There’s a disconnect happening right now that most traders are completely missing.

While Wall Street’s been busy piling into the usual suspects in the nuclear space, the U.S. Army just announced something that could reshape how we think about energy entirely — and it’s not what you think.

I’m talking about the Janus program. Sounds like something out of a spy thriller, but this is very real. The Army’s planning to power military bases with micro nuclear reactors — actual shipping container-sized units that require no water hookup, minimal maintenance, and can run for years on air-cooled engines. First deployment target? 2028, with contracts for nine bases already awarded in 2026.

This isn’t the Small Modular Reactor story everyone’s been trading. This is an entirely different category of nuclear power, and most people have never even heard of the private companies leading this charge.

The Real Players Nobody’s Watching

Here’s where it gets interesting. Two private companies are at the forefront of this micro reactor buildout, and they’ve been quietly raising serious capital.

Valora Atomics — founded by a high school dropout turned nuclear visionary — has raised $19 million and is breaking ground on a test reactor in Utah. Then there’s Radiant Nuclear, which has pulled in $250 million from heavyweights like Andreessen Horowitz and Peter Thiel. They’re building a portable 1-megawatt reactor and planning factory-scale production by 2028.

The publicly traded angle that popped on this news was New Scale Power (SMR), which jumped 16% when the Janus program was announced. But here’s the thing — they don’t actually have a micro nuclear reactor ready to go. They’re just furthest along in the regulatory process with the NRC, and they’re sitting on only about $8 million in revenue.

The picks-and-shovels play here might be more compelling: nuclear fuel suppliers like Centrus Energy (LEU) and BWX Technologies (BWXT). BWXT already has a $1.5 billion contract supplying fuel for naval reactors that run 30 to 50 years without refueling. Russia’s been the dominant supplier of nuclear fuel globally — the U.S. is finally getting back in the business.

Why This Matters Now More Than Ever

Goldman Sachs recently predicted that data centers alone will consume power equivalent to 75 million homes by 2030 — roughly a third of all U.S. households. Our grid was designed when microwaves were cutting-edge technology. Rolling blackouts and price spikes aren’t just possible — they’re increasingly likely.

I’ve been talking about micro nuclear reactors for three years as the real solution to our energy infrastructure problems, not SMRs. The Army’s commitment validates what a lot of us have been saying: We need reliable, portable, resilient power sources that can operate independently of an aging grid that’s vulnerable to everything from cyberattacks to weather disasters.

For traders looking at the uranium space more broadly, Cameco (CCJ) remains a solid miner play, or you can go the diversified route with the Van Eck Uranium and Nuclear ETF (NLR).

Fair warning — this is high-risk, high-reward territory with long timelines, regulatory hurdles, and some companies that are still in the vapor stage with zero revenue. But the military’s commitment to deploying these systems by 2028 adds a level of seriousness that changes the conversation entirely.

The energy crisis isn’t coming. It’s already here. And the solution might just be sitting in a shipping container.

Jeffry Turnmire

Jeffry Turnmire Trading

I host my “Morning Monster” livestream at 9:15 a.m. ET each weekday on YouTube, and then “30 Minutes of Awesome” at 5 p.m. ET each Tuesday!

Please check out my channel and hit that Subscribe button!

You can also follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

- Telegram:https://t.me/+6TdDE7-F6GlhMmJh

Important Note: No one from the ProsperityPub team or Jeffry Turnmire Trading will ever message you directly on Telegram.

I’m just a regular dude in Knoxville, Tennessee: a husband, father, civil engineer, urban farmer, maker and trader.

I’ve been at this trading thing with real money for 20-plus years, and started paper trading over 35 years ago. I have a knack for making some epic predictions that just may very well come true. Why share them? Because I like helping other people — it’s the Eagle Scout in me.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

P.S. Target High-Frequency Income Like Clockwork

If you’ve spent any time studying the market, you know it moves in patterns.

Daily, weekly, even hourly… you’ll find certain setups that repeat themselves like clockwork.

Some trigger right before an explosive move, and others right after.

The traders who have an advantage are the ones who know how to spot those repeating patterns…

And act fast when they show up.

That’s exactly what I’ve done with my latest breakthrough: CashBot.

