Apple’s Up Today

Apple was my pick this earnings season and last week I mentioned in Friday’s newsletter how the stock has been beaten down (much like Tesla) and Apple super fans were looking for any reason to be optimistic.

Well, that’s exactly how it played out. Today the stock soared. If you remember, I cited Apple’s Vision Pro headsets as the potential catalyst to send shares higher. That’s exactly what happened, iPhone sales fell by 10% this quarter, which you think typically would cause the stock to tumble.

But Apple CEO Tim Cook shared:

“During the quarter, we were thrilled to launch Apple Vision Pro and to show the world the potential that spatial computing unlocks.”

This quarter, Apple also made record revenue from its services division and went on to announce a $110 billion share buyback program.

Now remember, Apple reported its earnings yesterday after the market closed and today it’s trading about 6% higher than yesterday’s close.

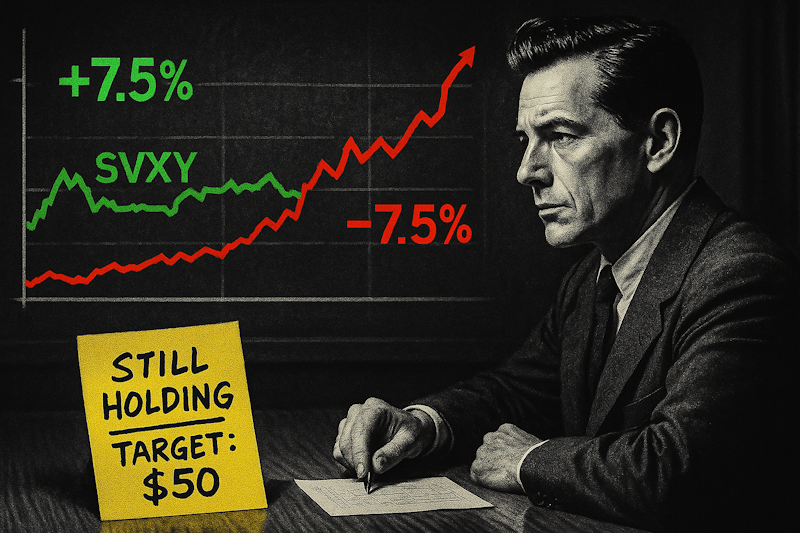

I decided to take the risk personally and make a play on the earnings… Now keep in mind, I trade small size when taking earnings plays, but on this move, it worked out great:

I hope Apple made you all some money today as well.

Looking Forward

One thing that is worth pointing out about this earnings season, however, is that it’s not like in the past where the big tech earnings caused everything else to spike.

In fact, we saw Microsoft go down a bit (now bouncing back) as if Apple going up was somehow taking their market share. Obviously, that’s not exactly the case. But we are definitely seeing some serious shakiness in the market compared to in the past where overall optimism in tech pulled all of tech up with it.

Now, what we need to watch out for is if the market holds on to Apple as an optimistic sign. And if the broad market closes positive overall this week.

That would be a bullish indication where the market might go on a bull run to attempt new all-time highs in May. Or it may be disregarded as a “one-off” and flip bearish.

If the market does weaken even after Apple’s promising outlook over the next few trading sessions (say by Wed next week) I think it’s a good indication that a deeper correction may be coming.

Let’s keep an eye out!

To your success,

— Nate Tucci

P.S.

If you haven’t locked in your Automated Options Membership, there’s still time to do that.

We’re going for our 2nd win in as many weeks!

And I’ve heard from tons of our top students who did great with the trade:

James F. shared:

“the automatic close is gold for full time workers like me”

Kathy L. shared:

“ I love the automatic close! It was so fun when it “magically” worked when I wasn’t watching.”

Celeste shared:

“I’m already in and also did the first trade; sold at 26 cents and bought back for 12 cents, 20 contracts.”

I’m ecstatic to hear that so many of you are doing so well with this already and even making your own additional plays like Celeste based on the strategy!