Everyone’s buzzing about artificial intelligence and its potential to reshape our world. Companies are racing to build bigger models, faster processors and smarter systems. But there’s something critical missing from this conversation — and it’s creating a massive opportunity hiding in plain sight.

The real story isn’t just about the technology. It’s about the enormous amount of power required to run it. AI-optimized data centers routinely burn through more than 60 kilowatt hours per rack when you load them with GPUs — six to twelve times the power density of traditional setups. That single stat alone tells you everything about the scale of what’s coming.

We’re not talking about a slight uptick in energy consumption. This is a fundamental rewiring of power demand that most people haven’t even noticed yet.

The Nuclear Fantasy vs Natural Gas Reality

Sure, everyone loves to imagine nuclear swooping in to solve everything. And maybe one day it will. But nuclear takes years to build, permit and connect. Meanwhile, a natural gas generator can be up and running in months. When you need huge amounts of electricity fast, speed matters.

So while Silicon Valley dreams about zero-carbon power, natural gas plants that can spin up instantly are carrying the load. And here’s where the irony gets thick — many of the same tech giants pledging to go carbon neutral are simultaneously building AI models that need more natural gas than a Texas pickup truck convention. Their public messaging and their actual energy requirements are on a collision course.

Data centers currently consume about 4% of US electricity. By 2030, that’s expected to jump to 8%. Natural gas will meet roughly 40% of that expansion, which means the opportunity here isn’t subtle — it’s flashing neon.

And to keep up, infrastructure is scaling just as aggressively. A dozen major projects are slated for completion within the next year, boosting Gulf Coast gas shipping capacity by 13% — roughly equal to the entire natural gas consumption of Canada. Moves like that don’t happen unless demand is exploding.

The Infrastructure Play Nobody Sees Coming

Look at where this trend is really heading. By the end of 2026, data centers alone could be pulling 2.5 billion cubic feet of natural gas per day, up from just 0.8 the year prior. That’s not an increase — that’s an earthquake.

And all that gas still has to move. Which means pipelines — lots of them — stretching into every emerging AI hub in the country. These are long-term, high-capex, high-certainty buildouts driven by a demand curve that hasn’t even begun to level off.

Traditional data centers once pulled 5 to 10 kilowatts per rack. Those days are gone. AI has rewritten the math, and with it the entire energy infrastructure picture. The AI revolution everyone keeps talking about is going to run on natural gas whether Silicon Valley wants to admit it or not.

For traders who can see past the hype and understand what’s actually powering this wave, the opportunity is enormous.

Jeffry Turnmire

Jeffry Turnmire Trading

I host my “Morning Monster” livestream at 9:15 a.m. ET each weekday on YouTube, and then “30 Minutes of Awesome” at 5 p.m. ET each Tuesday!

Please check out my channel and hit that Subscribe button!

You can also follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

- Telegram:https://t.me/+6TdDE7-F6GlhMmJh

Important Note: No one from the ProsperityPub team or Jeffry Turnmire Trading will ever message you directly on Telegram.

I’m just a regular dude in Knoxville, Tennessee: a husband, father, civil engineer, urban farmer, maker and trader.

I’ve been at this trading thing with real money for 20-plus years, and started paper trading over 35 years ago. I have a knack for making some epic predictions that just may very well come true. Why share them? Because I like helping other people — it’s the Eagle Scout in me.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

P.S. WARNING: The Data Unfolding Right Now Is Disturbing!

I’m raising a major red flag on the economy – and this isn’t hyperbole.

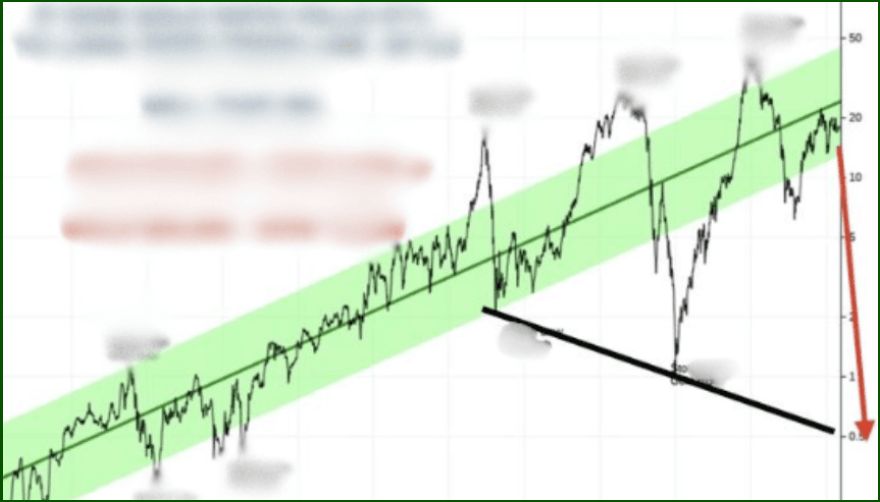

The data flashing across my screen looks disturbingly similar to the early warning signals we saw in 2020…

And if those patterns are repeating, we may be on the front edge of something far more serious than a recession.

Call it what you want – a severe downturn, a systemic break, even the early stages of a modern depression – but the warning signs are stacking up fast.

Now, this isn’t a “doom headline” with no direction.

Because every major crisis in the past century has delivered one thing consistently:

A massive, generational opportunity in Gold.

Back in 2020, when these same signals started to flash, I used this exact roadmap to turn a $250k account into $1.4 million.

And if this setup plays out again, Gold’s path to $10,000 is mathematically reasonable.

No guarantees on the market, of course – there never are.

But if the market cracks the way I believe it might, sitting on the sidelines won’t protect you… and it certainly won’t help you profit from the shift.

That’s why I’ve laid out the full game plan… how to position defensively and how to capitalize if the coming move accelerates.

If You Want the Roadmap, It’s Right Here

We develop tools and strategies to the best of our ability, but no one can guarantee the future. There is always a risk of loss when trading past performance is not indicative of future results. All examples shown today are based on a $2,000 starting stake unless otherwise stated. 11/22/2023 – 11/12/2025 on live trades the win rate has been 70.4% with an average return of 19% (winners and losers) with an average hold time of 3 days.