Here we are in yet another debt ceiling debate.

And you see the same old arguments cropping up once again – including the Treasury minting a $1 trillion platinum coin and depositing it with the Fed.

Of course, the GOP is digging in its heels. But before you put too much stock in partisan positioning, keep this in mind: the debt ceiling has been raised a total of 14 times since 2001.

Now, know that both parties share the blame. Nether can claim the high ground. And such an inglorious track record leads me to heavily discount any heel digging on the part of the GOP.

But my skepticism doesn’t rely entirely on the past. It also relies on incentives.

And the primary incentive for either party is to maintain order. Orderly capital markets. Orderly labor markets. Not to mention a continuation of the privileges that the U.S. dollars reserve currency status quo provides.

Unfortunately, order costs money.

And the price of order is only going up.

Doubling Down – Again and Again

During the Great Financial Crises, the cost of order through stimulus packages measured in the $100s of millions.

With COVID-19, that cost shot up to trillions. And the latest schemes wending their way through Congress could double the amounts spent once again.

And the debt ceiling debate, while a useful tool to cram in other legislative priorities, will do nothing to stave off its inevitable increase.

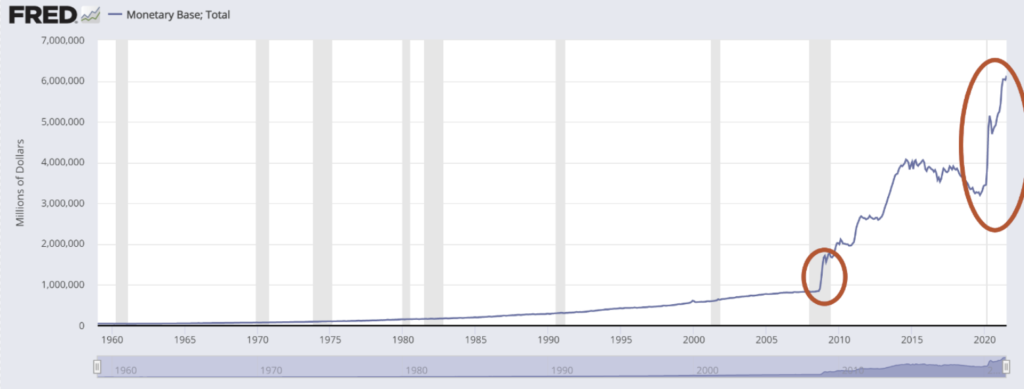

You can witness the flip side of this increase in the monetary base.

This is the base supply of U.S. dollars provided by the Federal Reserve. To increase money supply, the Federal Reserve must buy debt – most of which is issued by the U.S. Treasury Department.

It works like this.

The Treasury issues debt (and they need a higher debt limit to issue more). The Federal Reserve then ultimately buys it prints new dollars to pay for them. There’s a middle step that involves a network of banks called primary dealers, but they just shuttle bonds and dollars between the Treasury and Federal Reseserve.

In 2008, to stave off the worst effects of the Great Financial Crises, the Federal Reserve doubled the supply of dollars from $800 billion to over $1.6 trillion.

Over the next decade, that supply doubled again in spurts to $3.2 trillion. And, since the onset of COVID-19, it has surged to over $6 trillion.

And it’s this pattern of each successive crisis or government imperative doubling the cost of maintaining order each prior one that creates unavoidable risks, no matter the outcome.

Don’t issue more debt for the Federal Reserve to buy and we get a deflationary collapse. Do issue more debt and inflation could run out of control.

Now, governmental power structures don’t survive deflationary collapses. But they can scapegoat their way through runaway inflation.

It’s a tried-and-true method of maintaining order. And it’s from the spiraling cost of that order that you need a hedge.

Last week I suggested you buy Pax Gold (PAXG)– a cryptocurrency where each token is backed by one ounce of gold.

Today I have another solution for you. And I view it as a cheap way to buy gold in the future.

A Hedge at a Discount

It’s the Sprott Physical Silver Trust (NYSE: PSLV).

You can buy it just like any stock. And rather than being backed by paper claims on precious metals like most gold and silver ETFs, the PSLV trust only holds physical silver custodied at the Royal Canadian Mint.

Should the wheels come off the inflationary bus, the price of both silver and gold will rise significantly. But silver trades at a steep discount to gold – nearly 80 ounces of silver per ounce of gold – and in a real crises scenario, that gap could narrow to 20 or less.

At a 20:1 silver to gold ratio, you can exchange that silver for 4 times the amount of gold that you can buy for the same amount today. And with the price of both forms of money rising, your return in dollars could exceed 10x on the trade.

So, to hedge yourself from the incessantly higher cost of maintaining order, consider buying shares in PSLV. Because whether they raise the debt ceiling or mint a $1 trillion dollar platinum coin, the end result is the same.