>>>I’ll be live with Jack Carter at 11:30 AM ET for Market Masters — we’ll cover current trends and trades, actionable opportunities, trading education and more!<<<

Wall Street’s biggest banks just did something remarkable — they completely flipped their forecasts on when the Fed would end quantitative tightening.

We’re talking about Goldman Sachs (GS) and JP Morgan (JPM) suddenly claiming the Fed will end QT at next week’s FOMC meeting, when just weeks ago they were saying December at the earliest, maybe even Q1 2026. JPM even titled their note something like “When the facts change, I change my mind” — which honestly might’ve been more accurate as “we finally noticed all the flashing red lights.”

Because here’s what’s actually happening in the financial system’s plumbing, and it’s not pretty.

The System’s Warning Lights Are All Flashing Red

Bank reserves have dropped below the critical $3 trillion threshold, and the Fed’s reverse repo facility — which held over $2 trillion at its peak — is basically empty now. Even more concerning, we’re seeing emergency draws on the Fed’s lending window, around $6.6 billion, and overnight lending rates between banks are spiking.

If you were trading in Sept. 2019, this should give you flashbacks. That’s when the repo market essentially seized up and the Fed had to step in with emergency measures. We’re seeing similar stress signals now.

For two years, the Fed’s been on this QT diet — letting bonds mature and draining cash from the system to fight inflation. The balance sheet that peaked at around $6.6 trillion has been steadily shrinking. But the patient’s starting to look pale, and the vital signs aren’t great.

The Counterintuitive Reality About QT and Market Performance

Here’s where it gets interesting, and honestly a bit weird. Over the last two decades, stocks have actually performed better during QT periods than during QE — quantitative easing, when the Fed’s actively printing money and buying bonds.

I know that makes zero intuitive sense. You’d think flooding the system with liquidity would juice stocks, and draining it would hurt them. But data is data, even when it defies logic.

The real action happens at the transition points. When QT ends and potentially flips to QE, it’s like opening the floodgates of liquidity. And the assets that thrive in that environment? High beta tech stocks, small cap companies that need cheap credit, and crypto.

Speaking of crypto, Bitcoin’s already sniffing around the 110,000 to 111,000 range. That’s happening while the liquidity spigot is still mostly turned off. What happens when it actually gets turned back on?

Last week’s selloff gave us a preview — when liquidity hiccupped, speculative assets got hit hard. Which means they’ll be the first to fly when the money starts flowing again.

The question you need to ask yourself: Are you positioned for it? Do you have enough exposure to assets that thrive when money gets cheap again? With the FOMC meeting next week and the ongoing Trump-Xi dynamics, timing matters.

The Fed’s diet is ending. The only question is whether you’re ready for what comes next.

Jeffry Turnmire

Jeffry Turnmire Trading

I host my “Morning Monster” livestream at 9:15 a.m. ET each weekday on YouTube, and then “30 Minutes of Awesome” at 5 p.m. ET each Tuesday!

Please check out my channel and hit that Subscribe button!

You can also follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

- Telegram:https://t.me/+6TdDE7-F6GlhMmJh

Important Note: No one from the ProsperityPub team or Jeffry Turnmire Trading will ever message you directly on Telegram.

I’m just a regular dude in Knoxville, Tennessee: a husband, father, civil engineer, urban farmer, maker and trader.

I’ve been at this trading thing with real money for 20-plus years, and started paper trading over 35 years ago. I have a knack for making some epic predictions that just may very well come true. Why share them? Because I like helping other people — it’s the Eagle Scout in me.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

P.S. Target High-Frequency Income Like Clockwork

If you’ve spent any time studying the market, you know it moves in patterns.

Daily, weekly, even hourly… you’ll find certain setups that repeat themselves like clockwork.

Some trigger right before an explosive move, and others right after.

The traders who have an advantage are the ones who know how to spot those repeating patterns…

And act fast when they show up.

That’s exactly what I’ve done with my latest breakthrough: CashBot.

