Markets are volatile, headlines are flying, and uncertainty is the norm — which is exactly why I’m leaning into one of my favorite setups right now: the two-way trade.

This strategy isn’t about calling tops or bottoms. It’s about capitalizing on the move — any move — and stacking the odds in your favor by setting up a trade that can win if the market goes up or down.

In this kind of environment, where every day brings a fresh headline on tariffs, earnings or geopolitical drama, being directionally agnostic is a major edge.

Why This Setup Works in Today’s Market

Think about the tape right now. We’ve got high average true range, elevated volatility, and zero clarity on what comes next. It’s the perfect storm for setups that don’t require you to be right about direction — just movement.

That’s where two-way options come in.

With this approach, you define your risk upfront. You know what you’re targeting on both sides of the move. If the trade breaks the upper or lower boundary, you hit your profit. It’s not about being right — it’s about being ready. And if the market rips or tanks? You’ve got a trade that’s positioned to ride that wave either way.

One of the best parts of this strategy is that you can often sneak in an extra weekend of time decay when trading indexes like the S&P 500 (SPY) or the Nasdaq 100 (QQQ). That weekend pop can be the final push that takes you out at your target — especially if the market gaps.

I call it the “last bullet in the chamber,” and it’s a sneaky little trick that’s helped me close out more trades green.

When to Use the Two-Way

This isn’t a strategy I use every day. I’m looking for setups where the market is compressed, coiled and likely to break out. Ideally, it’s in a name or index with decent liquidity and options volume — I want to get filled quickly when my target hits.

It also shines in macro uncertainty. I’ve used this setup around major earnings, inflation prints, rate decisions and — more recently — the constant noise around tariffs and global instability.

If you’re tired of guessing direction and want a setup that thrives on movement, not predictions, the two-way trade might just be your new favorite weapon. You get your risk defined, you don’t have to time the market perfectly, and if the move comes, you’re in position to take your cut.

In markets like this, that’s exactly the kind of edge I want.

A Stock to Watch: Take-Two Interactive Software (TTWO)

Take-Two Interactive Software (TTWO) is a stock to keep on your watchlist this week, as it tends to be bullish starting at the end of April.

As the market continues to try to turn bullish, this seasonal trend could be worth a look.

Buying TTWO on April 29 and holding for 25 days has delivered a whopping average return of 9.45% over the past several years. While past performance is no guarantee, it’s definitely worth considering as we move into May.

Overall, earnings are front and center, but tariffs are still driving the narrative — especially for companies with global supply chains.

Stay tuned!

Graham Lindman

Graham Lindman Trading

Follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

Important Note: No one from the ProsperityPub team or Graham Lindman Trading will ever contact you directly on Telegram.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

P.S. AutoStrike Versus the Market Crash: 3-0

A few months ago, Chuck Hughes called me with news he couldn’t share with anyone else yet.

After 40 years of trading (and mentoring me for the past few), he’d finally done something I thought was impossible – he automated his trading method.

As Chuck’s student, I’ve seen firsthand how powerful his strategies are.

His guidance helped me double my account in about six months, posting over $30,000 in profits.

But this new trade engine he built? It’s on another level entirely.

It’s called “AutoStrike” – and it doesn’t just find good stocks.

It scans through 100,000+ options contracts to identify the precise ones with what it sees as having exceptional profit potential.

The kind that can target $500… $1,000… sometimes even more per trade.

I was skeptical until I saw what was possible during one of the worst market weeks in January.

