🚨 I’ll be live at 11:30 a.m. ET with Jack Carter🚨

We’ll discuss why you really only need one stock to make unlimited cash flow and more [tap to join us for Market Masters]!

Someone asked me recently if it’s possible to generate $10,000 a month with a $100,000 account. The short answer? Absolutely — and I’ve been proving it with a strategy that’s become my single largest profit generator.

I’m talking about what I call my beer money trade on Nasdaq (NDX) 0DTE options that’s won 85 times in a row, generating over $44,000 in profit since October.

Yesterday alone, I made $770 on 14 contracts.

The strategy is simple: I sell put credit spreads three standard deviations below the money on NDX, entering between 1:30 p.m. ET and the close, when rapid theta decay kicks in. That placement gives me a 99.7% probability that the trade works.

And honestly, there’s some magic in NDX — it’s the reason I picked it for the beer money trade. Now, let me be clear, if and when I lose one of these trades, it’s going to cost me big time. So don’t go thinking there’s no risk here because as always, there’s risk in trading and nothing is guaranteed.

But I’ve built up a nice cushion to withstand a few losers, and like I said, this is sitting at a 99.7% probability, so I’ll take my chances. If you can’t stand to lose the money, DON’T TRADE IT.

Now let me break down why this works and why I specifically chose NDX for this approach.

Why NDX 0DTEs Are Perfect for This Strategy

There’s something special about NDX index options that makes them ideal for this approach. When the market closes, these 0DTE options end at the market bell — no extra 15 minutes, no after-hours drama like some ETFs these days. The moment the bell rings, the trade is done.

Better yet, they’re cash-settled with no shares and no risk of early assignment. You’re not going to wake up to some surprise execution that disrupts your entire position.

The real kicker: NDX options get 60/40 tax treatment, meaning 60% of your gains are taxed as long-term, even on day trades. That’s a massive advantage when you’re doing this consistently.

Each contract requires about $5,000 in buying power, and I typically collect around 40 to 50 cents per contract. Some people hear that and think it’s not worth it. But when you run the numbers, that’s roughly 1% return per day on the capital deployed, which theoretically compounds to 250% annually.

The timing is everything here. I won’t enter before 1:30 p.m. because my analysis shows that from 1:30 to the close, the largest NDX drop in the last five years was around 400 points — roughly a 4% move. But if you enter at noon instead, the biggest drop increases to over 6%, adding 500 points of additional risk for just 90 more minutes of exposure.

That’s not worth it to me.

The Math Behind the 99.7% Win Rate

Here’s where probability really works in your favor. Three standard deviations means there’s only a 0.3% chance of losing, which translates to one potential loss every 333 trading days — or about once every year and a half given there are only 250 trading days per year.

