>>>Be sure to join Nate and I at 10 AM ET weekdays for Opening Playbook. Each episode is jam-packed with trading education and actionable ideas to help you become the best you can be, and you can also catch replays by clicking here!<<<

If you’ve been watching the market lately, you’ve probably noticed something…

It’s not exactly racing higher — but it’s not falling apart either.

And that’s not just OK — it’s actually good.

In fact, I’d argue that this sideways, choppy action is exactly what we want to see right now.

Here’s why…

After that massive rally that began in early April, the market’s been stretched thin. Bulls were overextended, RSI was running hot, and we were due for a breather.

Now we’re getting it — not with a nasty 10% correction, but with the kind of healthy consolidation that allows the market to catch its breath.

Think of it like an athlete in a distance race. You can’t sprint forever. You pause, slow your pace, and then — when you’re ready — you kick into high gear again.

So how do you trade a market like this?

Here’s my take:

✅ Be Patient — Don’t Force Directional Trades

Everyone wants to predict the “big break.” But the truth is, there’s no need to guess. Sideways action means the market is recharging. Forcing aggressive directional trades too early is how traders get chopped up.

✅ Focus on Quick, Low-Risk Setups

This is the perfect time for short-term income trades, not long-shot bets. I’m running my 60-Minute Income Strategy every day and smaller-dollar debit spreads during this kind of action because they don’t rely on huge market moves to work.

✅ Keep the Bigger Picture in Mind

This pause isn’t a warning sign — it’s a setup. Historically, July has been a strong month, and periods like this often lead to the next leg higher. Every day of consolidation is one more step toward letting the bulls “refill the gas tank.”

I know it’s not exciting to sit on your hands while the market chops sideways. But trust me — this is when patient traders set themselves up for the real moves that follow.

I’m not just watching for a breakout. I’m letting the market cool off, stacking my smaller trades, and waiting for that moment when the engine kicks back into gear.

Because when it does, that’s when we want to be ready.

We break all of this down during our Opening Playbook sessions daily at 10 a.m. ET — see you there!

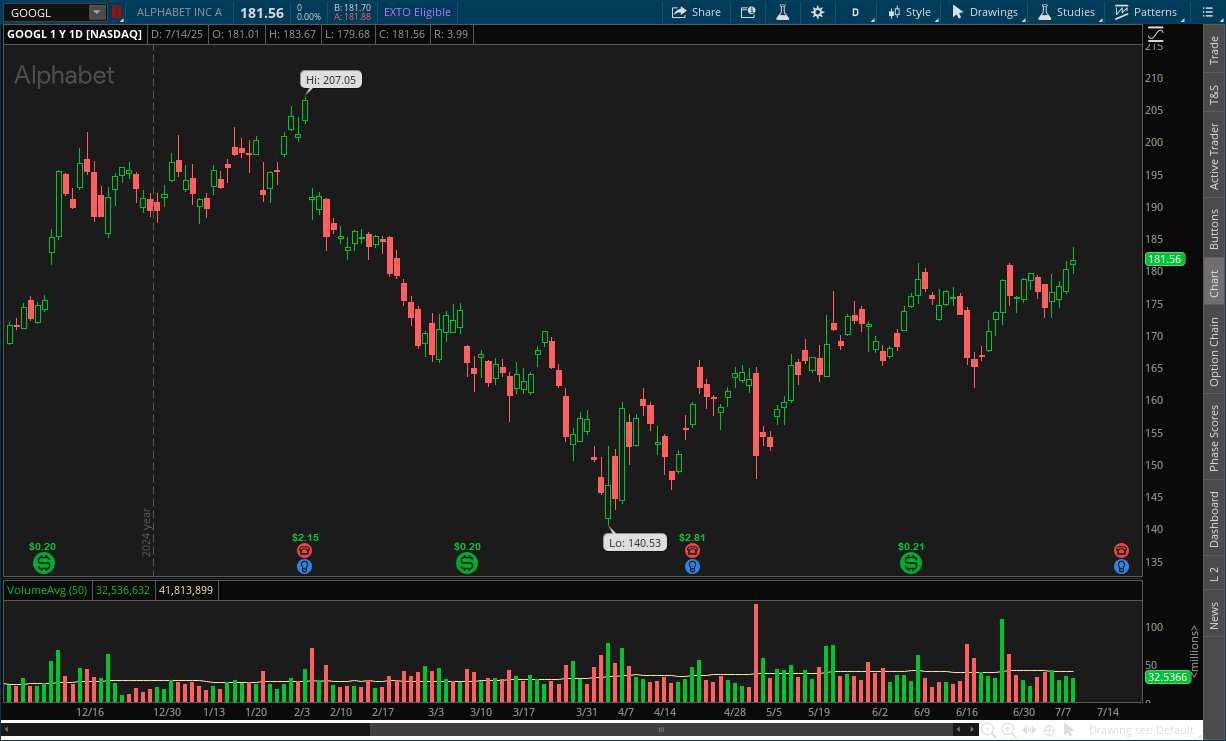

A Stock to Watch: Alphabet (GOOGL)

A stock to watch is Google parent Alphabet (GOOGL), as it tends to be bullish mid-July.

GOOGL has also been in an uptrend lately, so this seasonal play has some momentum behind it.

Buying GOOGL on July 15 and holding for 18 days has delivered an average return of 2.94% over the past several years. While past performance is no guarantee, it’s definitely something to consider as we move through July.

Graham Lindman

Graham Lindman Trading

Follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

Important Note: No one from the ProsperityPub team or Graham Lindman Trading will ever contact you directly on Telegram.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

P.S. A Pricing Quirk Makes It Possible to Target 100%+ Returns on Dirt-Cheap Options

It’s now possible to get in on your favorite stocks like Apple, Nvidia or Google for just $1 or less!

Targeting returns in days instead of weeks.