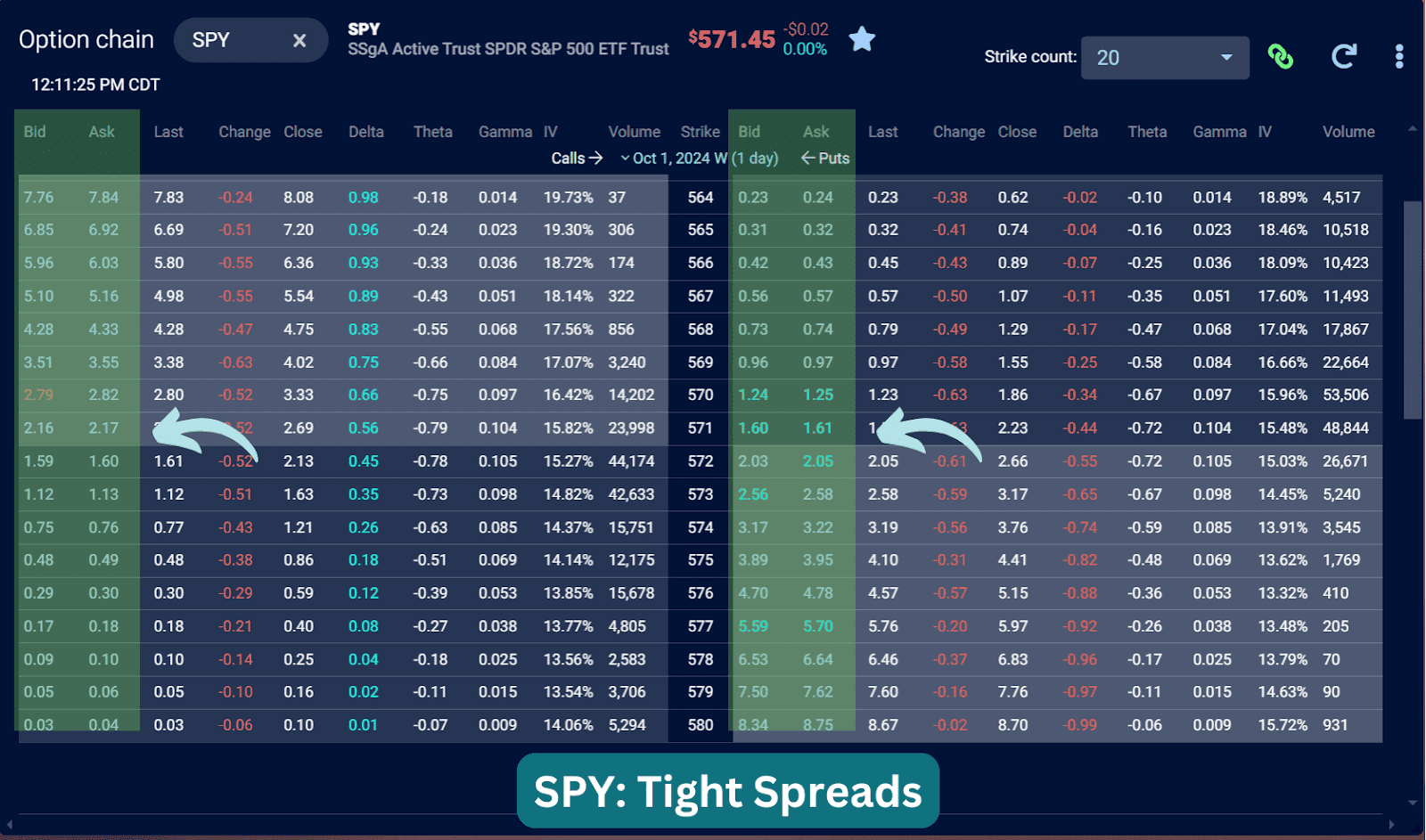

It’s a new type of trading engine built to exploit a “timed advantage” hidden deep inside the options market.

And after months of backtesting, it’s finally ready for traders like you to use.

I went LIVE with Jack Carter on Sunday to walk through exactly how it works… and since then, requests to get early access haven’t stopped coming in.

You still have a window to see it in action and learn how it spots opportunities most traders never even notice.