Seasonality in the stock market isn’t a perfect science — but history does leave clues.

Here’s something I’ve mentioned before…

Over the past 25 years, when the S&P 500 was up less than 5% through February, March tended to be positive. The median gain? 0.8%, with the index finishing higher 68% of the time.

Not bad, but also not the kind of rally that gets anyone super excited.

But remember the real takeaway — when the market finished the first two months of the year in the green (even slightly), it usually built on those gains.

Historically, when the S&P 500 was up less than 5% through February, it ended the year higher 80% of the time, with a median gain of 10.8%.

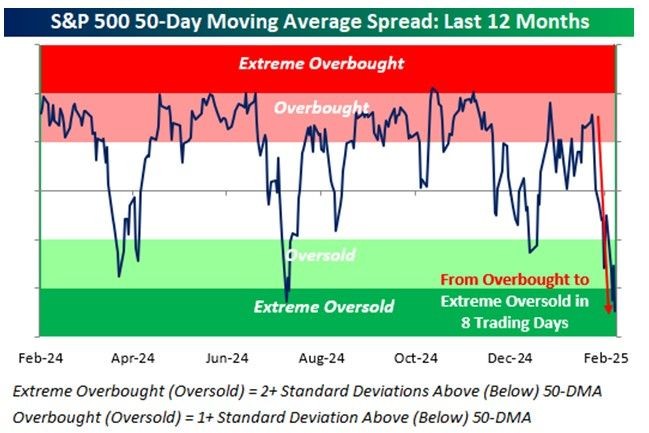

Now, March so far hasn’t exactly been bullish, but let’s not get lost in the doom and gloom. This market just went from Overbought to Extreme Oversold in less than two weeks, setting up a potential reversion to the mean.

Will the market turn around? As always, nothing is guaranteed in trading or the stock market in general. But if you’re leaning bullish, history suggests you might not be wrong to do so.

Stay tuned — I’ll share what I see in this daily newsletter, on my “Opening Playbook” livestreams at 10 a.m. ET on Tuesdays and Thursdays, and during my special events!

Markets Bounce After Brutal Sell-Off, But Trade War Fears Loom

Stocks are trying to claw back some losses after a brutal sell-off sent the S&P 500 (SPY) into correction territory, officially closing 10% or more off a recent high.

So, what’s behind the bounce?

The risk of a government shutdown eased after Senate Minority Leader Chuck Schumer backed off threats to block a funding bill. That’s helping the market find some footing, but let’s not pretend the storm has passed.

The bigger issue?

Trump’s escalating trade wars. Markets have been getting whipsawed all week as tariff tensions continue to overshadow almost any positive economic signals. All three major indexes are still set for roughly 4% weekly losses.

And while stocks are trying to recover, gold just broke above $3,000 an ounce for the first time ever — a clear sign that investors are still hedging against economic uncertainty.

Trump, for his part, isn’t backing down, saying he won’t “bend at all” on tariffs. So while today’s bounce is nice, this volatility isn’t going anywhere anytime soon.

Apex Indicator: PGR

Last week, we were watching Apple (AAPL) for a possible move up…

And then the market cratered.

So we’ll put that possible trade on the back burner for now. However, we do have an Apex stock that’s held up pretty well.

