Leveraged tickers are quickly becoming my go-to for trades where I want options-like gains without the complexity and drawbacks of actually trading options.

And judging by the feedback I’ve been getting, I’m not the only one tired of worrying about expiration dates, strikes and implied volatility wrecking a perfectly good setup.

This isn’t theory — I’ve been doing this in real time, so far delivering an annual return of 85% across more than 100 documented trades with a 72% win rate.

Why I Like Leveraged Shares Over Options

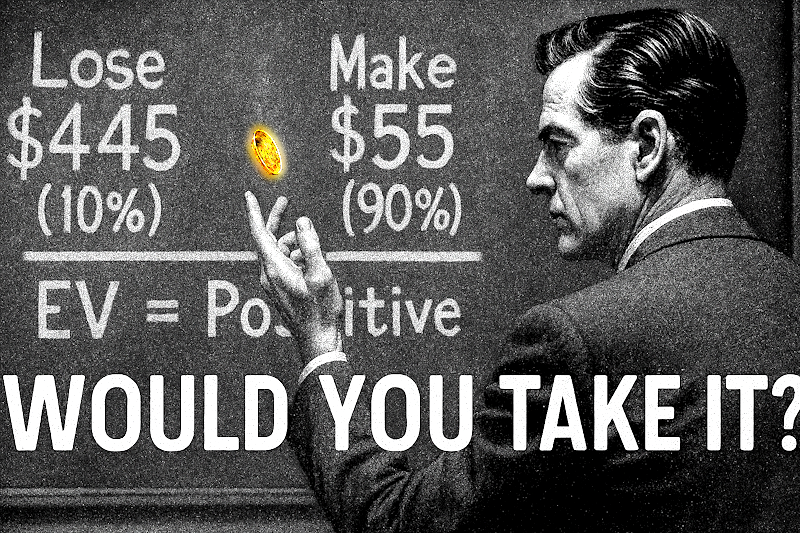

Options are great when you nail the timing — but that’s a big “if.” You’ve got to be right on direction, timing, price, strike selection and IV. Miss just one of those and your option could decay, even if the move technically goes your way.

That’s a lot of pressure — and it’s why 90% of retail traders lose money trading options.

Leveraged ETFs simplify all of that. Instead of worrying about a dozen factors, I just need to be right on direction — and I can use stops to manage my risk.

No worrying about time decay. No guessing which expiration to use. Just get the direction right and get in or out when the chart says so.

This is why I’m putting together a new strategy that focuses entirely on leveraged share trades. No options required. Just buying and selling shares on tickers that already come built with leverage.

The Gains Are Still There — Without the Headaches

Some people assume that ditching options means leaving big profits on the table — but that’s not the case. If I expect something like GLD to move 5%, I can go to UGL, which is 2x, and look for a 10% move.

Same thing with the Nasdaq — if I think QQQ is ready for a drop, I can go to SQQQ and play it that way.

I’ve shown examples where these leveraged tickers return 20% to 30% in a short window, and the best part is I can get in during extended hours and place stops.

Try doing that with options — it’s not happening.

Yes, there are risks — there are ALWAYS risks in trading. These things can implode if you hold too long or trade the wrong direction. That’s why I always look at the underlying chart, not just the leveraged ticker.

But when used right, they offer the same kind of upside I’d get with options — just with a whole lot less stress.

I’ll be rolling out more on this next week. For now, just know this…

If you’ve ever felt overwhelmed by all the variables that come with trading options, this approach might be exactly what you’ve been looking for.

I’m unveiling this new strategy at 1 p.m. ET on Tuesday along with the great Roger Scott, and we’d love to see you there…

Jeffry Turnmire

Jeffry Turnmire Trading

I host my “Morning Monster” livestream at 9:15 a.m. ET each weekday on YouTube, and then “30 Minutes of Awesome” at 5 p.m. ET each Tuesday!

Please check out my channel and hit that Subscribe button!

You can also follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

- Telegram:https://t.me/+6TdDE7-F6GlhMmJh

Important Note: No one from the ProsperityPub team or Jeffry Turnmire Trading will ever message you directly on Telegram.

I’m just a regular dude in Knoxville, Tennessee: a husband, father, civil engineer, urban farmer, maker and trader.

I’ve been at this trading thing with real money for 20-plus years, and started paper trading over 35 years ago. I have a knack for making some epic predictions that just may very well come true. Why share them? Because I like helping other people — it’s the Eagle Scout in me.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

P.S. Time Decay Is Killing Your Options Trades — but There’s a Better Way

Many people believe there are only a couple of ways to generate big returns in the market: by taking on more risk or waiting a long time.

But those people are wrong because there’s a third way…

You can target options-like returns without the added risk and time decay, and I’m going to share my plan to trade what I call “Supercharged Tickers” that have delivered an annual return of 85% across more than 100 documented trades with a 72% win rate. And I’ll share it all at 1 p.m. ET on Tuesday!