When it comes to building an options portfolio, most people get it wrong. They load up on aggressive trades that can knock them out in one bad move.

That’s not the game plan we used during Friday’s edition of “Opening Playbook,” when we built our dream portfolio to hold for the rest of 2025.

Be sure and catch the full stream here for a complete breakdown!

Instead, we’re being smart — blending safe, moderate and aggressive setups into a portfolio that can weather the ups and downs without blowing up.

The idea is simple…

Put more weight into your safe plays, a decent chunk into your moderate ones, and just a small sliver into the aggressive trades. That way, you’re still swinging for some home runs, but you’re not risking your whole season on one pitch.

Why Size Matters

For me personally, if I’m throwing $500 into an aggressive name like Tesla (TSLA), I might put $2,500 into a safer setup like Berkshire Hathaway (BRK.B) or Walmart (WMT). That gives the home run trades room to breathe without risking the core of the portfolio.

The goal is to stack the odds in your favor with smart positioning. It’s not just about picking the right stocks — it’s about putting the right size into each move.

We’re building this thing for the long haul. Most of these trades are structured over 12 to 18 months — giving plenty of time for the setups to work without feeling like you have to time the market day-to-day.

Why Now Is the Perfect Time

Right now, we’re seeing some rare signals flashing green for the market. After a stretch of big one-day moves, the historical odds point to strong returns over the next year. That’s why we’re leaning into this window — not after months of new highs, but right here when everyone’s still nervous.

This approach lets you flip stocks you’d already want to own at discounted levels into setups with much better risk-reward ratios. Instead of needing a huge rally, a stock just needs a small move — sometimes even staying flat — and you can still land a triple-digit return.

If you’re nervous about downside, you could even build a hedge into the portfolio with something like a put spread on the SPDR S&P 500 ETF (SPY). That way, you cover your bases while letting the rest of the portfolio work.

This is how you build it right — methodical, smart and structured for success. Check out the stream up top for the full rundown of our portfolio!

Graham Lindman

Graham Lindman Trading

Follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

Important Note: No one from the ProsperityPub team or Graham Lindman Trading will ever contact you directly on Telegram.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

P.S. AutoStrike Versus the Market Crash: 3-0

A few months ago, Chuck Hughes called me with news he couldn’t share with anyone else yet.

After 40 years of trading (and mentoring me for the past few), he’d finally done something I thought was impossible – he automated his trading method.

As Chuck’s student, I’ve seen firsthand how powerful his strategies are.

His guidance helped me double my account in about six months, posting over $30,000 in profits.

But this new trade engine he built? It’s on another level entirely.

It’s called “AutoStrike” – and it doesn’t just find good stocks.

It scans through 100,000+ options contracts to identify the precise ones with what it sees as having exceptional profit potential.

The kind that can target $500… $1,000… sometimes even more per trade.

I was skeptical until I saw what was possible during one of the worst market weeks in January.

