Every time you hit the aisles of your local grocery store; you make all kinds of tradeoffs.

Maybe you feel like paying up for organic kale today.

You like good cheese, but that grass-fed Irish white cheddar seems a bit steep.

Country ham from the deli-counter sliced as thin as your heart desires sounds great though you grew up just fine on Oscar Mayer bologna.

As consumers (see sidebar), we constantly make decisions to optimize our spending – some big, some small.

Even the items you buy without thought come with a history of past decisions.

Now, the only person with any clue as to what makes the most sense for you, given your needs, goals, values, desires, habits, or whatever, stares back at you from the mirror every morning.

But that fundamental truth gets lost on meddlers. They know what you SHOULD do because they incorrectly presume an informational advantage. They can make those tradeoffs better than you.

And when persuasion doesn’t work, they can always resort to force.

Thankfully, their arrogant presumption carries an enormous cost that undermines the one tool essential to impose their will.

And your edge in this Game of Wills lies in the fact that you will always be free to use that tool against them…

TMI

That tool is currency, fiat currency, to be precise.

U.S. dollars, euros, Yen, Pound Sterling – all major nation-backed currencies – amount to nothing more than “money on demand” for the governing forces behind them.

And as demands for “Unity” from authority’s lofty perch surge higher, so too do their demands for more money to pay for absolute compliance.

But no one could ever process the information necessary to optimize the actions of hundreds of millions of people. Even with a quantum computer capable of processing more data than you can meaningfully express as a number, the decisions would still fall short of what millions of individuals – with the freedom to choose for themselves – can deliver.

This spending in a massively inefficient manner results in a tremendous misallocation of resources. And the greater the misallocation, the more authoritarians spend to correct their errors. Which, of course, leads to a fantastic comedy of errors, each compounding the cost of the last.

That’s why a system increasingly reliant on centralized decision-making can’t work. The rising tide of malignant money demanded into existence ultimately crushes the productive potential of each dollar spent to support some top-down policy.

And we can break those policies down into the three M’s of Malignant Money – Mandates, Malinvestment, and Money for Nothing.

Multiplying Mandates, Compounding Problems

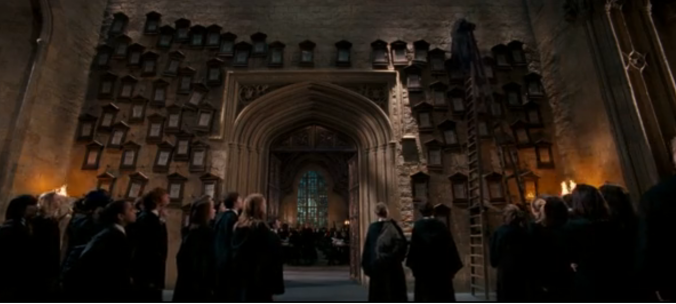

Like rules nailed to a wall increasingly crowded with dictates, executive orders pile up.

The current POTUS smells an opportunity to realize his “I know best” ambition while simultaneously placating a constituency whose only recourse lies in government force.

So, now, in a country that spent decades fighting the inhumane rise of communism, we have a president telling businesses who they can hire. The knock-on effects of which are already spreading like wildfire.

Teachers, doctors, nurses, firefighters, police, soldiers, and pilots – they’re having none of it. And rightfully so.

And to keep the wheels on the bus in their states, many governors now feel compelled to enact counter-mandates.

All of which sows confusion, wastes capital – both human and material – and makes getting the same work done as before more expensive.

To be sure, we can expect more mandates that attempt to correct costs imposed by preceding mandates. I’m sure a few of you remember the days of Nixon’s price controls and how well they worked to control inflation. Spoiler alert – they didn’t. They only served to take productive capacity off-line as no one willingly works for nothing.

And more money chasing fewer goods can only resolve itself one way – inflation.

Which brings me to the second M of Malignant Money.

Malinvestment Gone Wild

The Great Financial Crises (GFC) – brought about by congressional mandates meant to increase homeownership – gave us our first big taste of malinvestment in the form of bailouts.

Instead of shuttering insolvent banks and businesses, Congress with the help of the Federal Reserve doubled the money supply to save stockholders, lenders, and the executives from the consequences of their actions.

And with COVID bailouts now at our backs, that money supply now approaches nearly 8 times the level it sat prior to the GFC.

The next level comes with infrastructure spending.

Now, don’t get me wrong, infrastructure needs massive investment. But politicians don’t have nearly enough information to invest trillions of dollars efficiently across who knows how many competing ideas on how best to spend it.

That’s why markets exist. And while investors don’t always get it right, the threat of eating their own cooking makes them sharpen their pencils more than a politician ever will. All politicians need to do is remove the obstacles that lie between capital providers and projects.

So, while some of that infrastructure will pay off simply by chance, a vast amount of money gets wasted through cronyism, corruption, and downright idiotic decisions as the ensuing boondoggle tempts greed over reason.

And as mandates and malinvestment do their part to collapse the value of malignant money, the meddlers will lean increasingly on the last resort to assuage the populace’s rising discontent – Money for Nothing.

Your Actions Make the Exit

I’ll dive into this last M next week but know that you’re not trapped in this system.

Owning stocks is not owning dollars. Companies can choose how they get paid. They can also hedge their currency risk or simply exchange the dollars, euros, yen – whatever – immediately into something more stable. Their ability to create shareholder value isn’t hampered by one medium of exchange.

Innovation moves on. And the individuals driving business forward have choices.

And your choice isn’t limited to stocks.

Rather than saving in dollars – or worse, owning bonds that pay you dollars in the future – precious metals and other commodities offer a way out, provided you can stomach the dollar-price volatility.

Plus, truly open source, permissionless and decentralized crypto opens a vast field of opportunities for anyone seeing the writing on the wall. But you need to invest the time to learn how to take full control over whatever you own.

You are free to hold any form of payment you want. And your assets don’t have to be beholden to the dollar. Every act you take that favors something else over dollars amounts to a bet against the system. And the grand total of every recommendation we provide at The Prosperity Project amounts to nothing less than One Big Bet against it.

To help you make that bet, keep up with what we’re building here at The Prosperity Project. Because, while the system we have doesn’t work, your actions do.