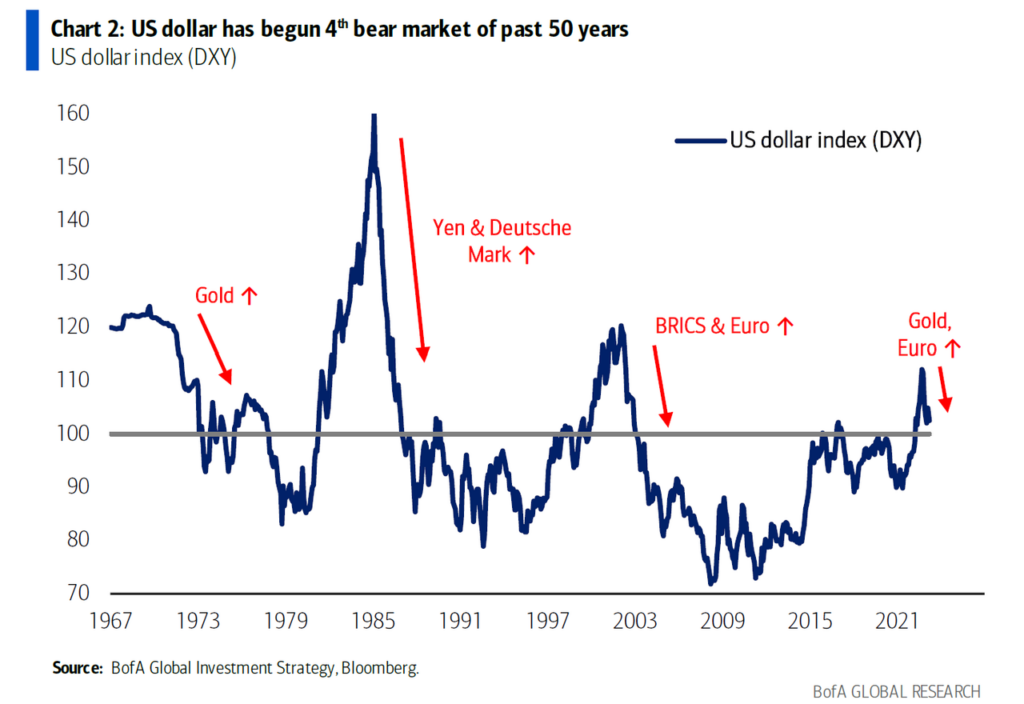

There have been 3 major bear markets in the U.S. dollar over the past 50 years.

The first major decline began in the late 60s and lasted a full decade. In fact, its selloff was the other side of the stagflation experienced over that same period.

The next, and this was a doozy, kicked off in the mid 80s. Japan was going to take over the world, Germany was a manufacturing powerhouse. And the U.S. just couldn’t seem to keep up.

Oh…and I suspect the Latin American debt-crisis had a thing or two to do with it too.

The third coincided with the bursting of the internet bubble, 9-11, the subsequent blowing of the housing bubble, and ended with the Global Financial Crisis.

According to Bank of America, the dollar could be entering its fourth bear market of the last 50 years.

Now, all fiat will fall.

I long expected that the Japanese Yen would be the first to tumble off the cliff. But given that the 3 pillars supporting the U.S. dollar’s exorbitant privilege have eroded, and with de-dollarization picking up steam, it’s entirely possible the U.S. dollar could get shoved off first.

So, not only are we entering the fourth U.S. dollar bear market. We could very well be witnessing its final bear market.

Take What the Markets Give You.