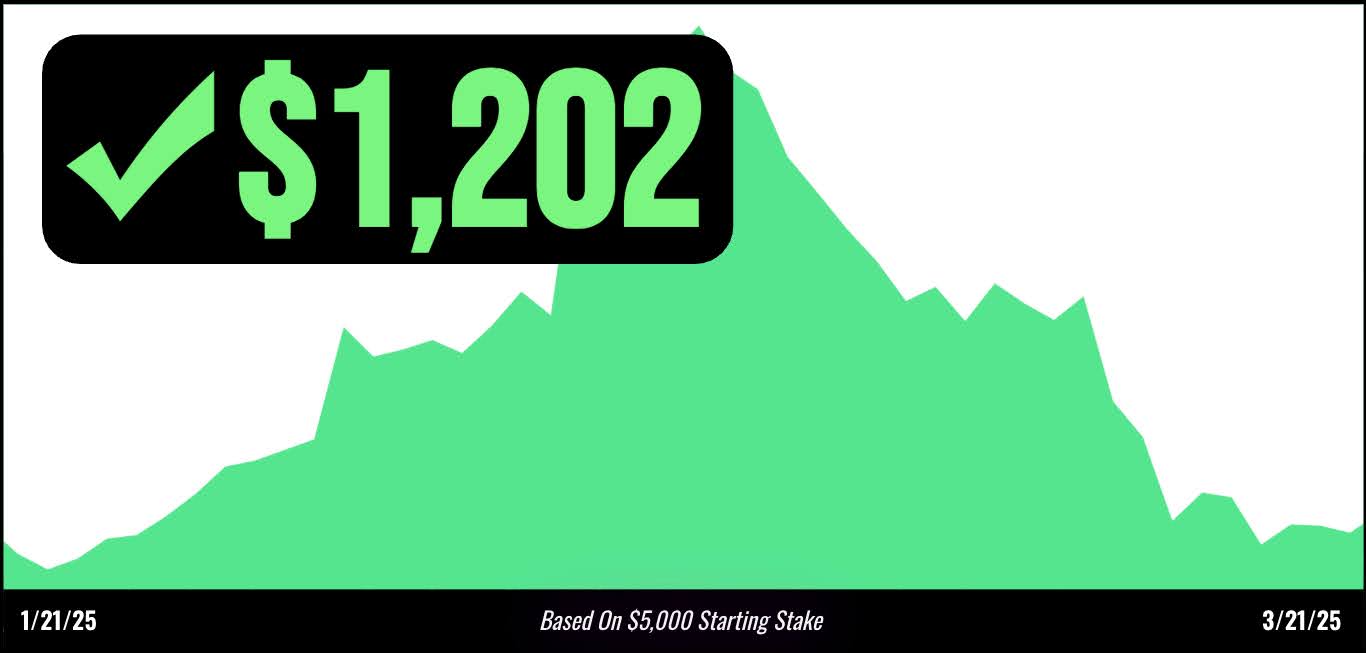

Based on the algorithm… On January 21st, AutoStrike could have flagged a trade on NET that would have paid $1,202 in just days.

