I’ll be live with Jack Carter at 11:30 AM ET for Market Masters — we’ll cover current trends and trades, actionable opportunities, trading education and more

Tesla (TSLA) is looking rough right now, and I’ll be straight with you — it looks like we’re headed for a lower low. But here’s where most traders get it wrong: they panic at the first sign of trouble without understanding how patterns actually work.

The question everyone’s asking is whether we just tap a lower low and bounce, or if we need to drop all the way down to the roadmap line around $380. That’s a significant difference if you’re holding leveraged positions.

I’ve been following Zach Mains on X — someone I respect — and he’s got a couple different paths mapped out. His primary warning right now? Tesla might need to hit $380 before it can go higher. So if you’re extra bullish and heavily positioned, you need to hear this.

The Weekly Pattern That Still Has Legs

Here’s what keeps me from hitting the panic button: the pattern on the weekly chart is still active. We’ve got something important working in our favor here.

We busted above the 618 retracement level, and the target is $550. That’s the roadmap, and it’s still in play. But — and this is the part that’ll save you from blowing up your account — this pattern can pull all the way back down to the low and then still run up to hit the $550 target.

The pattern doesn’t actually break unless we see a move down to around $214, below the prior low. That’s your line in the sand. Above that level, the pattern can still work even if it drops to the roadmap line first.

I’ve seen this movie before. We run up to the prior high, stall out of gas, drop back down to tap the roadmap line, and then push on up to the target. It happens more often than you’d think, and we’ve got a double entry trigger pointing to that same upside objective.

Managing Risk When You’re Heavily Positioned

Look, I’m not going to sugarcoat this: if you’re super leveraged in TSLA and it decides to test $380, that would be pretty devastating. You need to know your eject point before the market decides it for you.

Full transparency here — TSLA is my biggest position right now, bigger than Palantir (PLTR). So yeah, it’d be a bummer if it drops to $380. But I’m managing my risk with the understanding that the weekly pattern target of $550 remains valid even if we see that pullback.

The key is understanding pattern flexibility. Just because something can drop doesn’t mean the bullish thesis is dead. But if you’re in leveraged positions without a clear exit strategy, you need to fix that today. Know where the pattern actually breaks, and trade accordingly.

Jeffry Turnmire

Jeffry Turnmire Trading

I host my “Morning Monster” livestream at 9:15 a.m. ET each weekday on YouTube, and then “30 Minutes of Awesome” at 5 p.m. ET each Tuesday!

Please check out my channel and hit that Subscribe button!

You can also follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

- Telegram:https://t.me/+6TdDE7-F6GlhMmJh

Important Note: No one from the ProsperityPub team or Jeffry Turnmire Trading will ever message you directly on Telegram.

I’m just a regular dude in Knoxville, Tennessee: a husband, father, civil engineer, urban farmer, maker and trader.

I’ve been at this trading thing with real money for 20-plus years, and started paper trading over 35 years ago. I have a knack for making some epic predictions that just may very well come true. Why share them? Because I like helping other people — it’s the Eagle Scout in me.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

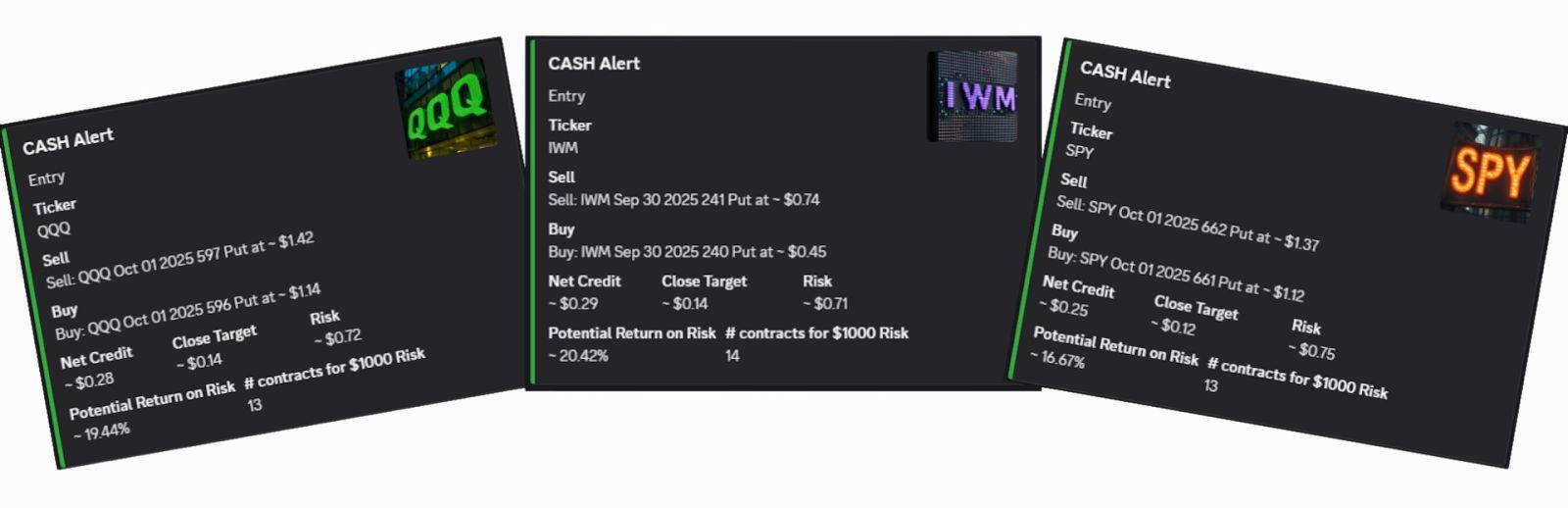

P.S. Would You Like 3 Hot Cash Opportunities per Day… Delivered on a Platter?

My CashBot is showing folks what seems to be a better approach to income trading.

With up to 3 opportunities to target cash every day, CashBot is changing the game for day traders.