See how Jeffry’s been able to go 82-0 on the same trade for 32 months straight — LIVE at 2 p.m. ET

After a brutal sell-off, U.S. stocks are trying to bounce back today. It wasn’t a roaring bullish open but after hitting four-month lows, any sign of green is welcome.

What’s behind the move? Hopes that President Donald Trump might walk back some of his newly announced tariffs on Canada and Mexico. Commerce Secretary Howard Lutnick hinted that relief could come as soon as Wednesday, which was enough to stop the bleeding — at least for now.

But then there’s the jobs data…

ADP reported just 77,000 private-sector jobs added in February, well below expectations. That’s a red flag for the labor market and raises concerns ahead of Friday’s nonfarm payrolls report. If job growth continues slowing, it could be another reason for investors to hit the sell button.

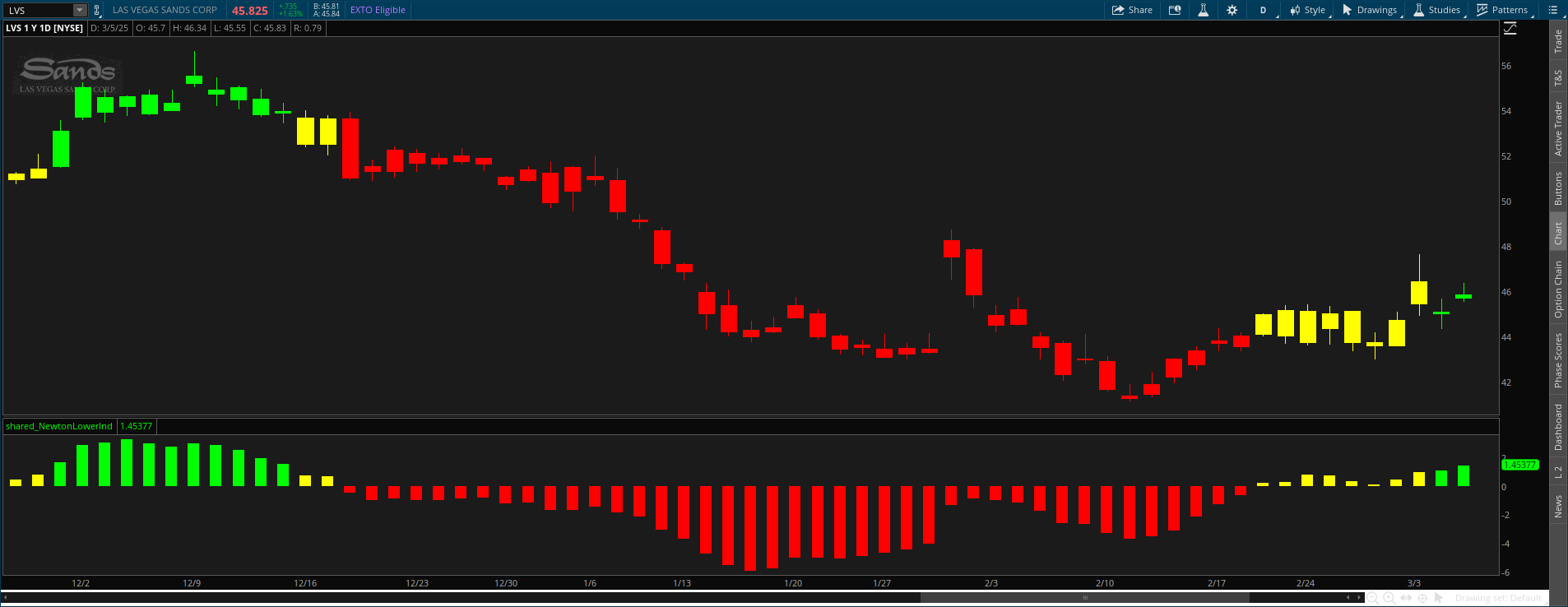

Las Vegas Sands (LVS) Moving Higher

Las Vegas Sands (LVS) has experienced a nice upward trend so far in 2025. The company’s recent financial restructuring is aimed at supporting the expansion of Marina Bay Sands in Singapore and refinancing existing debt.

This move shows a strong commitment to growth.

If you add in stock buybacks and an increased dividend, there’s a lot to like. Analysts now show price targets reaching up to $69, reflecting a potential upside of over 30% from current levels.

At the same time, our Newton Indicator is in bullish mode. After moving up but staying yellow, it’s just recently printed a green momentum bar. This indicates it could be ready to make a run higher.

Ametek (AME) Staying Bearish

On the other side, Ametek’s (AME) momentum is turning down.

AME has been mixed so far in 2025, turning bearish recently. After reaching an all-time high in November, the stock has been moving down ever since.

Insider activity also may be pushing the stock down as Director Steven Kohlhagen sold 1,320 shares on March 4, 2025.

And after attempting to climb, the Newton Indicator shows momentum has just gone back to red. It looks ready to continue its move down.

Bottom line?

The market wants a reason to bounce, and a softer stance on tariffs could help. But weak economic data is creeping in, and that could be an even bigger problem in the long run.

I’ll keep an eye on Friday’s jobs numbers — they might be the next big market mover.

Graham Lindman

Graham Lindman Trading

Follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

Important Note: No one from the ProsperityPub team or Graham Lindman Trading will ever contact you directly on Telegram.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

P.S. The Earnings Season Shortcut…

During earnings season, you need to be extra precise with your trading…

And this NEW way to buy and sell stocks could be the answer.

Take a look at this:

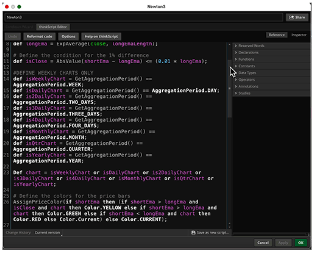

Those 117 lines of code are the heartbeat behind my Newton Indicator…

And over the next month-plus, I’ll be watching this tool like a hawk to find the best entries on trending earnings stocks.

NVDA? AMZN? TSLA?

Newton covers it all…

Join me here to learn how to get your hands on this tool immediately