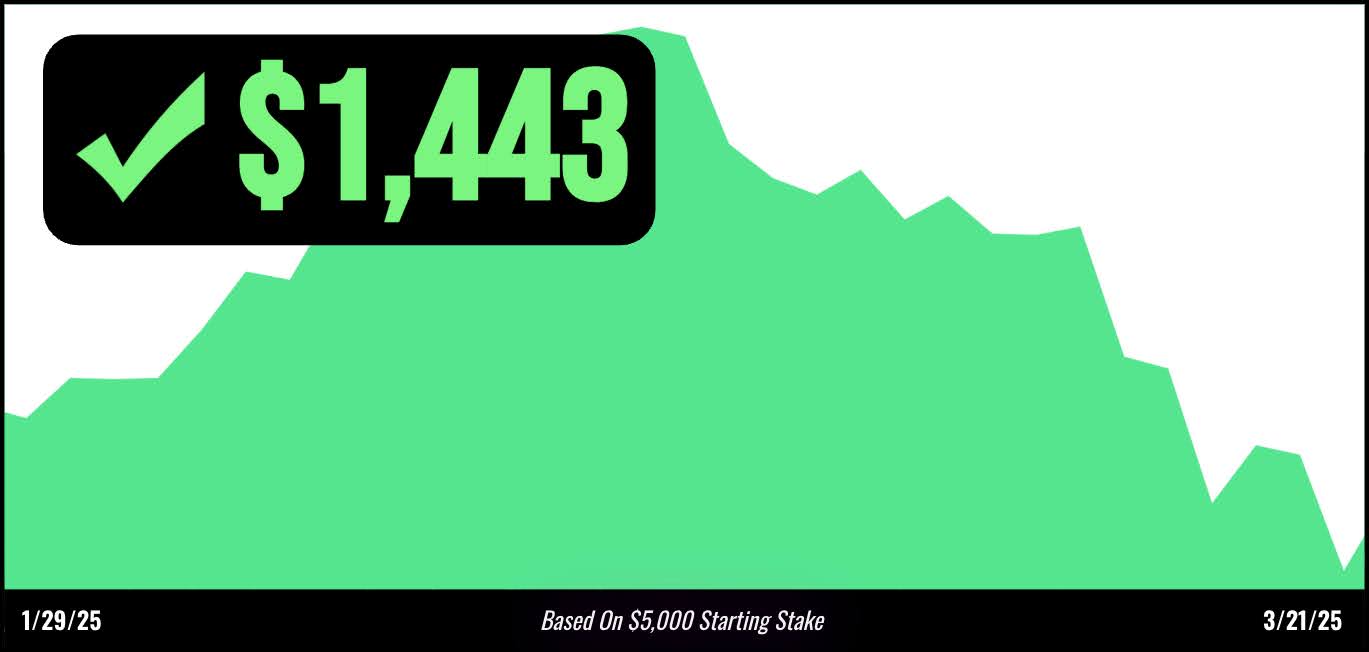

Again, a few days later, on January 29th, another alert on FTNT that would have delivered $1,443.

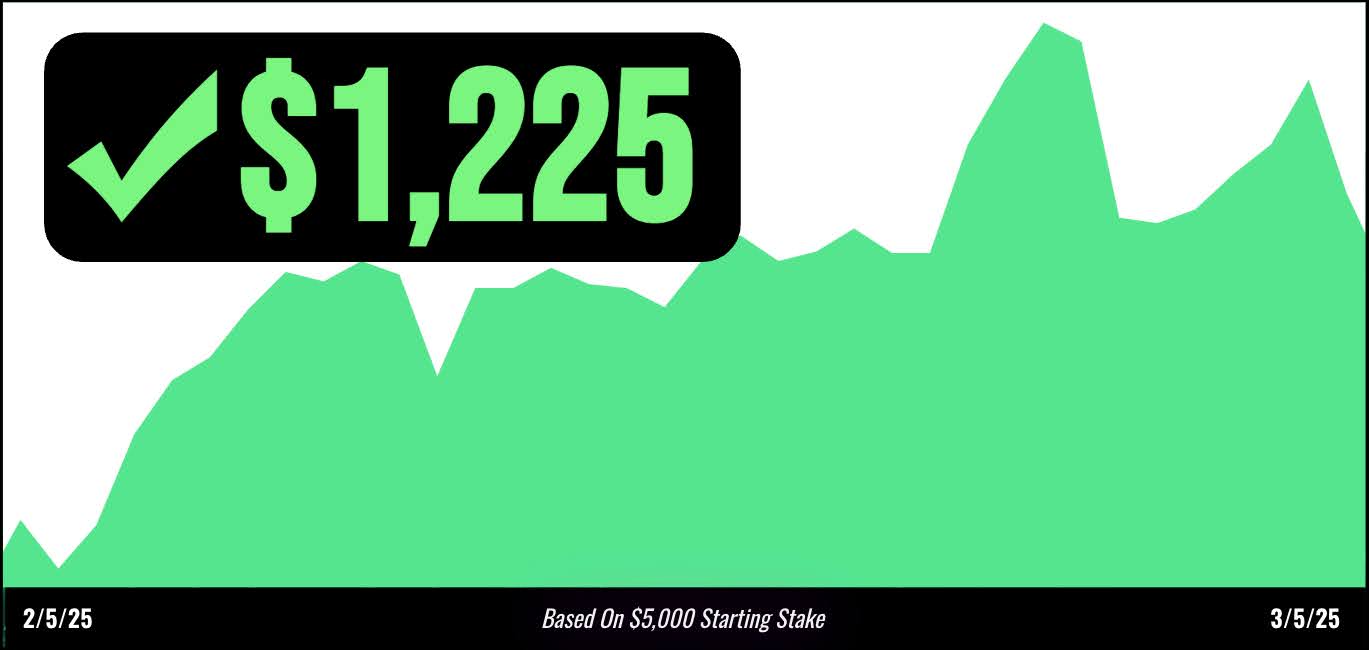

And even by February, it was the exact same story on yet another opportunity with HWM, with a short at $1,225 in profits.