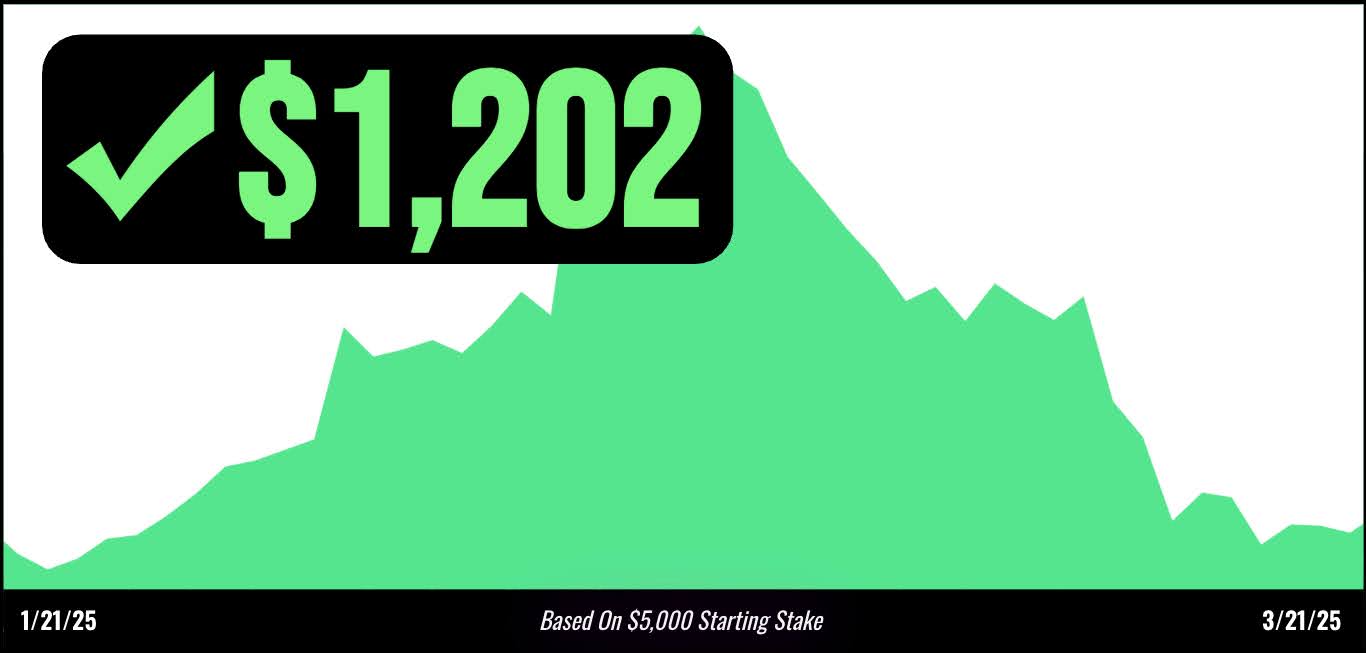

Based on the algorithm… On January 21st, AutoStrike could have flagged a trade on NET that would have paid $1,202 in just days.

