To be ambivalent is not “to care less.”

It’s to care a lot — but equally — between two, often mutually exclusive, outcomes.

It’s a pulling in two directions that makes you ambivalent, not a lack of direction.

Ambivalence builds until the choice breaks one way or the other, releasing all the stored potential energy into an explosive range of volatile, kinetic outcomes.

And the process working to resolve that ambivalence is chaotic.

Now, chaos can mean a lot of things. But it isn’t random. It is a process. One that results eventually, albeit iteratively, in a more stable state. A new equilibrium.

The order that emerges might in fact be many smaller equilibriums. But with ambivalent tension resolved you can look at what world emerged and adapt.

At least until the next destabilizing force begets another round of chaos…

Initial Conditions

That chaos can be either large or small. Small bouts of chaos occur all the time while big ones wait decades, even centuries, to manifest.

Of course, I would prefer several small bouts. In fact, my preference for lots of small chaos is my moral justification for a far more decentralized geopolitical landscape. It’s why I’m rooting for an end to the nation state. With power distributed widely, there is far less chance for any one set of opposing tensions to take everyone out.

| It’s tough to imagine the end of the nation state, and I’m going to read this book to beef up imagination. (I’ve thought a lot about this stuff, but it always helps to get more perspective.) |

But I digress…

Now, I say chaos isn’t random because it isn’t. It’s a realm whose dimensions involve imaginary numbers, fractals, and strange attractors.

Chaos theory is a mathematical discipline. One that is as relevant to our understanding of how the world works as 1 + 1 = 2.

