Central bankers think they can wield the Ring of Power over price. But price will not be denied. It will always have its way.

And price demands that the yen fall despite the Bank of Japan’s interventions.

In fact, I’ll bet it’ll be the first fiat to fall off the face of the earth (though the British pound could arguably get there first). And this most recent symbolic move above 150 only pushes it that much closer to the edge.

I know that I promised to step you through two more headwinds pushing equity markets lower. But when yet more evidence of the glaring failures of centralized planning propitiously presents itself, I can’t help but point out the errors.

And the BOJ’s error is a doozy.

You Need Three Lemmas to Make Lemma-nade

Running a modern economy requires, above all else, free capital flows.

That way money and goods can flow unencumbered to ease investment and trade.

Unavoidably, however, this requires the citizens of a country to find ways to be globally competitive. An absolute advantage1 isn’t necessary. But the population must at least have some comparative advantage it can exploit to add value.

Global competitive conditions also change, though. That demands adaptation.

But voters tend to resist adaptation. When manufacturing steel, growing sugar or corn, building cars or any number of economic activities becomes uncompetitive, the tendency is to whine to politicians rather than find something else productive to do.

It’s easier to beg for help than learn how to push a button on a different assembly line…

And it’s this groveling that empowers politicians (and central bankers) to do something — anything — to shift that competitive burden onto someone else.

One way to shift the burden is through tariffs. But that’s too politically obvious and a more laborious path. To do tariffs right, countries must bend the knee to multilateral institutions like the World Trade Organization (WTO).

The more politically expedient way is to let central banks play with money. They buy and sell debt to bring interest rates in line with their grand designs. But you can’t move the price of money without moving its price relative to other forms of money — i.e., the exchange rate.

When the exchange rate goes too far in the wrong direction, intervention begins its tempting call to central bankers.

But heeding that call runs them headfirst into a trilemma that serves as an Iron Law limiting money and its price.

You Can’t Have Your Cake and Eat it Too

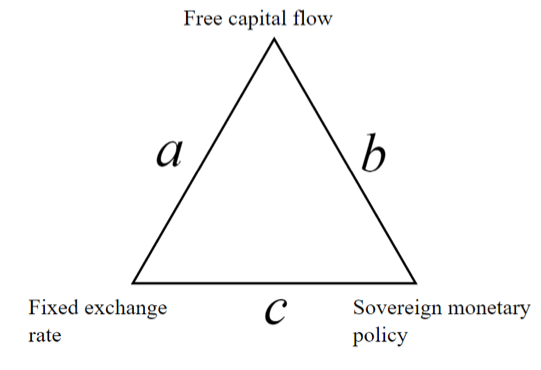

This trilemma is called the Impossible Trinity.

It states that, in an economy with free capital flows, you can manage your exchange rate or interest rates but not both.

The Bank of Japan is managing interest rates through bond purchases intended to peg 10-year yields at 25 basis points (not that there are very many left to buy). They buy the bonds with newly printed yen, thereby increasing the supply of yen on the market.

The increasing supply drives down the yen’s exchange rate and drives up the price of imports. This is the natural way of things. The Bank of Japan should be pleased because they have tried for 30 years to manufacture inflation. But they’re not. And like a game of whack-a-mole for morons, they buy back the yen they just printed hoping to have their cake and eat it too.

But price will have its way and the yen will soon reflect the value of the hollowed-out economy that supports it.

Take What the Markets Give You

1 Absolute and comparative advantage are key concepts to understand in economics. Here’s a good place to start.

P.S. For more deep analysis, click to join my free Prosperity Pub Telegram channel.

And if you’re ready to start putting systemic chaos to work for you — and playing the yen like a fiddle (like we have), click here to submit a coaching application to start trading along with me in my 21st Century Wealth Society group. But I warn you — it’s only for those who want to put in the work and kick their trading into high gear.