All while the market was getting hammered.

The most impressive part?

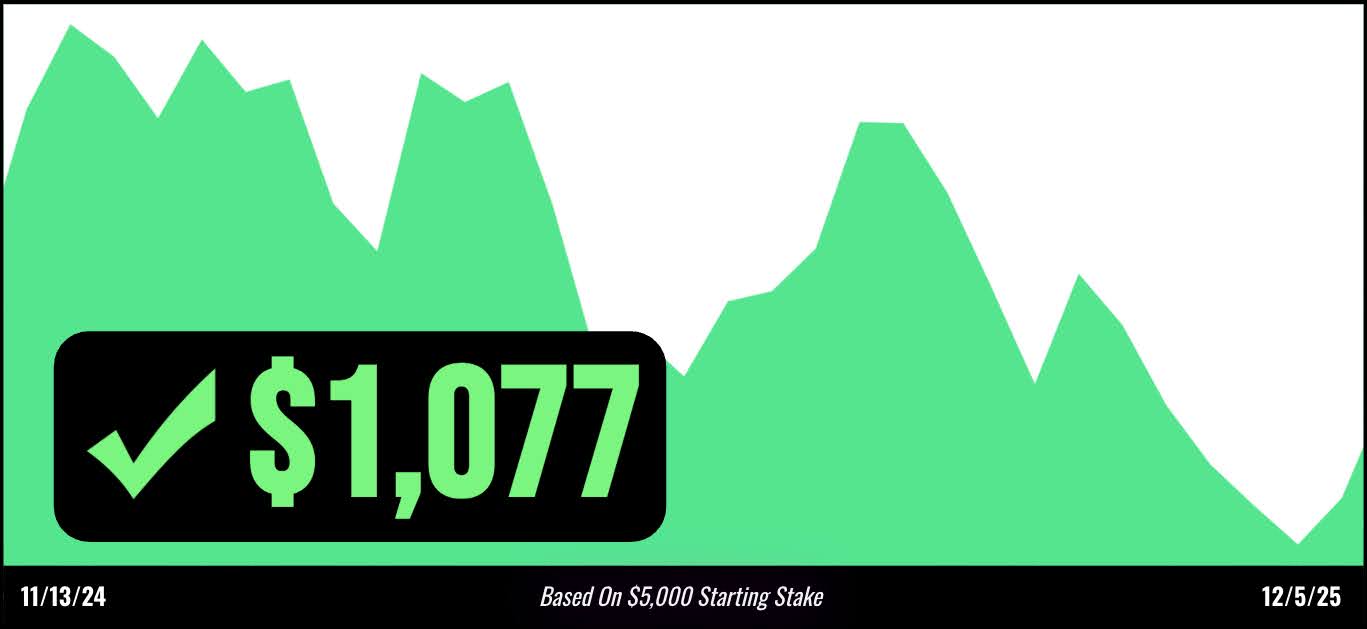

Even when stocks like NVDA dropped 8.5% in November and most traders got crushed.

Anyone following these “AutoStrike” alerts had a shot at walking away with $1,077 in profits.

How? Because Chuck and his team programmed it to help you find options with the power to pay out EVEN if a stock drops 10%+ in a month.

Of course, there would have been smaller wins and some that did not work out, and I cannot promise every single trade would play out this way.

But we will share the secret behind his incredible 96.2% win rate on real money trades – and now it’s fully automated, working 24/7.

Just check your phone once during market hours, and all the heavy lifting is done for you.

Just this morning, AutoStrike flagged a new trade setup that’s primed to target profits, and I want to share it with you before the window closes.

These alerts are time sensitive, but you can get your hands on the ticker…