin

Now, define Nuts as an extreme outcome.

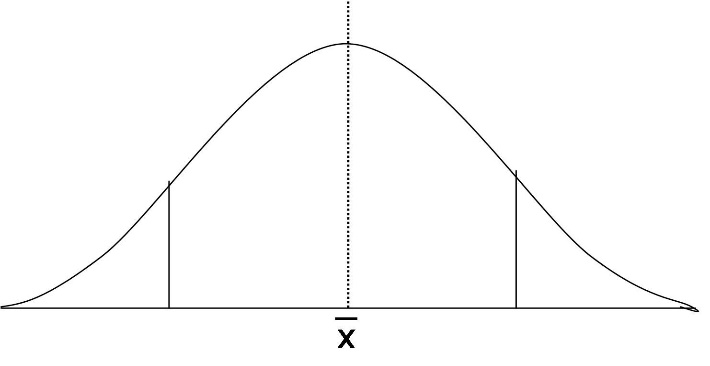

With nuts more likely, instead of a normally distributed range of outcomes like you might see in the familiar bell curve above, the curve will have flattened out.

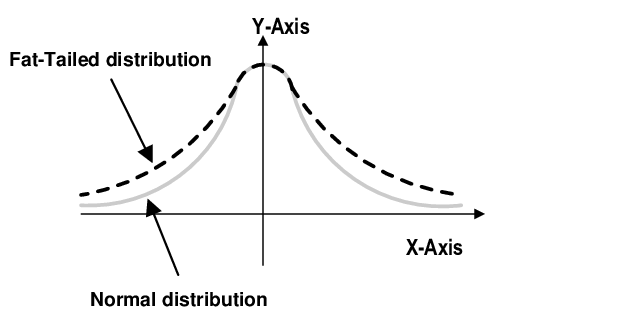

It now has fatter tails. Good ‘ole leptokurtosis. Which really just means more “things” are equally likely.

That leptokurtosis moves the curve towards the one with the dotted line below.

Which begs the question, when extreme outcomes no longer qualify as extreme can you still call them nuts?

Anywho…

With nuts as previously defined more likely, it’s time to decide whether to be a fortress or light on your feet.

And most people have only one option, including me.

Jack be Nimble

A fortress strategy for you finances costs money. A lot of money.

I’m talking millions counted in the 100s at least. Plus, a financial fortress requires that you really commit to the Nuts-as-the-only-option range of outcomes.

Alas, that’s not me. And, without too much presumption, that’s not you either.

So, we gotta be nimble.

We have no choice but to respond to whatever order emerges from the now-more-likely-chaos.

For example, from where we stand today, I don’t know what we’ll see first, the S&P 500 at 2,500 or 5,000. Oil $50 or $200. There’s just too many risks from outside the realms of finance on the horizon.

But I do know Nuts means volatility. And while volatility shortens the lifespan of any single opportunity, it also creates more opportunities in the process.

So, take what the market gives you and trade it. Trading increases your awareness to opportunity which makes you Anti-Fragile with respect to financial risk (you know, Nuts).

I’ll be launching a trading service soon to help you flex some anti-fragile muscle. With that, you can build your fortress. In the meantime, you are free to join my public Telegram channel at no charge. I drop trades there from time to time and at last count, we’re up over 400% on these trades in just the last 3 months.

Join now, and you can check out some recommendations before I take the service private.