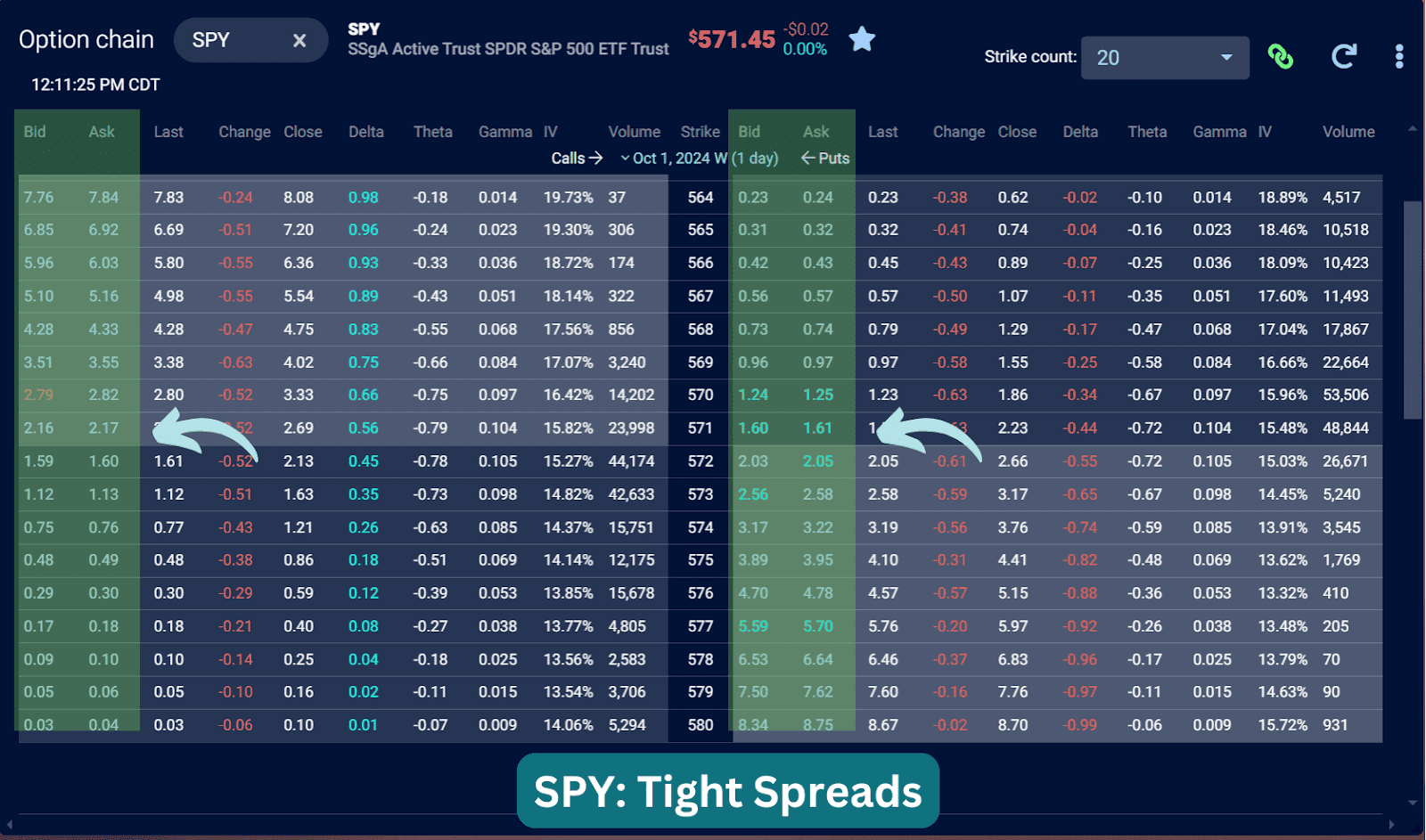

It’s a new type of trading engine built to exploit a “timed advantage” hidden deep inside the options market.

And after months of backtesting, it’s finally ready for traders like you to use.

I went LIVE with Jack Carter on Sunday to walk through exactly how it works… and since then, requests to get early access haven’t stopped coming in.

You still have a window to see it in action and learn how it spots opportunities most traders never even notice.