Jeffry Turnmire it s a guy who recognizes change before just about anyone else.

He called Bitcoin’s bottom in December 2022, he called the bottom on Tesla’s (TSLA) multi-month slump back in April…

And he even did a double prediction on Boeing (BA), warning that 265 was a top for the stock before it would embark on a long, slow slide down to the 160 level — both targets which it hit.

We could go on and on — literally — SBUX, NEM, MARA, BUD, GLD,…

Ok, ok, we’ll stop, because right now we want to focus on the broad market.

See, Jeffry’s been warning for months now of a pattern lining up on the charts that indicates we could be in for broad market crash in the next 12-24 months.

So we wanted to find out if the market’s tantrum last week was the start of that crash.

Jeffry played it straight down the line, telling us that while there’s not enough information yet to know which direction the market will pick, it comes down to one simple test for him.

According to Jeffry, the S&P is at a crucial juncture, trading just below a significant resistance level.

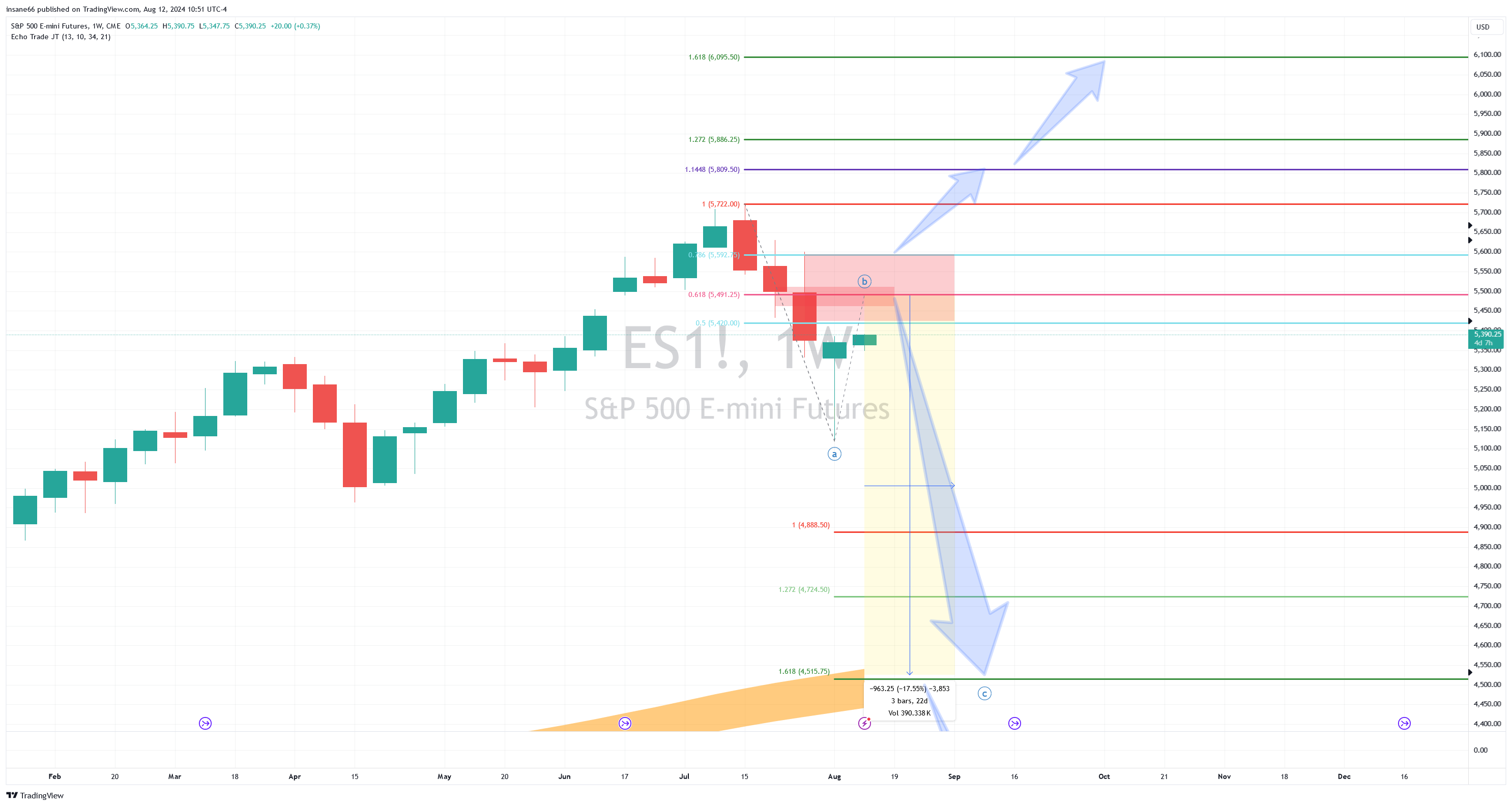

His analysis is based on the following chart, featuring key Fibonacci levels.

As the S&P currently tests the 0.618 Fibonacci retracement level at 5467, he highlights a red resistance zone on his chart, spanning from the 0.786 level at 5592 down to the 0.500 level at 5420.

He noted that the market’s reaction to this resistance zone will be telling.

If the index reacts negatively and fails to break through the resistance, Jeffry predicts a potential drop of approximately 950 points on the S&P 500, which could lead to a real market crash.

Far more severe than the “puny market rout” (his words) we saw last week.

On the flip side, if the S&P 500 can break through this resistance, Jeffry sees the possibility of new all-time highs in the S&P before the election. His targets for this bullish scenario are the 1.448 Fibonacci level at 5809 and the 1.618 level at 6095.

Importantly, Jeffry reminds us that while mainstream media outlets closely watch numbers like PPI and CPI… and hang on every word from The Fed… “the news doesn’t make the charts”, as he likes to tell us.

“Mainstream media often uses the same headline to explain moves up or down “CPI is soft” market moved down in response vs “CPI is soft” so market moved up in response.”

Jeffry’s analysis underscores the knife’s edge that the market finds itself at right now, with a move in either direction virtually sealing its fate over the next few months.

For traders, this is a critical time to stay vigilant and prepared for whichever direction the market takes. And definitely avoid “trading the news”.

The only real telltale sign of where we’ll be is when the market breaks through or breaks down from the resistance zone.

In the meantime, Jeffry’s analysis gives us a critical roadmap to find our footing at a time when plenty of traders are adrift without a rudder.

— The Prosperity Pub Team

The Perfect Time for the Perfect Gold Trade?

After taking an extended spring-into-summer slumber, Gold looks like it’s setting up for another run higher!

And this one ticker has outperformed every August in an election year for the past 8 election cycles.

Click here to find out how Geof plans to play the potential gold surge!