The market’s been a little choppy this week, and inflation data is playing a big role in that.

As you know, CPI came in better than expected month-over-month, but the annual rate ticked slightly higher at 2.7%. That tiny overshoot was enough to crush hopes for a July rate cut — just a few weeks ago, odds were around 25%, and now they’re closer to 3%.

That shift is why I’m staying patient with small caps. Rate-cut optimism tends to fuel the strongest small-cap rallies, and we’re not quite there yet.

But there’s something happening under the surface that has my attention: Hedge funds are quietly removing their shorts at the fastest pace in four years.

When the “smart money” starts backing off bearish bets, it’s often a sign they’re positioning for a potential run higher — and small caps are usually among the first to benefit when money rotates back into riskier areas.

The seasonality picture supports that idea.

July tends to be a strong month across most sectors, and market internals still look healthy. Roughly 70% of stocks are trading above their 50-day moving averages, and the number above their 200-day is steadily climbing, even though it’s still below typical bull-market averages.

That tells me there’s room for “catch-up” plays — exactly the kind of environment where small caps can shine.

I’m not jumping in just yet. I want confirmation before putting on any new trades.

But when you combine seasonally strong tailwinds, healthy internals and hedge funds quietly repositioning to the long side, it’s worth keeping small caps at the top of your watchlist.

One or two positive catalysts — whether that’s softer inflation data or a hint of future rate cuts — could be all it takes to spark the next leg higher.

We’ll keep covering the strongest ones every morning on Opening Playbook!

Graham Lindman

Graham Lindman Trading

Follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

Important Note: No one from the ProsperityPub team or Graham Lindman Trading will ever contact you directly on Telegram.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

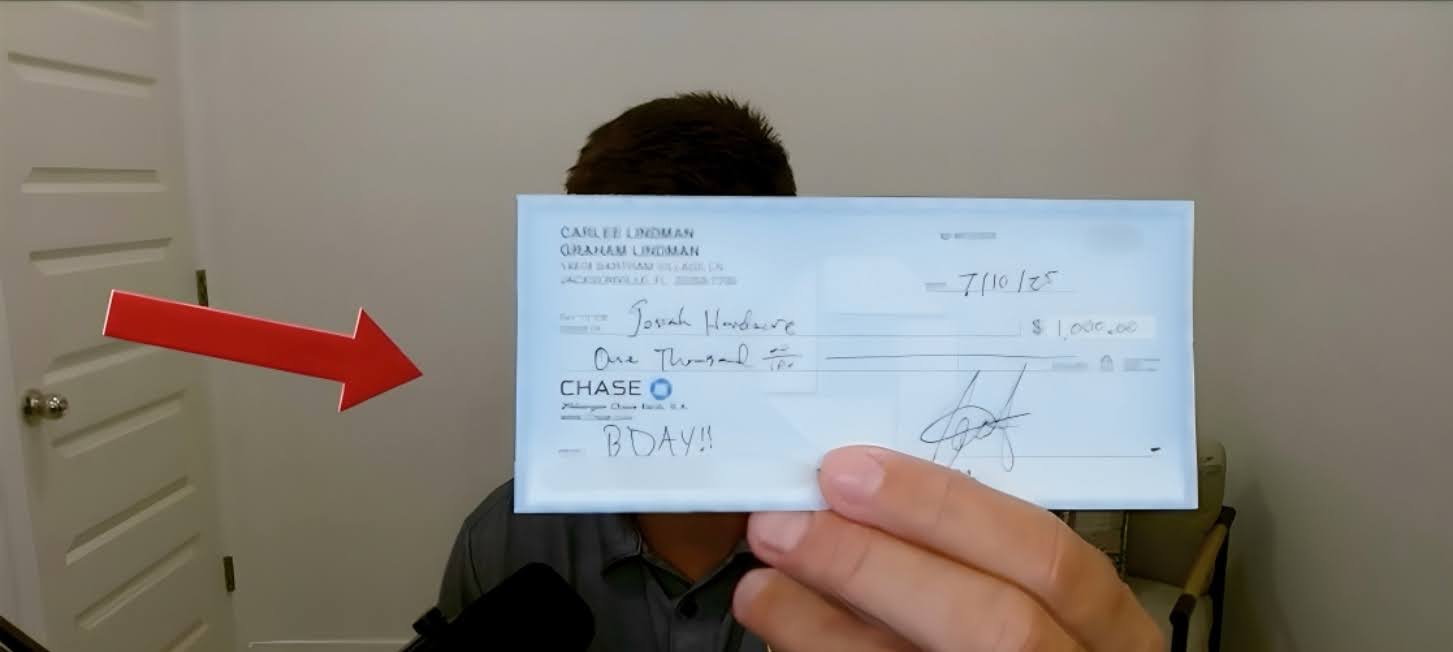

P.S. Why I’m Making My Best Friend Trade for the First Time

Josiah, our Marketing Manager here at TradingPub, walked into my office some the other day…

And I slid a $1,000 check across the desk…

“Happy birthday in advance,” I said.

He picked it up, looked at it, and grinned.

“What’s the catch?”

You see, Josiah is a smart guy, and he knows me too well… We’ve been best friends since fifth grade.

The catch is simple… he has to use it to make his first real trade.

And I’m going to show him exactly how to turn it into $1,500 by Monday morning.

Here’s what makes this interesting…

Josiah’s been working around traders for years but never pulled the trigger himself.

He says he doesn’t know enough… doesn’t have the time to learn properly.

And that’s perfect for me.

Because what I’m about to show him takes 60 minutes MAX.

All he has to do is set it up at 10 a.m. ET… The market moves a few ticks, like it always does, and he walks out potentially with his profit.

It doesn’t matter if the underlying stock goes up or down.

This setup I’ll walk Josiah through has been working 87% of the time this year.

And at 7 p.m. ET this Sunday, I’m walking him through his very first trade…

Showing him why the market only needs to move a little bit for this to work.

And how someone starting with $1,000 could be looking at an extra $500 the very next morning.

Of course, we both know no one can guarantee returns or against losses, but…

I can’t wait to see Josiah’s face when he realizes how simple this actually is.

If you’d like to see how this trade works, and how you can tag along for his first trade…