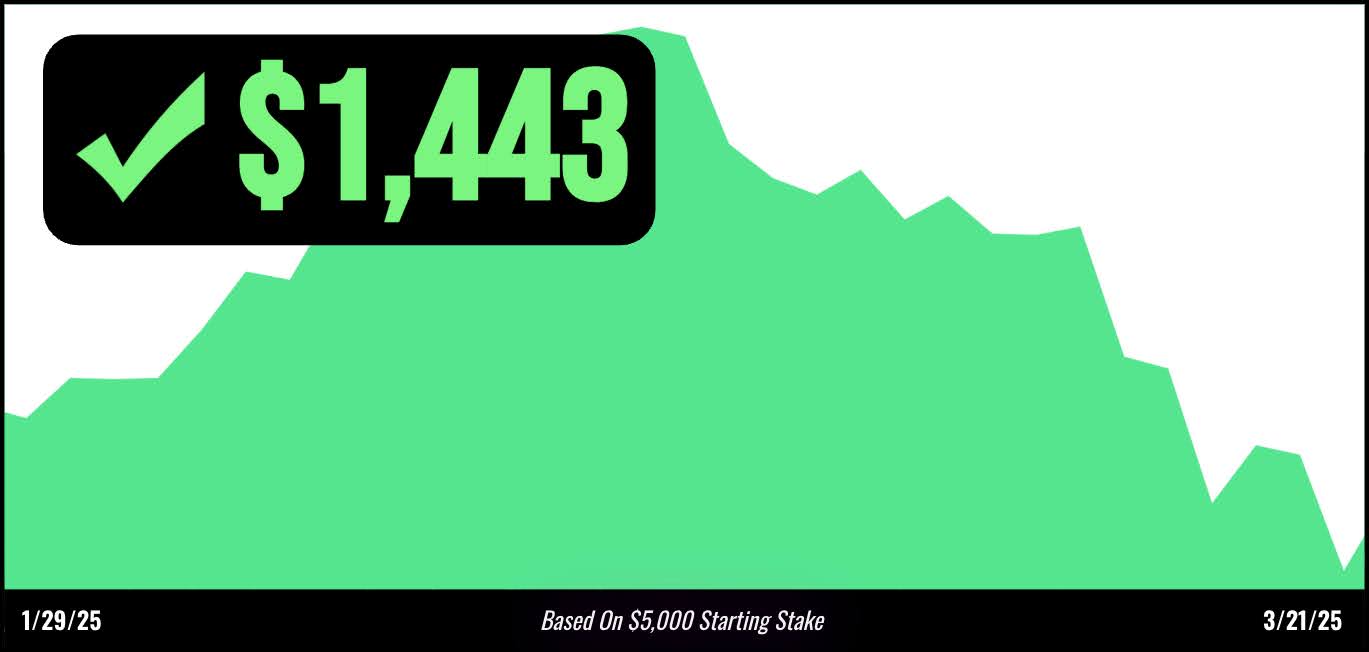

Again, a few days later, on January 29th, another alert on FTNT that would have delivered $1,443.

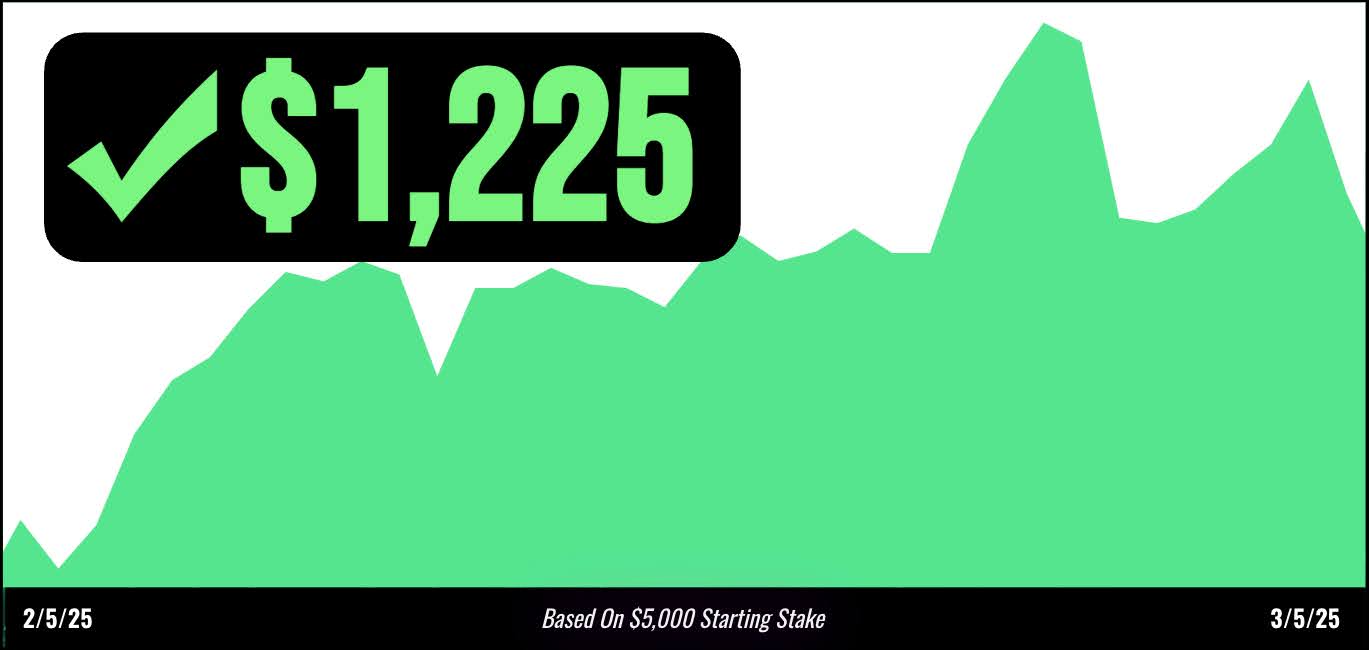

And even by February, it was the exact same story on yet another opportunity with HWM, with a short at $1,225 in profits.

