The Art of Timing the Trade

Time — something we wish we all had more of and could manage better. And traders know this better than most. One of the most challenging parts of trading is timing your trades: When to get in, and when to get out… Not to mention, choosing an expiration if you are trading options.

It can feel like a real guessing game when it comes to time.

Like I said, this is especially true in options trading because we’re battling time decay from the moment we place a trade.

Time decay is also known as theta decay. It’s the decrease in value of an options contract as it approaches its expiration date.

It’s caused by the diminishing of extrinsic value, which is the cost of owning an options contract. Time decay doesn’t happen at a fixed rate either, the closer an option gets to its expiration date, the less time value it holds, and the more time decay increases on an exponential curve.

What that means in reality is that as a trade gets longer in the tooth, the more desperate your situation as an options buyer becomes as the trade loses value in a hurry.

That’s a very painful thing, because you could be in a perfectly good trade but then run out of time and lose money.

Let’s look at a hypothetical trade on Tesla.

The green arrow marks the entry point and the red arrow shows the expiration.

Let’s say that on May 1st, we bought a $190 call that expired on June 14th.

Every day that ticks by, the option will get less and less valuable because of time decay. Think about time decay like a meter that measures chance, every day that passes there are fewer chances left for the stock to push above our strike price.

When we saw the stock pop on May 21st right in the middle between our two arrows, our option was likely in a profitable position despite not being in the money. This is because of the amount of time left until expiration — the time premium. It was moving in such a positive direction towards our strike in such a quick time, that the chance we would be in the money by the June 14th expiration seemed even more likely.

But how would this hypothetical trade have turned out?

The option would have expired worthless and someone who bought it would have lost what they invested because the option never closed above that $190 strike.

It’s a matter of time… Had the option been given two more weeks of time (meaning the person would have bought a June 28th expiration), then the position would have closed well in-the-money and they would have made a hefty profit.

When it comes to options trading… Timing is (almost) everything.

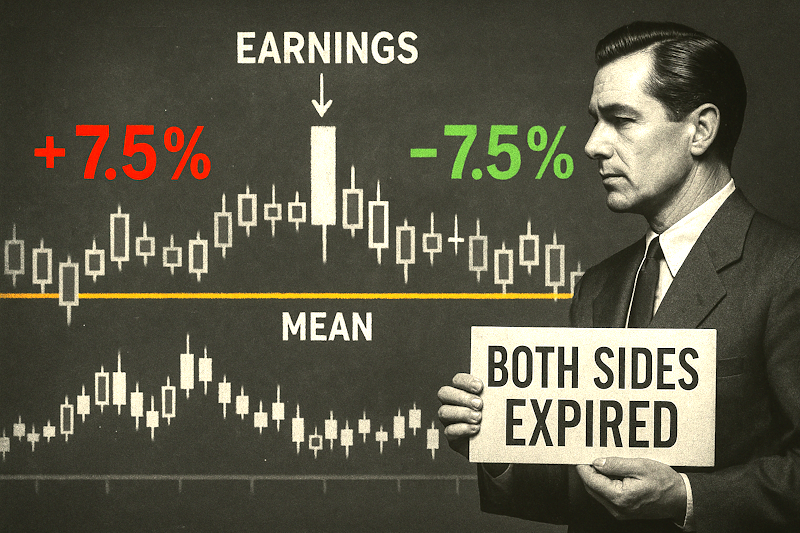

Battling Time Decay

There are two ways to deal with time decay that I recommend. The first is likely one you have heard before, but the second I think is a little more surprising.

So, first, use trade structures that reduce or eliminate the impact of time decay. A lot of these will be in the “spreads” category.

Most people think spreads are valuable because they create “income” or cut down the cost of a trade. While that’s true, the way I like to use spreads is very directionally but by having both a bought and a sold option, I can eliminate a huge chunk of the time decay and put myself in position to still create a winner.

Now, the second way to deal with time decay is simply by being willing to lose 100% of the price you paid for the option…

Why be willing to lose 100%?

Because it gives me a clear risk guideline going into my trade. I don’t have to worry about stop losses or the emotional toll of losing more than I intended — I know from the moment I open the position what my risk is going to be. But beyond that, the willingness to lose 100% means I can give the trade all of the TIME it needs to have a chance to work out.

For example, a few weeks ago one of our trades was down 85%… People got scared and, unfortunately, some of them sold it for a loss.

A few days later it was up 50% and my Automated Options system automatically pulled me out for a 50% gain. (That would have never happened on a regular call option where the time was killing the value, by the way.)

The reason this trade flipped from loser to winner is that I gave it enough time for the trade to come to fruition. If I wasn’t willing to lose 100% it would have certainly lost. But I let it stay open knowing I could lose it all, knowing that each day it remained open was another day for it to make the move I needed to flip into a profitable trade.

This combination of trade structure and willingness to lose 100% is what makes Automated Options the most powerful strategy I have. We’re currently up on our 9th trade with 8 for 8 in the bag as winners.

If you’d like to join me and learn more about this strategy, I’d love to have you. Click here and take advantage before our 10th trade fires!

— Nate Tucci