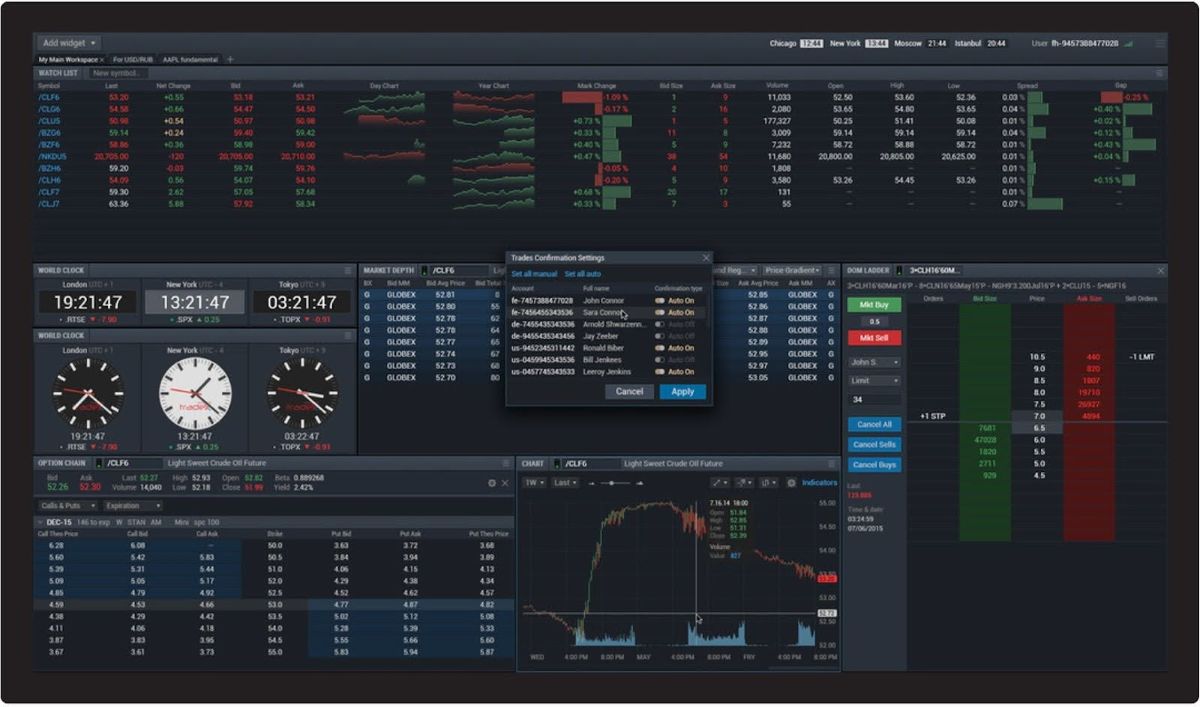

I use TastyTrade’s platform because it makes this easy. It clearly displays the probability of profit percentage, so I just look for strikes showing 99.5% or higher, which is as close as they calculate to three standard deviations.

And the big thing about this is I place three standard deviations below the money when I play it, so probability is definitely on my side.

If the trade goes against me, my defense plan is straightforward: Close the position at a $10 or $11 loss (so $1,000 to $1,100), which I can recover in about a month.

But with 85 consecutive wins under my belt, I’m not sweating it too much because I’ve built myself a nice cushion.

The best part? This strategy is repeatable daily and has generated $27,601 in this account — far exceeding my next best trade. When you’re working with a $100,000 account and looking to generate consistent income, this is exactly the kind of high-probability, systematic approach that compounds over time.

I’m not saying this is risk-free. Nothing in trading is. But when probability is this heavily in your favor and you’re disciplined about entry timing, you’ve got a strategy that can print money day after day.

Feel free to follow my X (aka Twitter) account, where I post these trades each day!

Jeffry Turnmire

Jeffry Turnmire Trading

I host my Morning Monster livestream at 9:15 a.m. ET each weekday on YouTube, and then 30 Minutes of Awesome at 5 p.m. ET each Tuesday!

Please check out my channel and hit that Subscribe button!

You can also follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

- Telegram:https://t.me/+6TdDE7-F6GlhMmJh

Important Note: No one from the ProsperityPub team or Jeffry Turnmire Trading will ever message you directly on Telegram.

I’m just a regular dude in Knoxville, Tennessee: a husband, father, civil engineer, urban farmer, maker and trader.

I’ve been at this trading thing with real money for 20-plus years, and started paper trading over 35 years ago. I have a knack for making some epic predictions that just may very well come true. Why share them? Because I like helping other people — it’s the Eagle Scout in me.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

P.S. Wall Street’s Been Routing Its Orders Through the Dark Pool

I found a way to trail them using a special class of securities called Supercharged Tickers.

Even better, I have a 100% win rate so far, and right now I’m looking to target the next opportunity…

We develop tools and strategies to the best of our ability, but no one can guarantee the future. There is always a risk of loss when trading past performance is not indicative of future results. From 2/5/2025 to 02/12/2026 the win rate on live closed trades has been 100% with an average return of 27.8% and average hold time of 18 days.