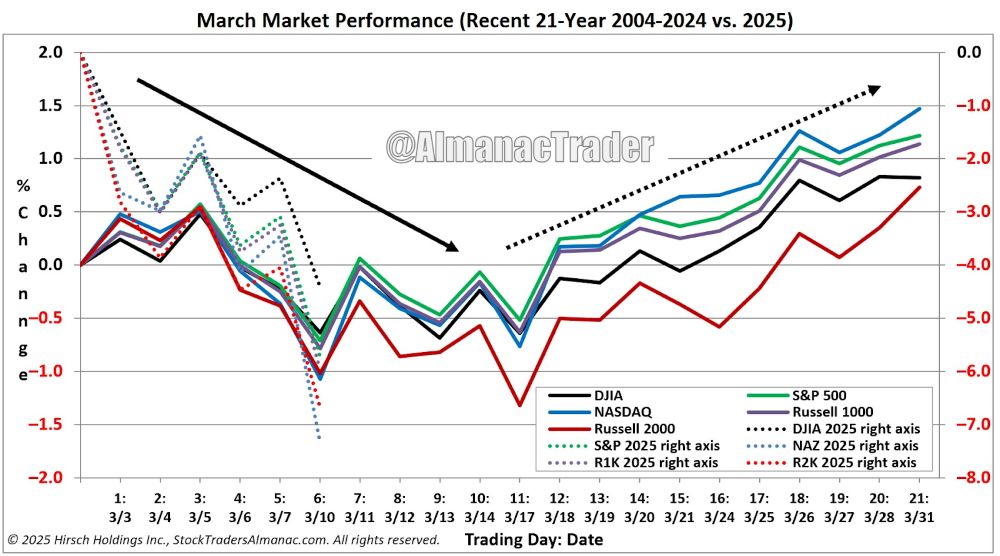

Seasonality isn’t perfect — but it does leave strong clues.

Here’s something I’ve mentioned before…

Over the past 25 years, when the S&P 500 finishes February up less than 5%, March tends to be a positive month. The median gain is around 0.8%, and the index finishes higher 68% of the time.

Now, historically, the second week of March is usually a little rough — and that checked out again this year. But seasonality also tells us that things typically start turning bullish right after, and we’ve started to see some of that shift this week.

Will the uptick continue? That’s the million-dollar question…

As always, nothing in the market is guaranteed, and we’ve seen plenty of fake-outs before.

But if you’re leaning bullish here, seasonal data suggests you’re not crazy for thinking a bounce could be underway.

Stay tuned — I’ll share what I see in this daily newsletter, on my “Opening Playbook” livestreams at 10 a.m. ET on Tuesdays and Thursdays, and during my special events!

Fed Optimism Fades and Tariff Fears Creep In

Well, Friday isn’t looking great…

After a midweek bounce, markets are lower again as investors tried to process the Fed’s latest message — and brace for whatever’s coming next in Trump’s ever-changing trade agenda.

Both the S&P 500 and Nasdaq are now in correction territory and trying to avoid a fifth straight weekly loss.

Earlier this week, it looked like the Fed might calm things down. Powell signaled that two rate cuts are still on the table for 2025, and he reassured everyone that the trade war impact looked manageable for now.

But by Thursday, that optimism started to wear off.

Why? Because the Fed also updated its outlook — and it wasn’t exactly comforting. Think higher inflation and slower growth — not what markets want to hear with more tariffs looming.

Speaking of tariffs, Trump’s got another round set to hit on April 2, and while he’s still negotiating, markets don’t love the uncertainty. On Friday, we saw FedEx (FDX) and Nike (NKE) drop after warning about the economic impact in their earnings reports.

So, yeah… the vibes are mixed. The Fed tried to reassure us, but traders are still on edge — and for good reason.