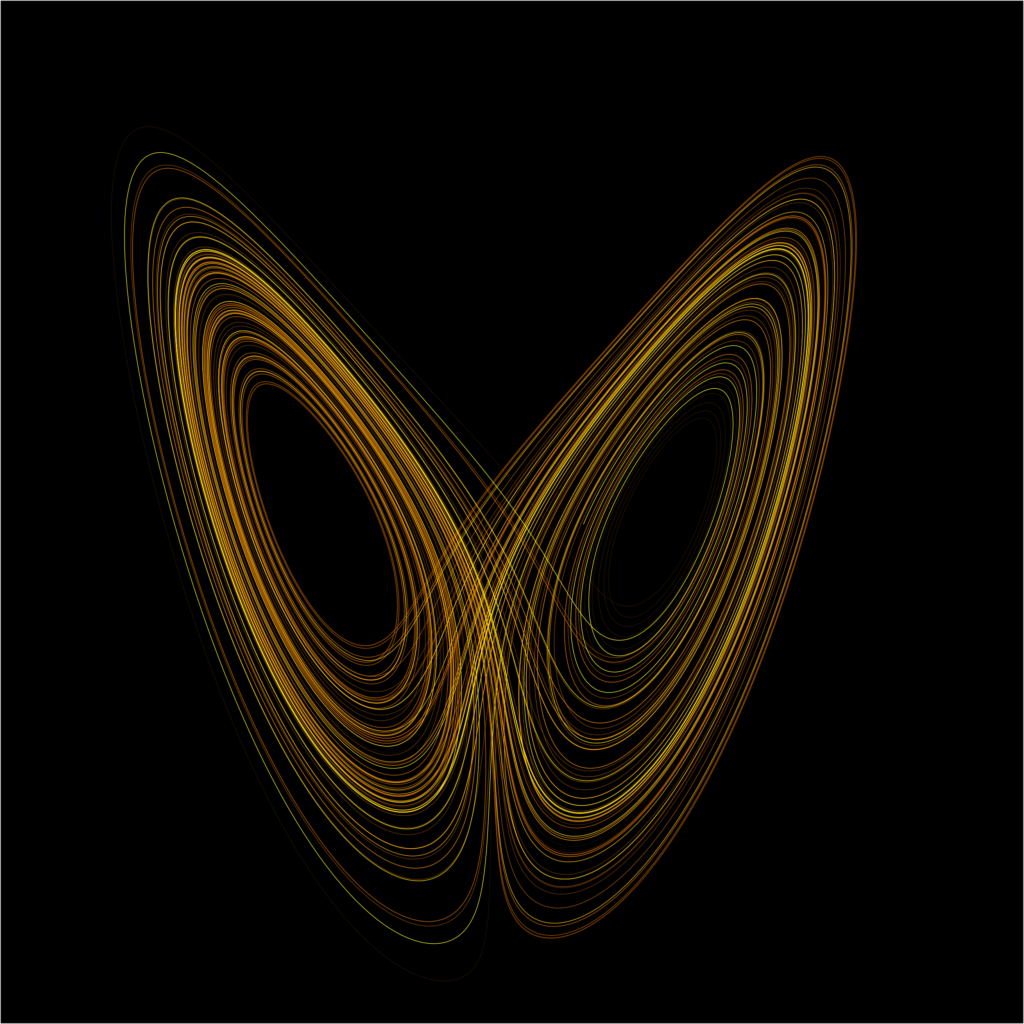

Ever hear of the Butterfly Effect? That refers to a special type of mathematical process called a Lorenz Attractor. Iterate through the Lorenz attractor formula from a valid starting point, and you end up with a sequence of numbers that, when plotted, look like a butterfly.

The results of this formula aren’t anywhere near close to predictable – even infinitesimally (practically) small variations in initial conditions (that valid starting point) result in wildly different sequences that never repeat. Choose a starting point too large or too small and you veer off into infinity. Get it right, and you get an infinite variety of butterflies. But infinity or not, the results are not random. They are the result of a process – a chaotic one.

And here at S&P 4100, it looks like the stock market is on the cusp of resolving extreme ambivalence.

A Fork In The Road

The ambivalence revolves around growth. One side stoking growth and inflation and the other pouring buckets of water on the embers.

To see what I mean, let me walk you through the next two Volume Profile charts. The first shows how trading volume on the S&P 500 has distributed itself over the last year across the range of prices covered (4000 to 4800).

This is a beautiful distribution. It indicates a long-term trading range that with today’s ambivalent-fueled volatility could easily launch the S&P 25% higher from 4100 to even 5,000.

And that wouldn’t be irrational.

Because one of the factors aligning itself with growth is valuations. Based on economic value, the S&P is not rich. It has not been rich. Lower capital requirements from an economy thick with highly scalable intellectual property enabled tech stars to deliver massive economic profits. So long as revenue growth retains any type of positive trajectory, stocks are not rich.

And with the Fed flinching at threats to growth during Wednesday’s FOMC meeting, inflation is back on, risk is back on, and, heck, maybe even growth is back on.

So, valuations aren’t a threat to prices and the Fed is pro-growth even if it comes with a side of inflation.

The smells like long to me.

And were it not for the even bigger picture, I would be all in.

This graph covers May of 2019 to today. And over that time the S&P has ranged from 2174 when Covid hit to 4800 last December.

But, to put any relevance to the gap in volume, one has first assign relevance to trading that occurred at least two years ago.

I don’t know how long the market’s memory is and neither does anyone else. But, of all the stock that changed hands over the last three years, a whole heckuva lot happened below 3400 when the market took its Covid dive. A dive (and an opportunity) that is hard to forget.

As the market dips, those buyers that bought into the Covid fire sale could hasten efforts to take profits.

Plus, every other god dang thing going on the world does nothing to support growth.

So, growth is toast and buyers from two-years ago may spark a sell-off that could cut the S&P in half.

And that’s where the market is torn in two.

But it’s this nexus of ambivalence – S&P 500 around 4,000 – that defines the opposing forces:

- A growth and inflation biased Fed versus a market that won’t forget to take profits.

- Strong economic profit trajectory versus deleveraging.

- A low resistance path for a rally versus recession, war war war, supply chain snags with innumerable and significant knock-on effects, and productivity squeezed between higher wages and less output.

And it’s the volatility that results from resolving this massive tension that could take the market up 25% or down 50% – in no time flat.

The market is massively ambivalent.

So, how do you play it?

Take What the Market Gives You

Don Yocham, CFA

p.s. I just recommended a way to play Extreme S&P Ambivalence to my 21st Century Wealth Society members. To get in on it, and all the other trades we’ve put on to skip our way through chaos, you are free to join us today. And to stay on top of all the other incredible opportunities created by tension resolving itself through pricing chaos, check out the Prosperity Pub Community on Telegram. It’s free. And you can join at any time.