Nvidia (NVDA) is down again — off over 5% to start the week — and from a technical standpoint, the chart looks like a clean downtrend. If someone looked back a year from now, they’d probably call it picture perfect.

But we all know what really triggered this move: the export restrictions to China. That policy shift is what started this whole slide with NVDA down over 30% the past three months.

It’s been rough, no doubt — especially for long-term holders. I’ve had a position in Nvidia since it was at $94. That’s still green, but barely. The good news is we’ve been trading this thing aggressively to the downside, and so far the puts have worked like a charm.

If momentum holds up, this week’s position should be another triple-digit winner.

That’s the beauty of knowing how to trade both sides of the market. Even when your long-term holdings are taking heat, there’s opportunity in the short term.

Momentum Trumps Fundamentals in the Short Term

At some point, Nvidia will probably be a screaming buy again — but we’re not there yet. For now, momentum is firmly to the downside, and that’s exactly the kind of setup we look for with the Newton signals.

Each time Nvidia flipped red, we followed up with bearish trades and got paid for it. If that continues, the same setup could play out for a fourth time in a row. This is how you manage volatility — by sticking to the signals, not the headlines.

Now, obviously, the broader tariffs story is creating a lot of uncertainty. People keep asking if we’re going to get clarity once the 90-day extension runs out in July.

Maybe…

But it’s just as likely we get another round of deals, delays or partial rollbacks. The back-and-forth isn’t going to end anytime soon — and that means directional setups like this are going to keep popping up.

Hedging With Strategy, Not Emotion

You don’t need to love the headlines to find opportunity in this market. If you’re sitting on beaten-down semiconductors, like the MAGS or other names in SMH, pairing them with downside trades in Nvidia or Broadcom (AVGO) is a smart way to hedge and stay active.

We don’t have to guess when the market will stabilize. What we can do is follow the flow and trade what’s in front of us. Right now, that means Nvidia’s short-term trend still favors the bears — and the next trade might already be setting up.

Graham Lindman

Graham Lindman Trading

Follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

Important Note: No one from the ProsperityPub team or Graham Lindman Trading will ever contact you directly on Telegram.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

P.S. AutoStrike Versus the Market Crash: 3-0

A few months ago, Chuck Hughes called me with news he couldn’t share with anyone else yet.

After 40 years of trading (and mentoring me for the past few), he’d finally done something I thought was impossible – he automated his trading method.

As Chuck’s student, I’ve seen firsthand how powerful his strategies are.

His guidance helped me double my account in about six months, posting over $30,000 in profits.

But this new trade engine he built? It’s on another level entirely.

It’s called “AutoStrike” – and it doesn’t just find good stocks.

It scans through 100,000+ options contracts to identify the precise ones with what it sees as having exceptional profit potential.

The kind that can target $500… $1,000… sometimes even more per trade.

I was skeptical until I saw what was possible during one of the worst market weeks in January.