All while the market was getting hammered.

The most impressive part?

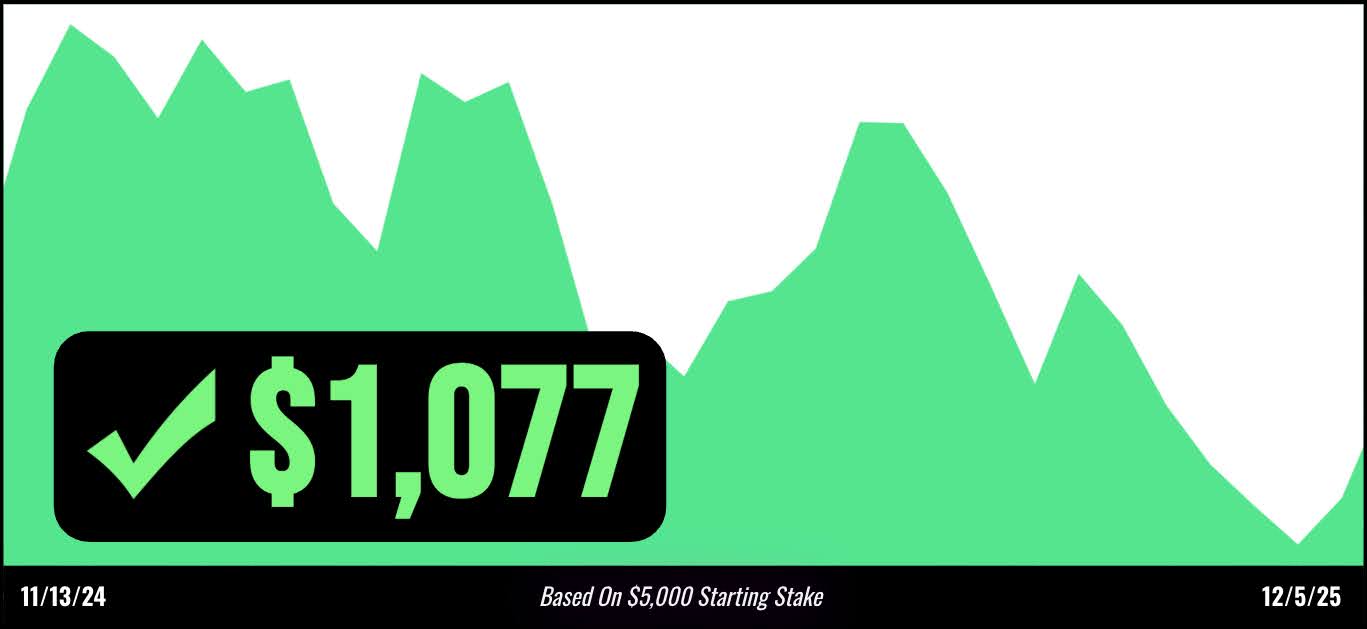

Even when stocks like NVDA dropped 8.5% in November and most traders got crushed.

Anyone following these “AutoStrike” alerts had a shot at walking away with $1,077 in profits.

How? Because Chuck and his team programmed it to help you find options with the power to pay out EVEN if a stock drops 10%+ in a month.

Of course, there would have been smaller wins and some that did not work out, and I cannot promise every single trade would play out this way.

But we will share the secret behind his incredible 96.2% win rate on real money trades – and now it’s fully automated, working 24/7.

Just check your phone once during market hours, and all the heavy lifting is done for you.

Just this morning, AutoStrike flagged a new trade setup that’s primed to target profits, and I want to share it with you before the window closes.

These alerts are time sensitive, but you can get your hands on the ticker…