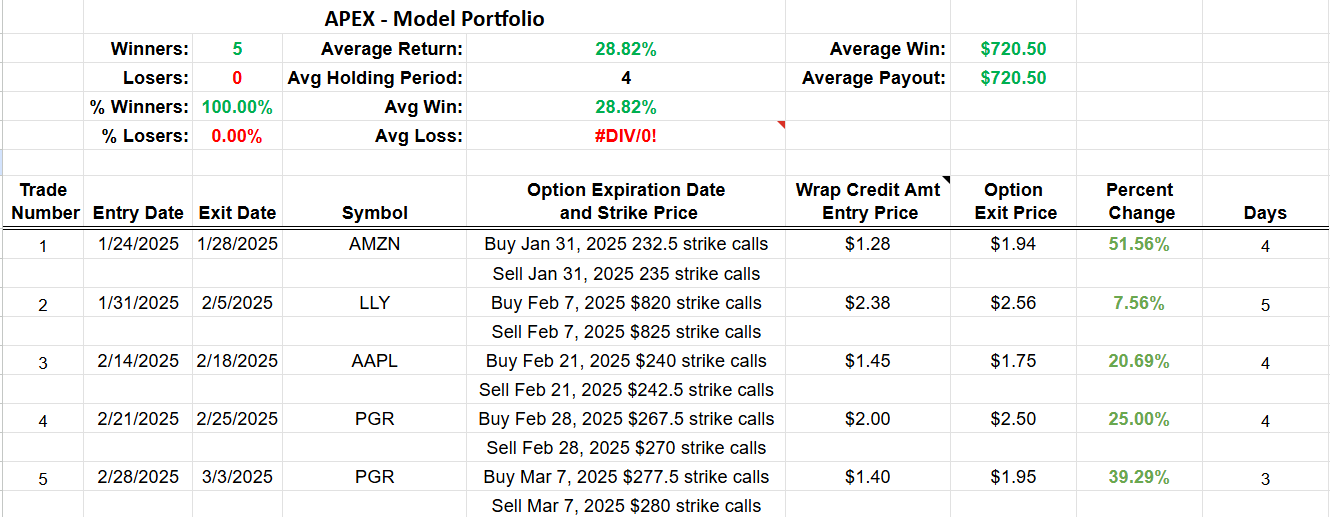

First, here’s our model portfolio for these free signals I share each week:

That 100% win rate won’t last forever, of course, but it’s great to see early success! There are no guarantees in trading, so trade at your own risk. But we’ll keep these signals coming because I want to show off the power of my Apex Indicator.

As I mentioned, we’ve had another big sell-off this week, which has put our entry signals on a delay.

But Progressive (PGR) continues to show some strength — I love insurance stocks! — amid all the weakness…

We had an entry a few weeks ago that worked well and it looks like we might get another entry soon.

Our target would be up at $296.10 and our stop would be down at $248.16.

We enter these trades using wrap orders, and for more training on how to place wraps… go here!

That’s all for today. I hope everyone has a great weekend — we’ll be back at it on Monday, and then at 10 a.m. ET on Tuesday for “Opening Playbook”!

Happy trading!

Graham Lindman

Graham Lindman Trading

Follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

Important Note: No one from the ProsperityPub team or Graham Lindman Trading will ever contact you directly on Telegram.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

P.S. EXCLUSIVE RED CARPET EVENT SATURDAY… AND YOU’RE INVITED!

This is something a little different than usual… But Roger Scott is really pumped about this new development so we wanted to give you the inside scoop.

You may know how Roger’s been knocking it out of the park with that 94.1% win rate across 300+ live alerts using his ProTrader Dashboard…

Well, that dashboard is built for trading weekly options on stocks like Apple, Microsoft, etc. And those weekly options generally have 10-20% return potential.

That’s when it hit Roger: “What if I applied that same winning methodology to tickers with DAILY options? We could be looking at 5X bigger wins on the same moves!”

After six months of hard work behind the scenes…

He’s created what could be the most innovative day trading system for daily options: Alpha Zone Pro.

The official launch is scheduled for Wednesday, but we’re so excited to share this with our loyal readers… and to be honest, we simply can’t wait.

So Roger has put together a special Red Carpet event at 11 a.m ET TODAY, March 15, just for readers like you.

If you want the first look at trading hot daily options plays with Alpha Zone Pro and to get in on the ground floor…

Then join Roger for this exclusive demo and Red Carpet event…

Stated results are from hypothetical options applied to real published trades from 10/30/23 – 3/10/2025. The result was a 94.2% win rate on 330 trades, an average return of 11.2% including winners and losers and average hold time of less than 24 hours. Performance is not indicative of future results. Trade at your own risk and never risk more than you can afford to lose.