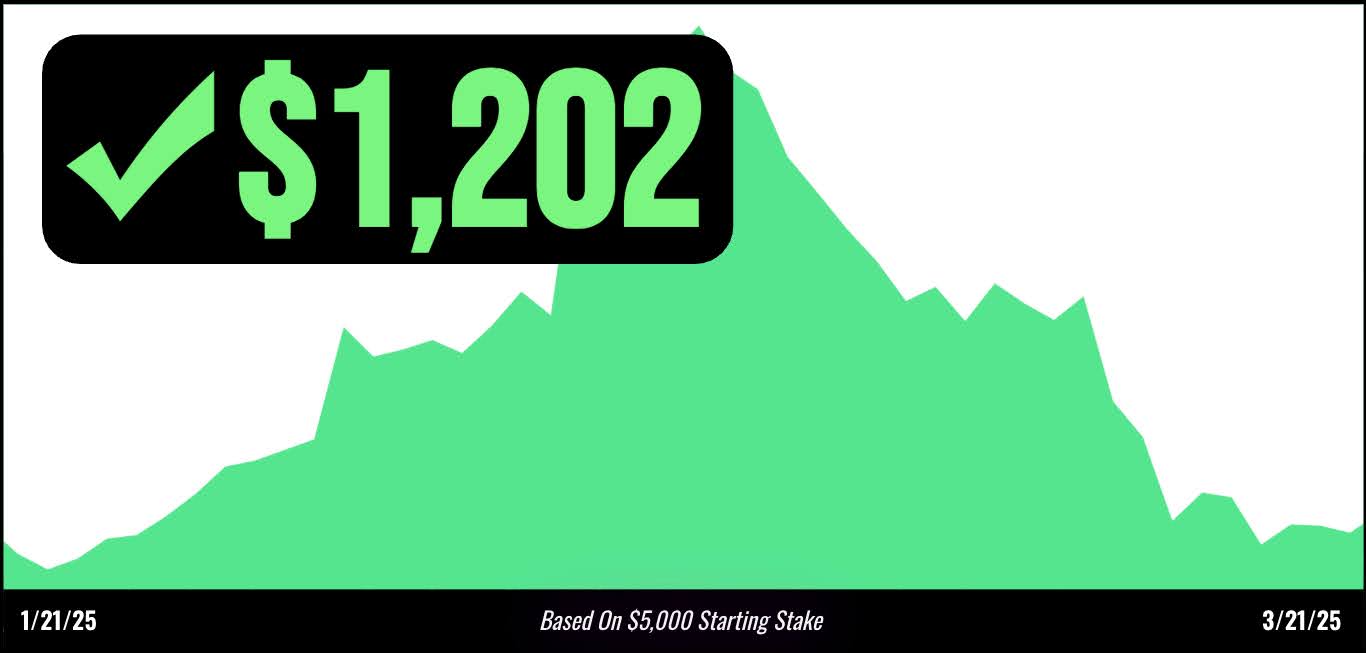

Based on the algorithm… On January 21st, AutoStrike could have flagged a trade on NET that would have paid $1,202 in just days.

