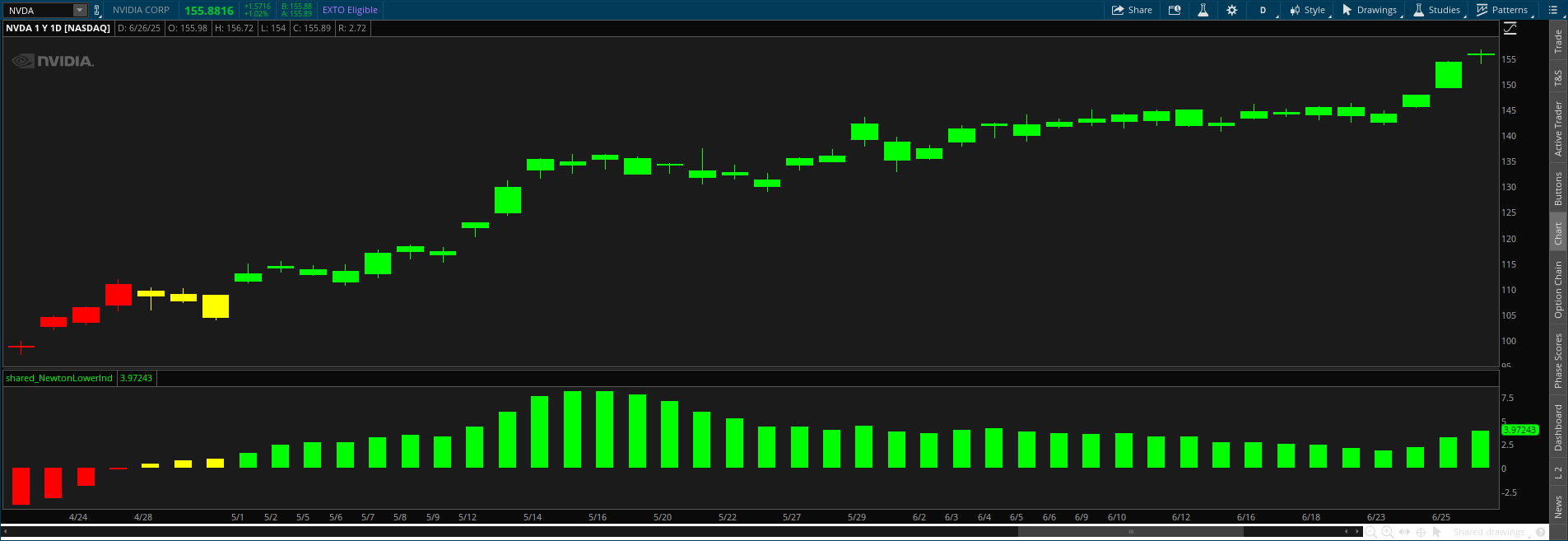

I’ve got to tell you — watching Nvidia (NVDA) dominate the market lately has been nothing short of spectacular. While many stocks have struggled to find their footing in this volatile environment, Nvidia has been consistently pushing higher, up over 30% the past month and seemingly unconcerned with the broader market’s indecision.

Here’s the thing…

Nvidia isn’t just riding a temporary wave. What we’re seeing is a company that’s positioned itself at the center of multiple technological revolutions — AI, cloud computing, gaming, and data centers. That’s not luck… that’s strategic brilliance.

Why Nvidia Keeps Winning

Look, market leadership doesn’t happen by accident. Nvidia has created an ecosystem around its GPU technology that’s nearly impossible for competitors to replicate. Their CUDA platform has become the standard for AI development, giving them a moat that widens with each passing quarter.

The company has shown remarkable strength recently, even on days when the broader market pulled back. This kind of relative strength is exactly what you want to see in a market leader — it suggests institutional investors are accumulating shares regardless of short-term market noise.

Remember when Nvidia was “just a gaming company”? Those days are long gone. Its data center revenue has exploded, growing faster than anyone predicted. And with AI implementation still in its early stages across most industries, this growth runway stretches far into the future.

How to Play It Smart

If you’re wondering whether you’ve missed the boat on Nvidia, I don’t think you have. The stock has certainly had an incredible run, but the fundamentals supporting higher prices remain solidly intact.

That said, you don’t want to chase momentum blindly. Consider these approaches:

- Use pullbacks to add to positions gradually rather than going all-in at once.

- Look at options strategies that benefit from continued upward momentum.

- Consider the Information Technology sector (XLK) as a complementary investment if you want broader exposure.

The technical picture supports the bullish case too. Nvidia has been forming a series of higher lows on its chart — the classic definition of an uptrend.

As long as this pattern continues, the path of least resistance remains upward.

Is Nvidia expensive by traditional metrics? Sure. But revolutionary companies rarely look cheap during their strongest growth phases. Amazon didn’t. Apple didn’t. And Nvidia likely won’t either.

What matters most is whether they can continue executing their vision — and all evidence suggests they’re doing exactly that.

I’ll be watching Nvidia closely in the coming weeks. If you don’t have exposure to this market leader yet, it might be time to consider how it could fit into your portfolio.

Graham Lindman

Graham Lindman Trading

Follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

Important Note: No one from the ProsperityPub team or Graham Lindman Trading will ever contact you directly on Telegram.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

P.S. JOIN THE EMERGENCY ROUNDTABLE AT 1 PM ET

Kane Shieh, Nate Tucci, Chris Pulver, Jack Carter and I are locked in on today’s Emergency Roundtable…

We’ll start at 1 p.m. ET and our goal is to hand you the No. 1 Income play we’re watching right now.