Blockchain is more than code – it’s digitized economics.

Protocols like Bitcoin, Ethereum, Cardano, Filecoin, Zcash, etc. use economic incentives to monetize the value of the work performed on their network. With the right incentives, the token or cryptocurrency then acts as a conduit to monetize that value.

For Bitcoin, that incentive is block rewards. Solve the riddle, get some Bitcoin. Easy peasy.

Well, not easy. Unless you find ASIC chips running bare-metal code solving a mathematical riddle with more possible solutions than there are atoms in the universe, simple. But I digress…

In any case, the incentives that support the Bitcoin network are clear and powerful.

The first Bitcoin mined – known as the genesis block – resulted in a block reward of 50 Bitcoin.

The code governing the network halves that reward every 210,000 blocks – or roughly every 4 years.

We’re rapidly approaching Bitcoin’s 5th “halvening,” taking the block reward down from the current 6.25 Bitcoin to 3.125. Which, at current prices represents an $80K haul for the miner that wins the block.

These milestones along the road to a max 21 million Bitcoin supply never fail to pull more investors and HODLers into the world’s top crypto.

With the next halvening slated for March 28th, 2024, we’re at the cusp of yet another cycle of growing interest in crypto.

You can expect countless opportunities to come along during this cycle.

The attention each halvening brings to Bitcoin spills over to other smaller cryptos, typically leading to outsized performance. And the setup ANKR is showing in today’s chart makes me think it may be the next to move.

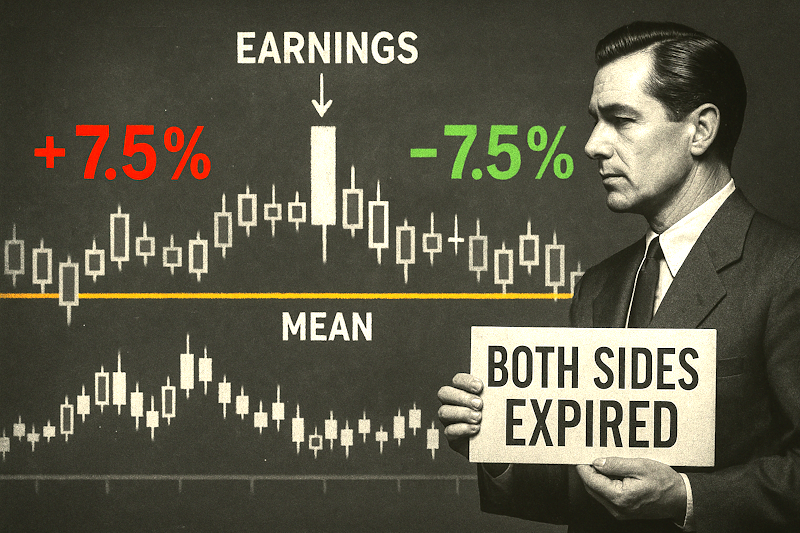

Check out the chart and the potential upside targets.