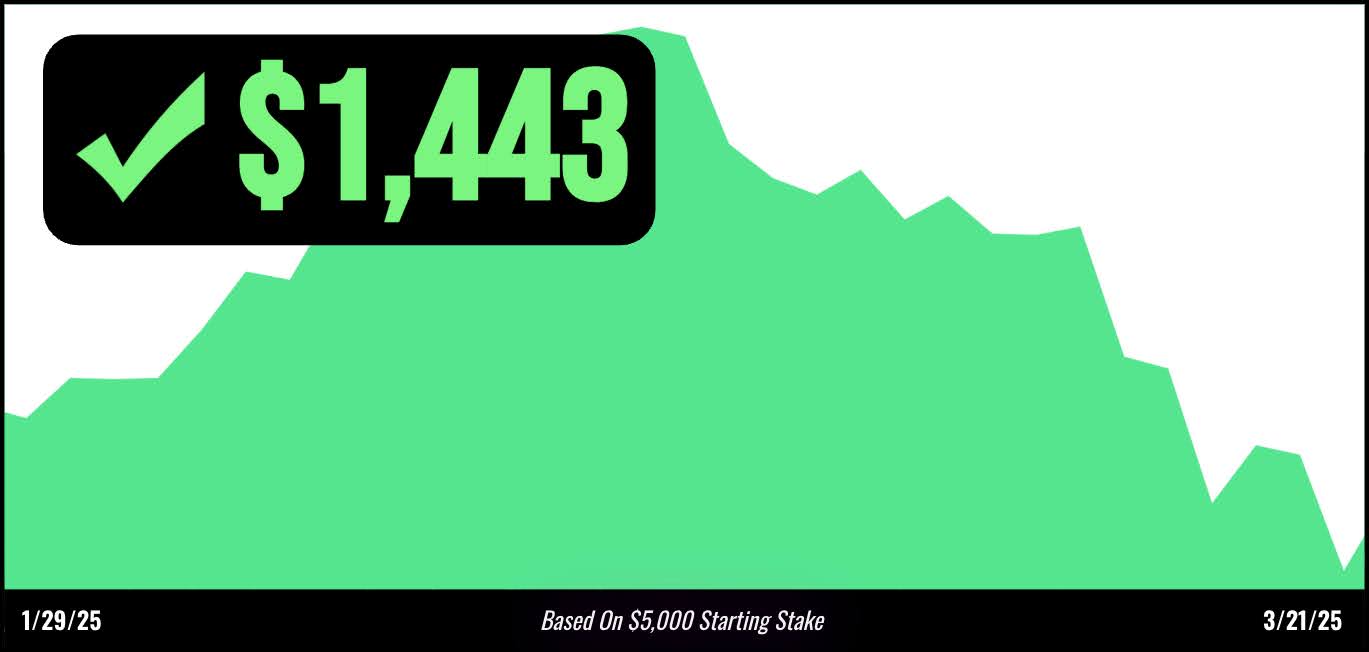

Again, a few days later, on January 29th, another alert on FTNT that would have delivered $1,443.

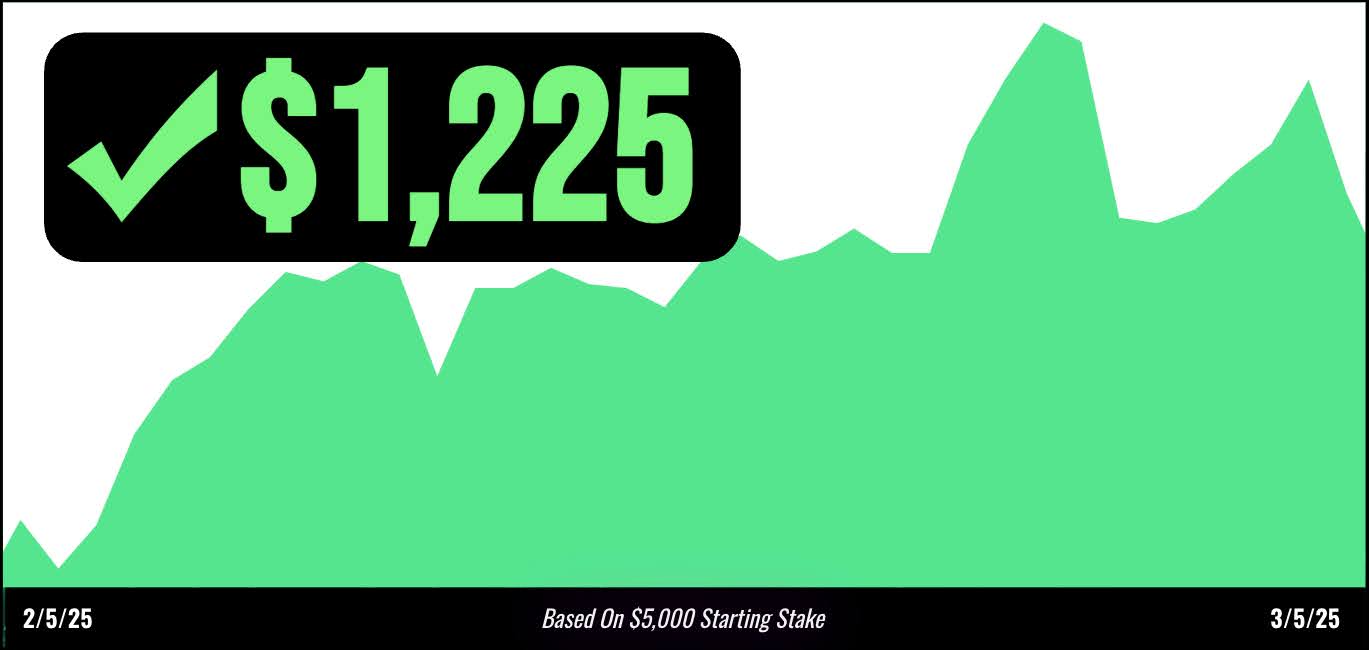

And even by February, it was the exact same story on yet another opportunity with HWM, with a short at $1,225 in profits.