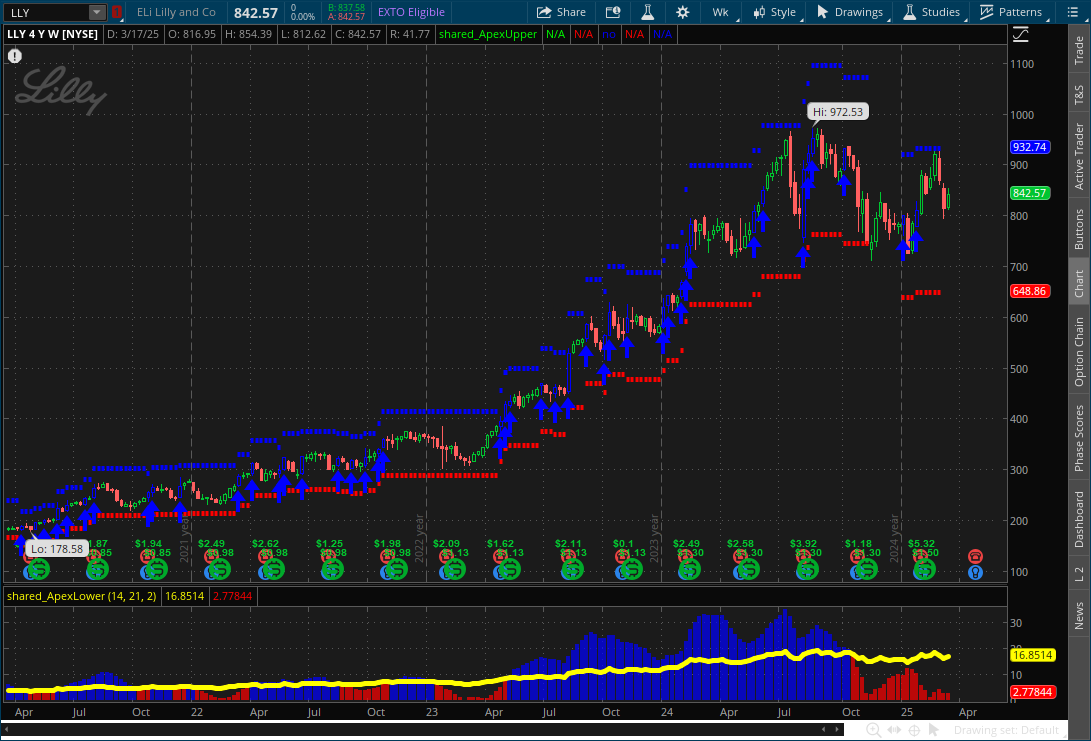

Apex Indicator: LLY

Last week, we were watching Apple (AAPL) for a possible move up…

We haven’t really seen any movement yet…

But we do have a stock that looks like it might set up soon.

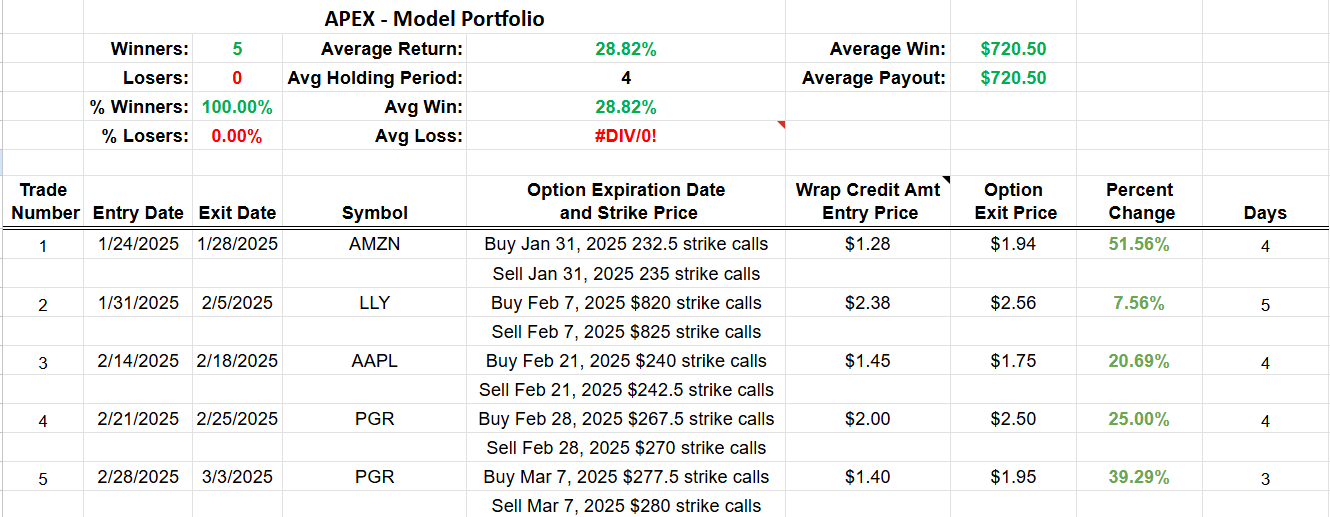

First, here’s our model portfolio for these free signals I share each week:

That 100% win rate won’t last forever, of course, but it’s great to see early success! There are no guarantees in trading, so trade at your own risk. But we’ll keep these signals coming because I want to show off the power of my Apex Indicator.

As I look through the charts, Eli Lilly (LLY) stands out. And that makes sense. We’ve seen a rotation into “safety” stocks lately. Here’s the chart:

It’s been showing great momentum this week and looks like it might fire off a Buy signal next.

Our target would be up at $932.74, and our stop would be down at $648.86.

We enter these trades using wrap orders, and for more training on how to place wraps… go here!

That’s all for today. I hope everyone has a great weekend — we’ll be back at it on Monday, and then at 10 a.m. ET on Tuesday for “Opening Playbook”!

Graham Lindman

Graham Lindman Trading

Follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

Important Note: No one from the ProsperityPub team or Graham Lindman Trading will ever contact you directly on Telegram.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

P.S. It’s Time to Blow the Lid Off!

I probably shouldn’t be telling you this…

But I just leaked a private text thread between me and my buddy, Nate Tucci.

And if you read it here, you’ll see why I couldn’t keep this to myself.

The texts reveal something insane:

- Nate’s backtested weekend trading method would be 8 for 8 in 2025 so far, which mean zero losers in this brutal market crash

- A small tweak that changes how weekend trades are placed… and most traders completely overlook it

- A staggering 94.3% accuracy rate based on the data

Nate wanted to sit on this, but now, I’m blowing the lid off.

I can’t promise the same results as Nate’s, but I’ve arranged an exclusive sit down with him at 2 p.m. ET on Sunday, March 23, to grill him on this weekend trading breakthrough…

And you’re invited.

If you sign up, I’ll personally send you the secret Zoom link to watch along.

But I can’t keep the window to register for this world premiere open forever.

So get in before Nate realizes what I’ve done…

Secure Your Invite Before It’s Too Late!

Disclaimer: The profits and performance shown are not typical. We make no future earnings claims, and you may lose money. The trades expressed are from historical back tested data unless otherwise stated in order to demonstrate the potential of the system. The average backtested return per trade (winners and losers included) is 20.6% per trade over the weekend and a 94.3% win rate with an average winner of 26.9%.