All while the market was getting hammered.

The most impressive part?

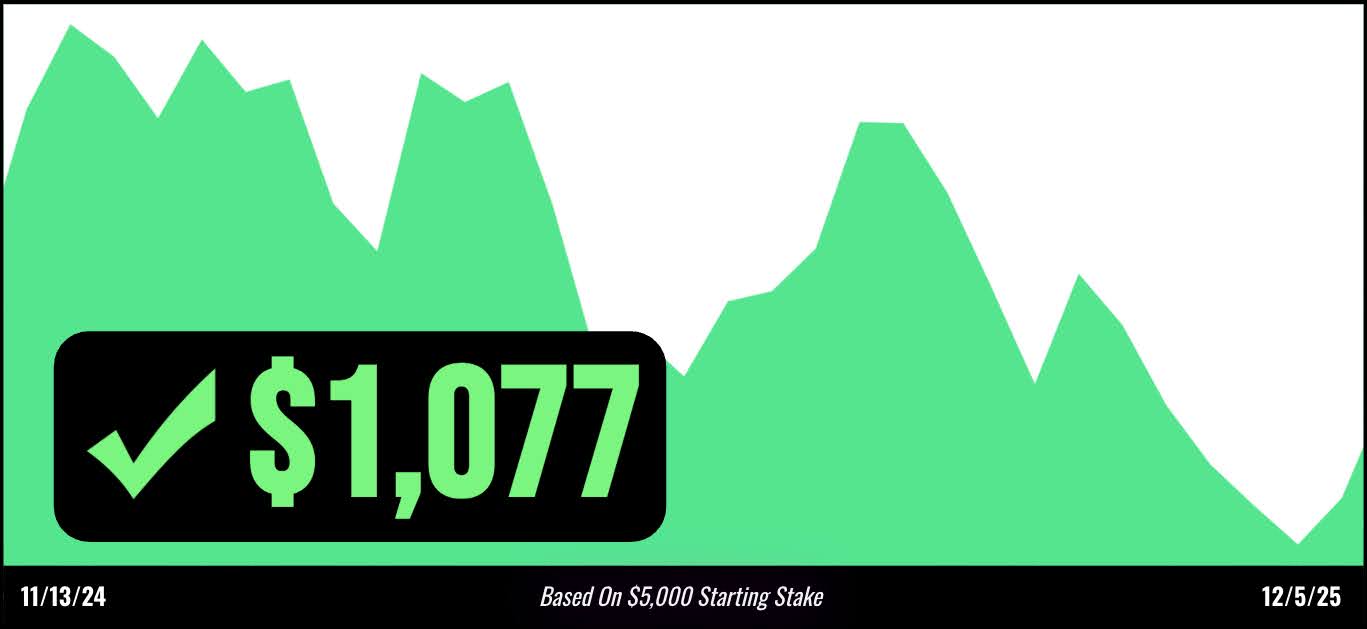

Even when stocks like NVDA dropped 8.5% in November and most traders got crushed.

Anyone following these “AutoStrike” alerts had a shot at walking away with $1,077 in profits.

How? Because Chuck and his team programmed it to help you find options with the power to pay out EVEN if a stock drops 10%+ in a month.

Of course, there would have been smaller wins and some that did not work out, and I cannot promise every single trade would play out this way.

But we will share the secret behind his incredible 96.2% win rate on real money trades – and now it’s fully automated, working 24/7.

Just check your phone once during market hours, and all the heavy lifting is done for you.

Just this morning, AutoStrike flagged a new trade setup that’s primed to target profits, and I want to share it with you before the window closes.

These alerts are time sensitive, but you can get your hands on the ticker…